by Glen | Jul 22, 2024 | 2024 election real estate impacts, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Commercial Lending, mortgage rates, Property Valuation, Real Estate economic trends, Real Estate Trends, Real estate Valuation, recession impact on real estate

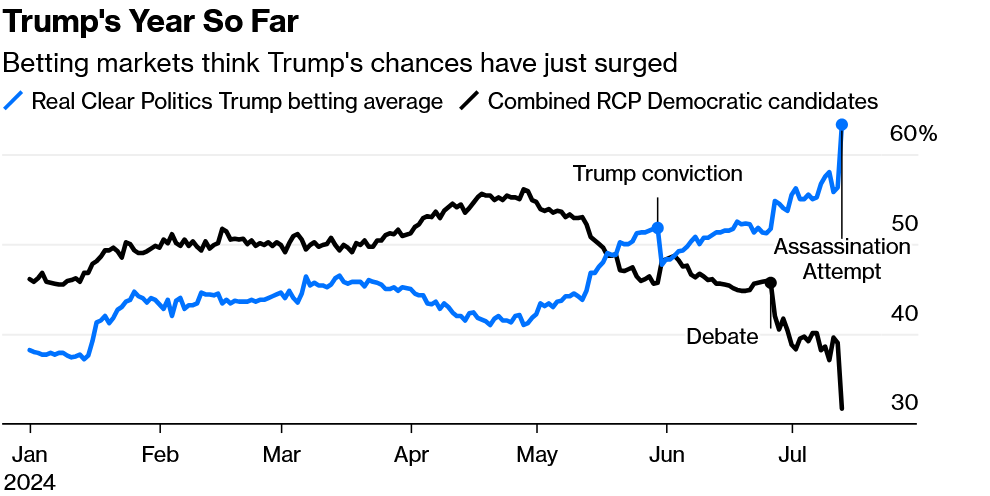

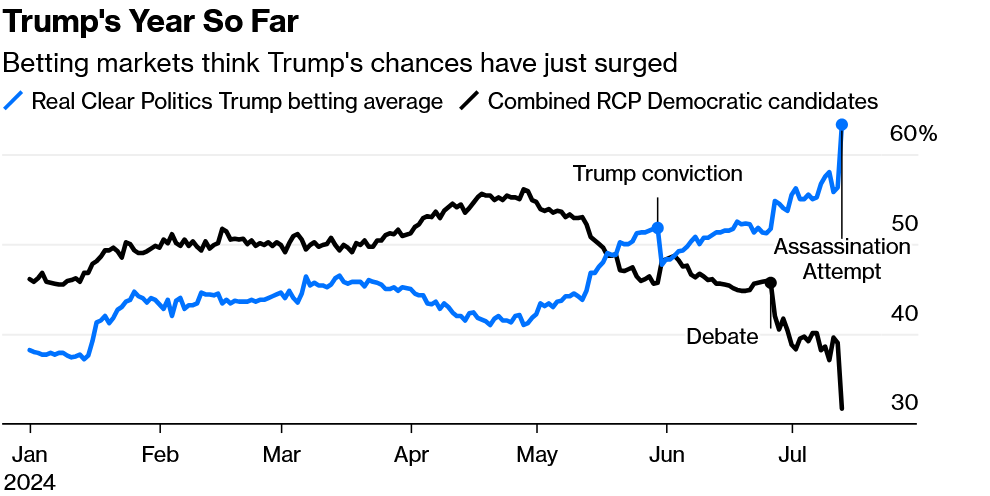

Wow, it is amazing how quickly tides have changed. Look at the chart above of the betting market on the next presidential election right after the assassination attempt. Fast forward and another twist happened over the weekend with President Biden stepping...

by Glen | Jul 15, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

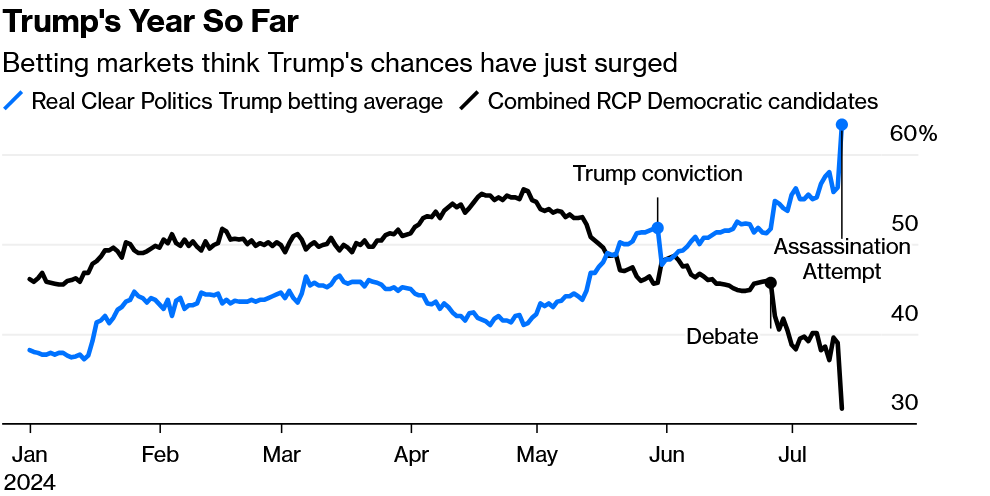

It is astonishing that house prices continue higher in the face of high interest rates and a slowing economy. The media keeps pinning the continued appreciation on lack of supply even while listings in places like Denver have jumped 33% year over year. What is...

by Glen | Jul 8, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money

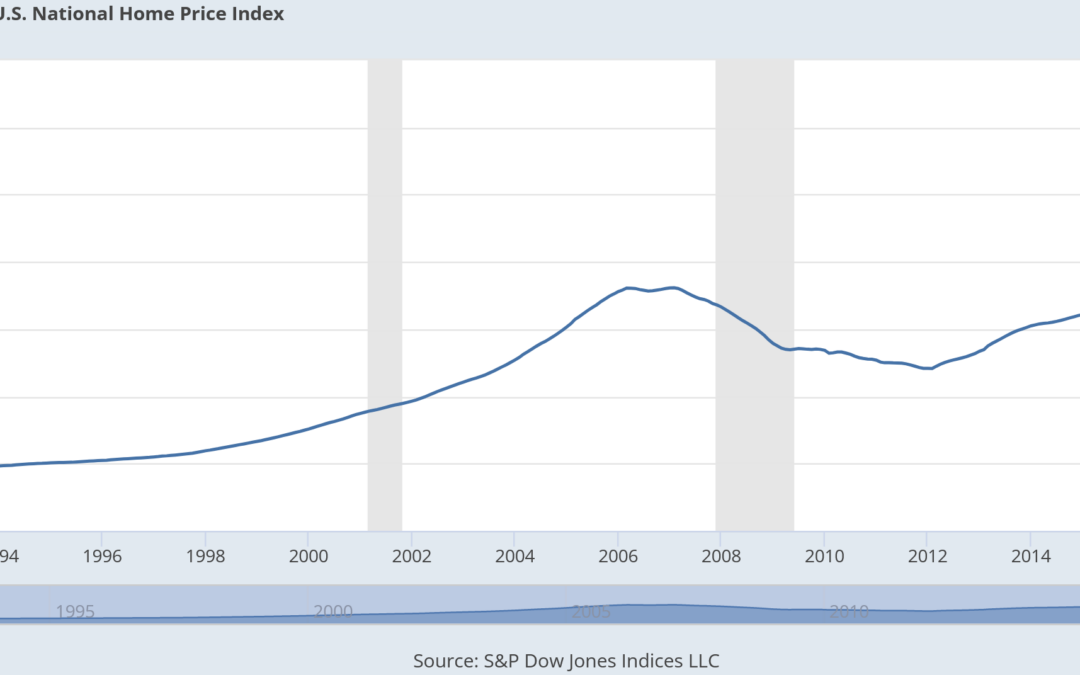

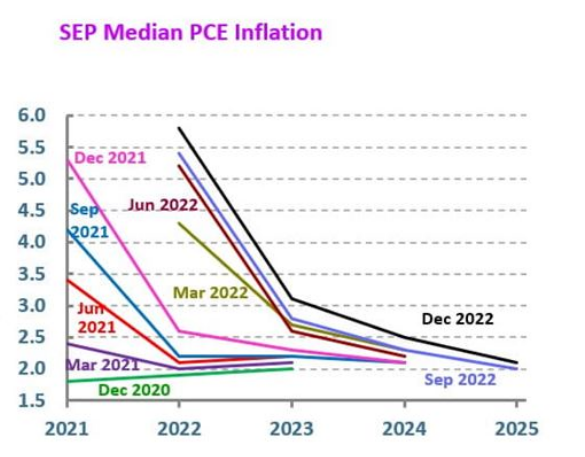

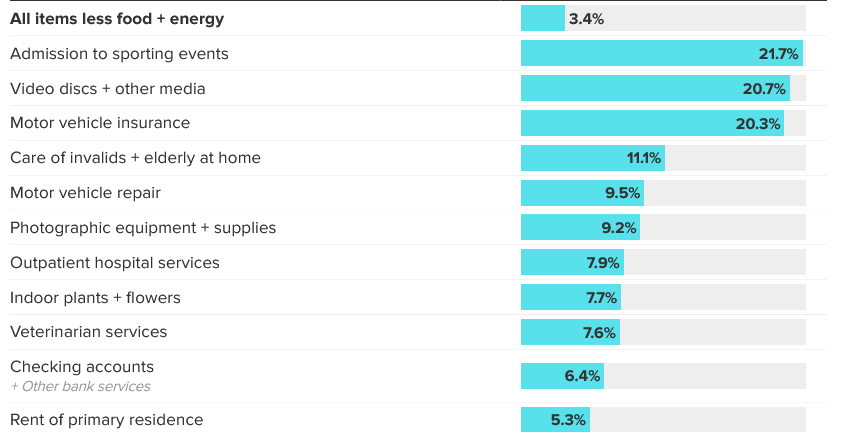

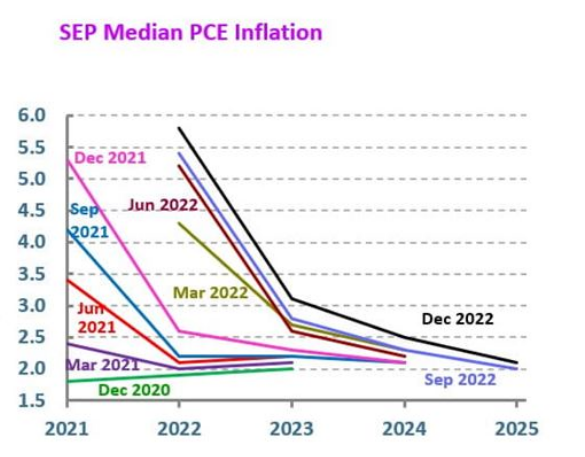

When I was writing this article mortgage rates were hovering right around 7%. At the same time June showed the first real slowdown in inflation in the last year. The stock market soared on the slowdown in inflation while the federal reserve took a much more...

by Glen | Jul 1, 2024 | 2024 mortgage rates, 2024 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Denver Hard Money, Denver private Lending, Government Bailout

There is a new mantra being used in small/regional banks that is “survive until 2025”. In essence the theory is that rates will drop precipitously and basically “bail out” many banks’ portfolios. This includes treasury holdings that are underwater, commercial...

by Glen | Jun 24, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Denver Hard Money, Denver private Lending, General real estate financing information, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information

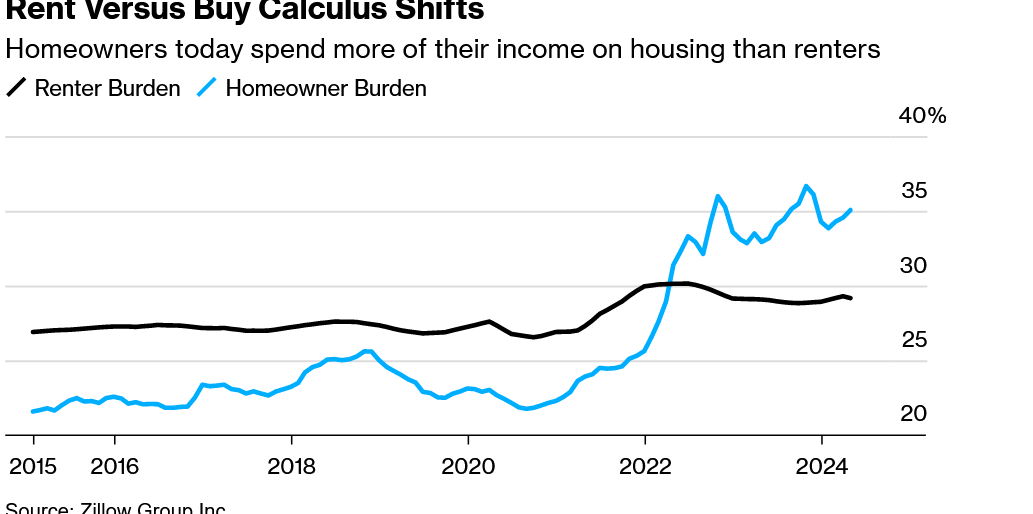

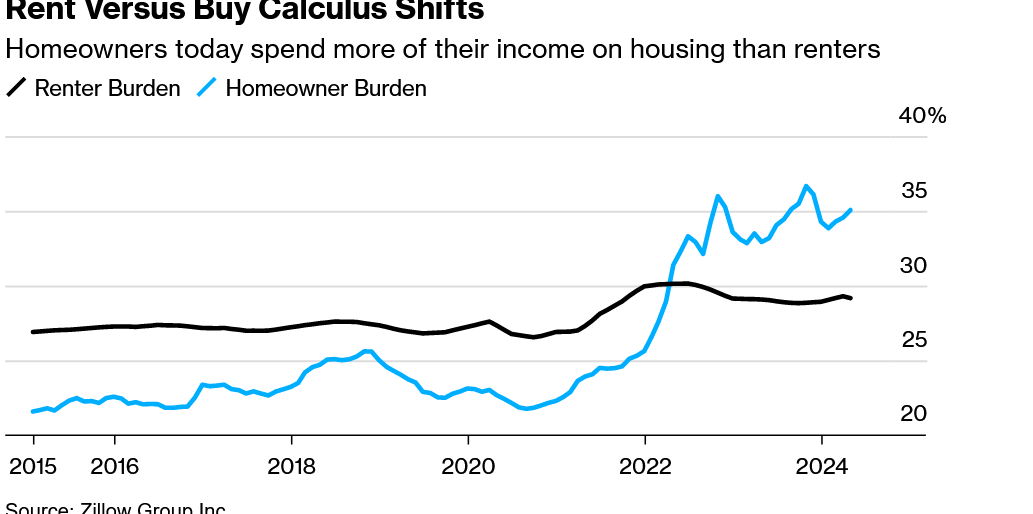

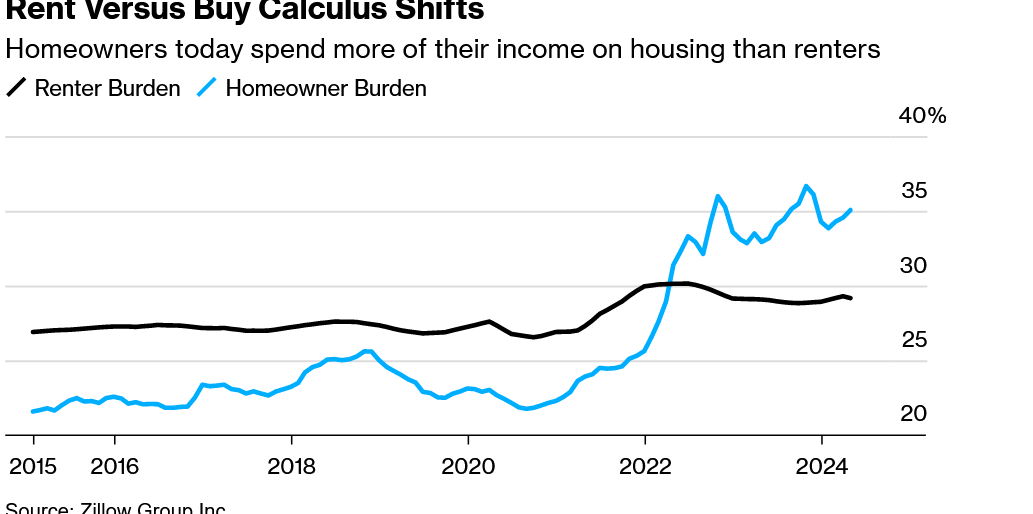

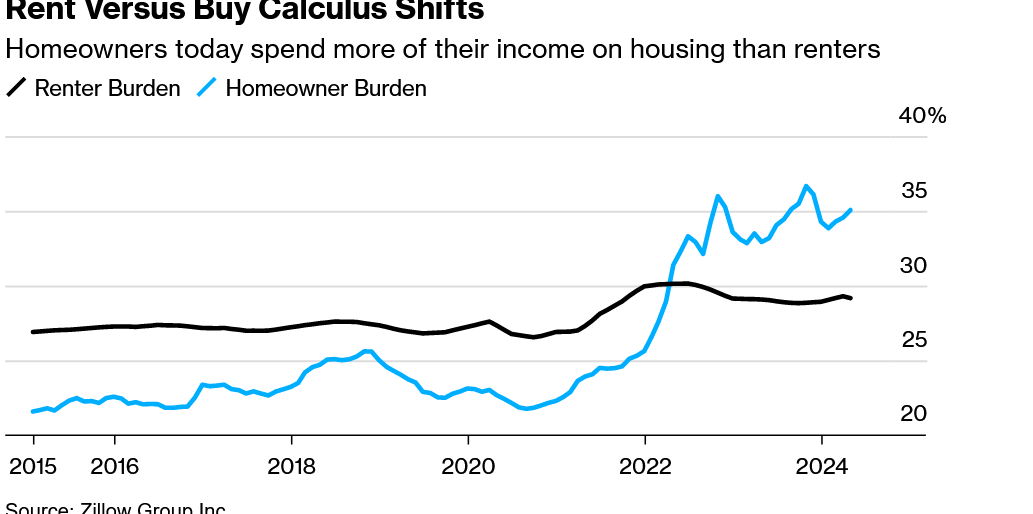

There is a huge premium to buying a property compared to renting. It is now 70% more expensive to buy vs rent a property, which is considerably higher than at any time in the last fifty years. What is causing the large divergence in renting vs buying? What does...

by Glen | Jun 24, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Denver Hard Money, Denver private Lending, General real estate financing information, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information

There is a huge premium to buying a property compared to renting. It is now 70% more expensive to buy vs rent a property, which is considerably higher than at any time in the last fifty years. What is causing the large divergence in renting vs buying? What...