by Glen | Oct 3, 2022 | 2022 real estate predictions, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

Home values slipped for the second consecutive month as mortgage costs continue to sideline buyers. From June through August, prices usually decline about 2%, but this year they have fallen about 6%. At the same time, mortgage rates hit highs of around 6.4%. ...

by Glen | Sep 26, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, Private Lending, Property Valuation, Real Estate Trends, Real estate Valuation

First, the pic above was the leading picture for a listing I looked at. I guess they were stressing the work from home conveniences in the office Unfortunately this could lead to some “interesting” conversations with coworkers. With the back to office trend in full...

by Glen | Sep 13, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates

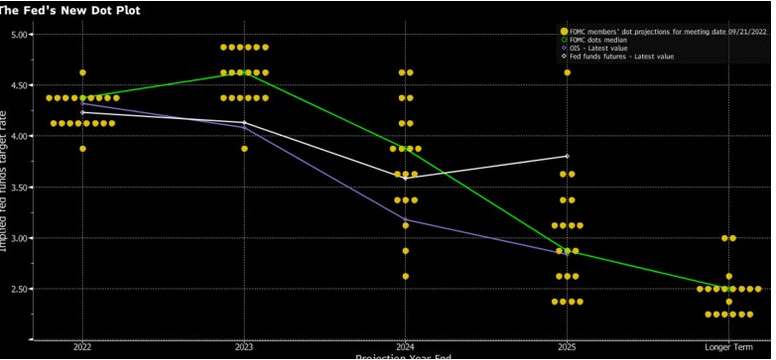

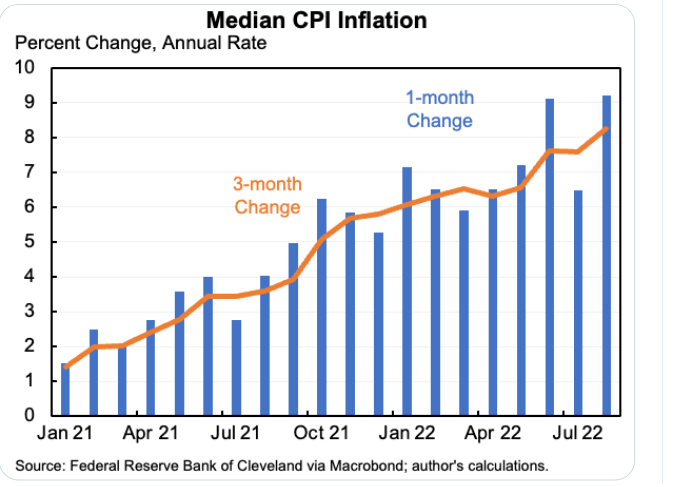

Once again, the recent CPI report came in much higher than expected. Why did the market drastically miss this prediction? I’m not even an economist and figured out months ago inflation would be higher for longer as everything I buy from groceries, dining out,...

by Glen | Aug 15, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, hard money, Hard Money Commercial Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

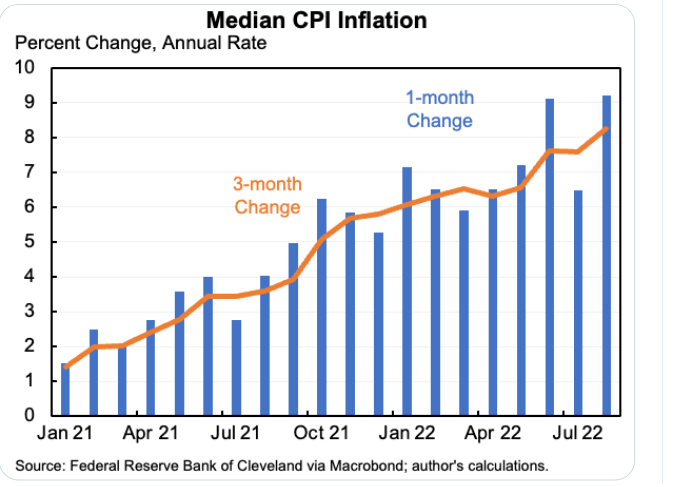

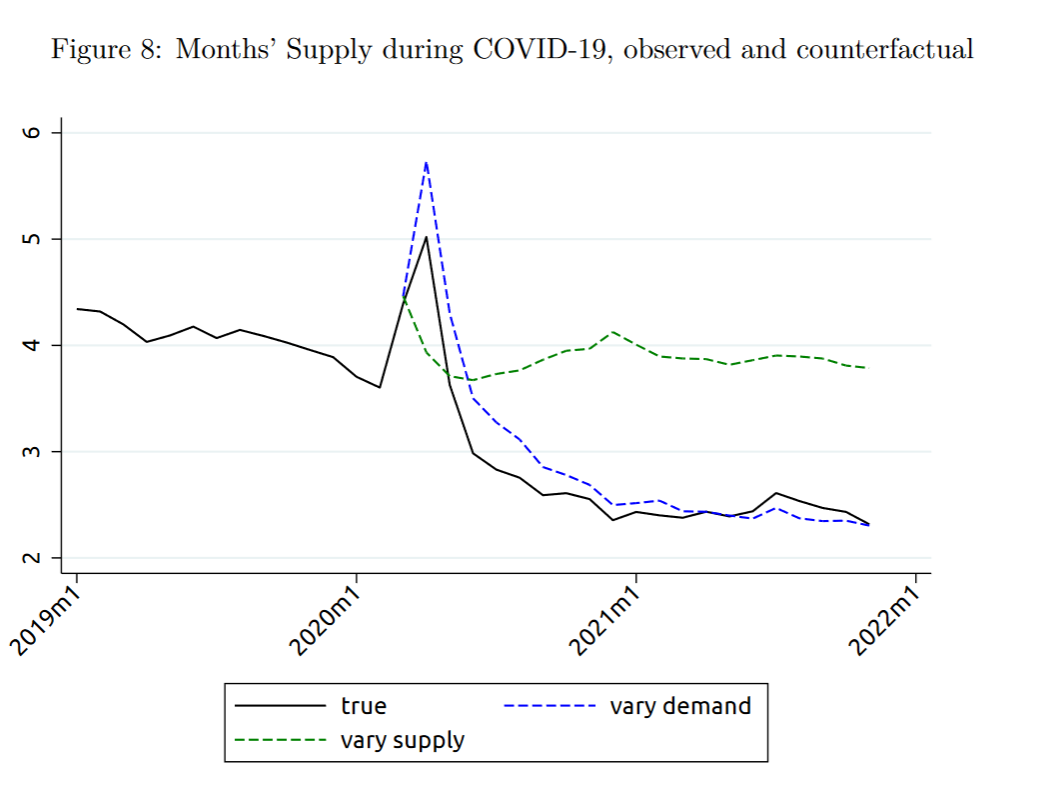

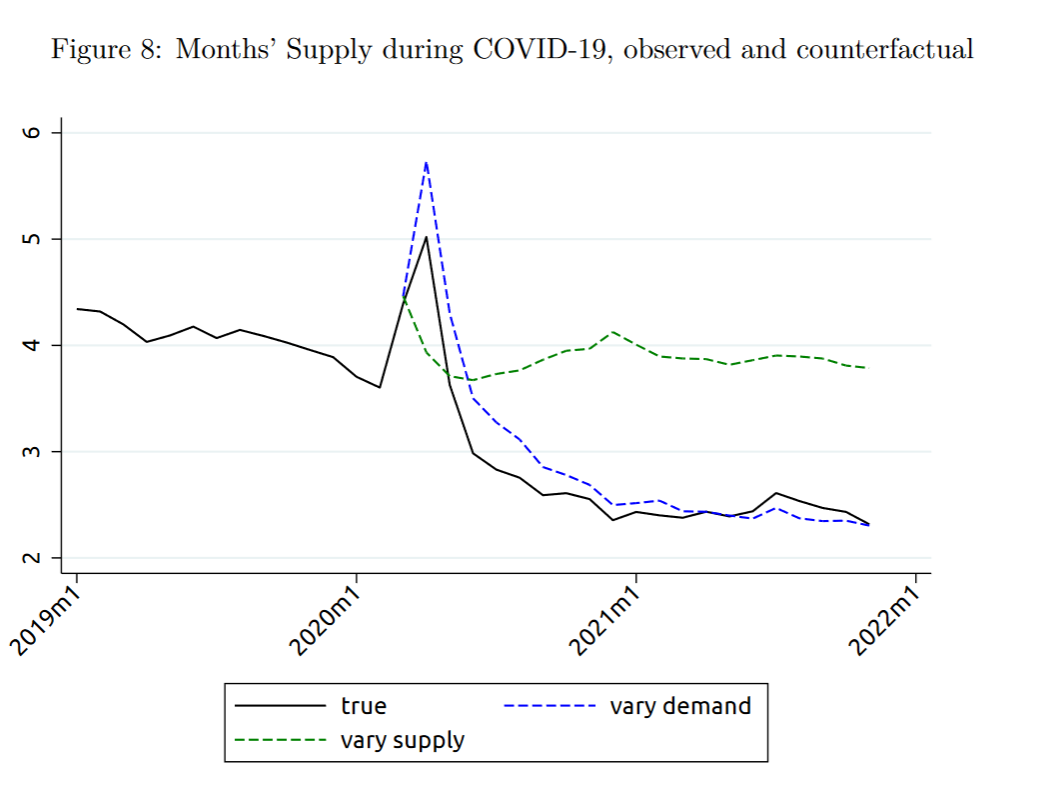

The federal reserve did an analysis of what has led to the surge in housing prices and has a conclusive answer; the driver of high prices is not that we don’t have enough houses as the media has been claiming. What is the real culprit behind soaring prices? Is there...

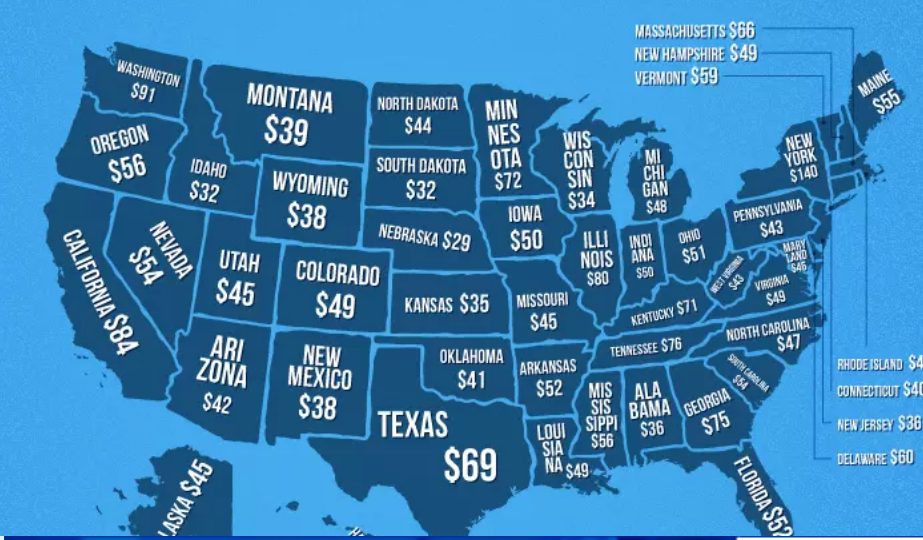

by Glen | Aug 8, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Commercial Lending in the news, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

If you haven’t gotten a haircut in a while, you are in for a surprise. Haircut prices like many other services in the economy are experiencing large increases. What does the increase in haircut prices mean for the economy and in turn real estate? Why are haircuts...

by Glen | Aug 1, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

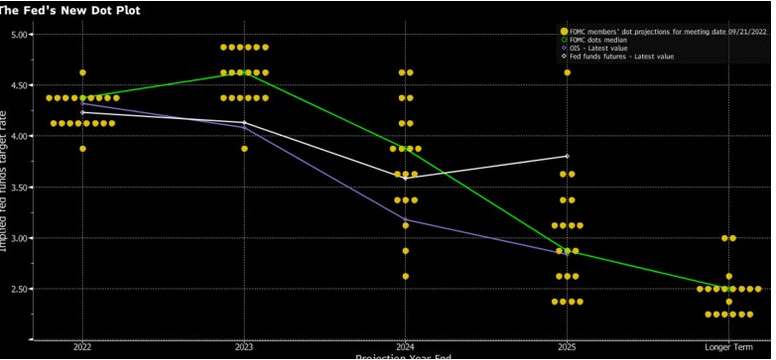

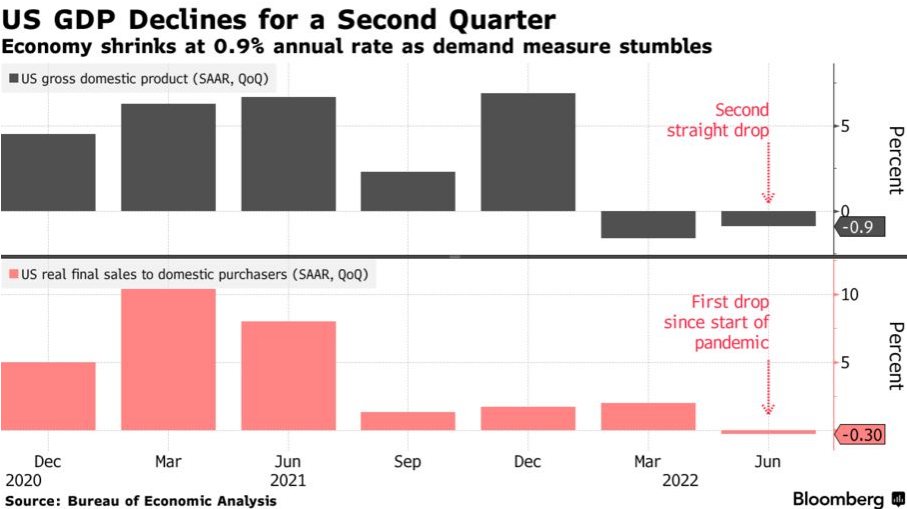

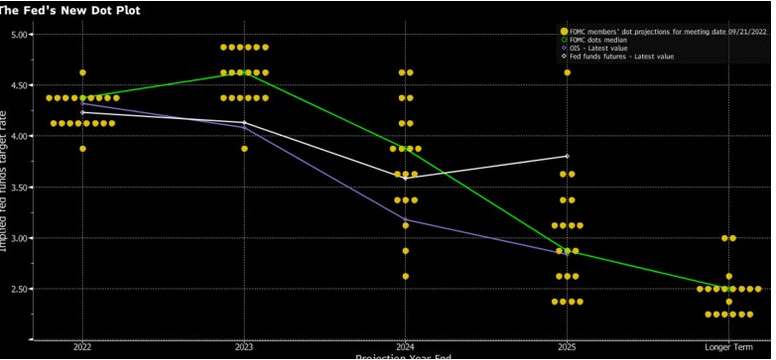

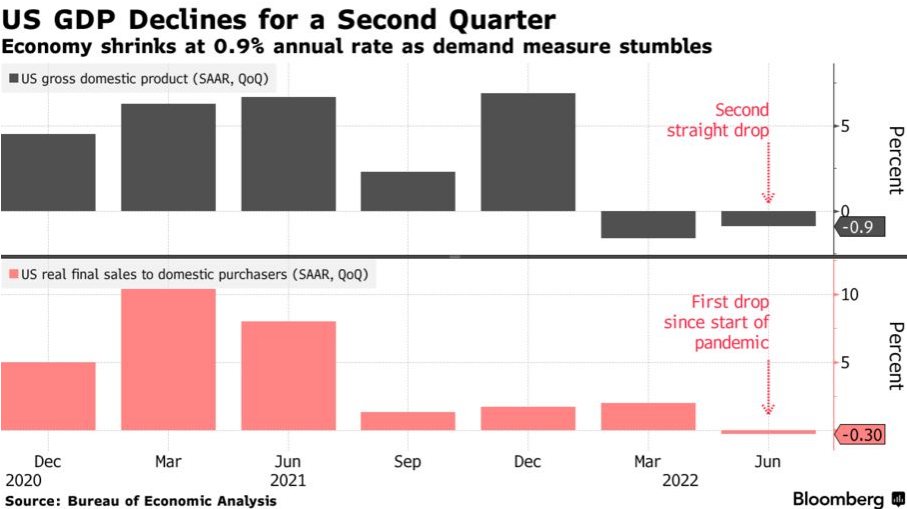

What a week it has been in the economy. The federal reserve is still struggling to contain inflation and as a result increased the fed funds rate .75%. After the announcement stocks roared back in a huge “relief” rally and mortgage rates plummeted. Shortly after,...