by Glen | Sep 12, 2022 | 2022 real estate predictions, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Georgia hard money, Housing Price Trends / Information, interest rates

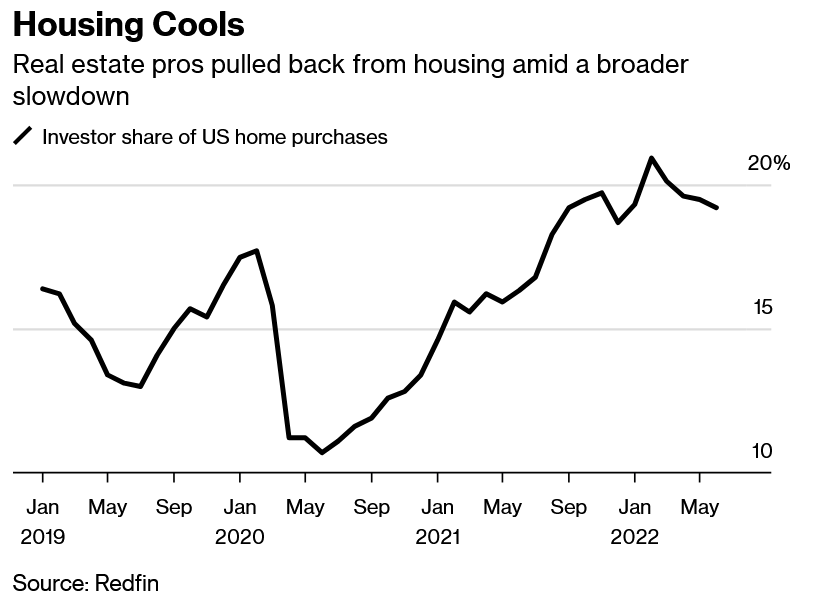

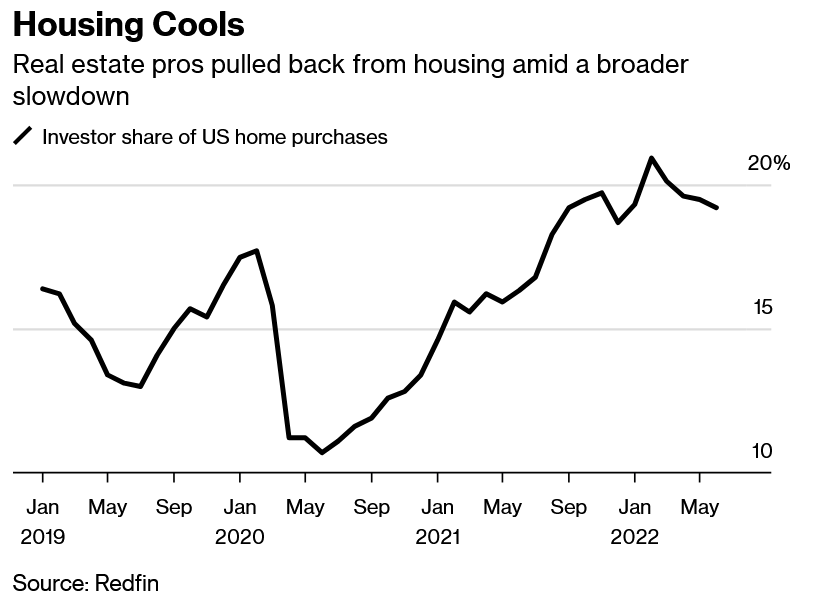

Wow, what a difference a few months makes. Earlier in the summer, basically any property with 4 walls had multiple offers and prices were on a tear. Fast Forward a few months and Blackstone, one of the largest buyers of residential rental homes, is pausing...

by Glen | Sep 5, 2022 | 2022 real estate predictions, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates

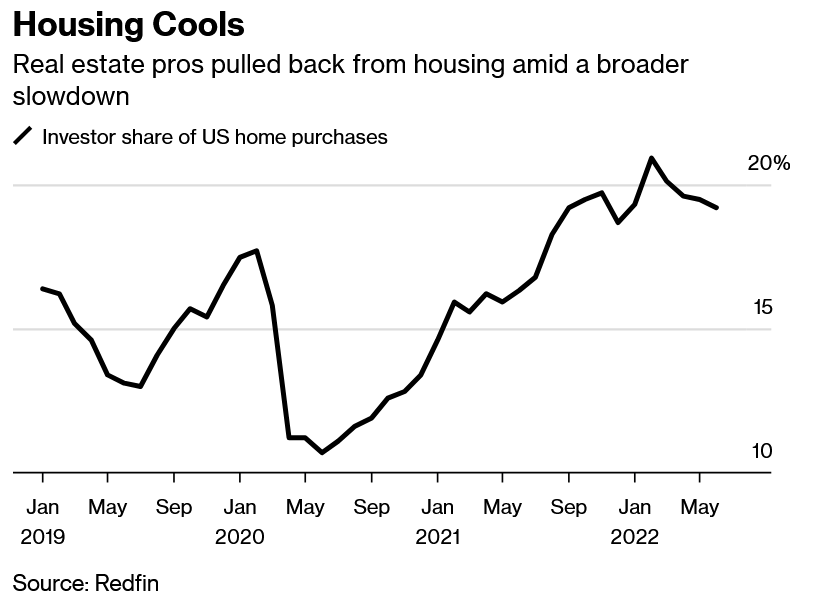

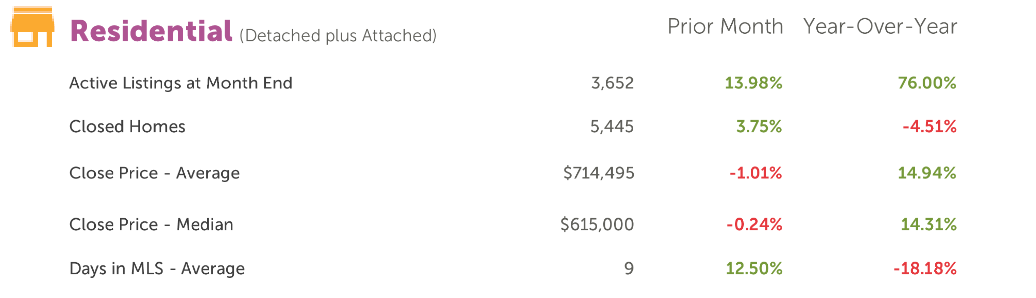

The National Association of Realtors predicts sales to rise again throughout 2023. At the same time, demand for mortgage refinances are down 83% from a year ago. Applications for a loan to purchase a home were 18% lower than the same week one year ago. Signed...

by Glen | Aug 25, 2022 | 2023 real estate prediction, 90s real estate recession, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Denver Hard Money, Denver private Lending, if there is a recession what happens to real estate, mortgage rates, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation

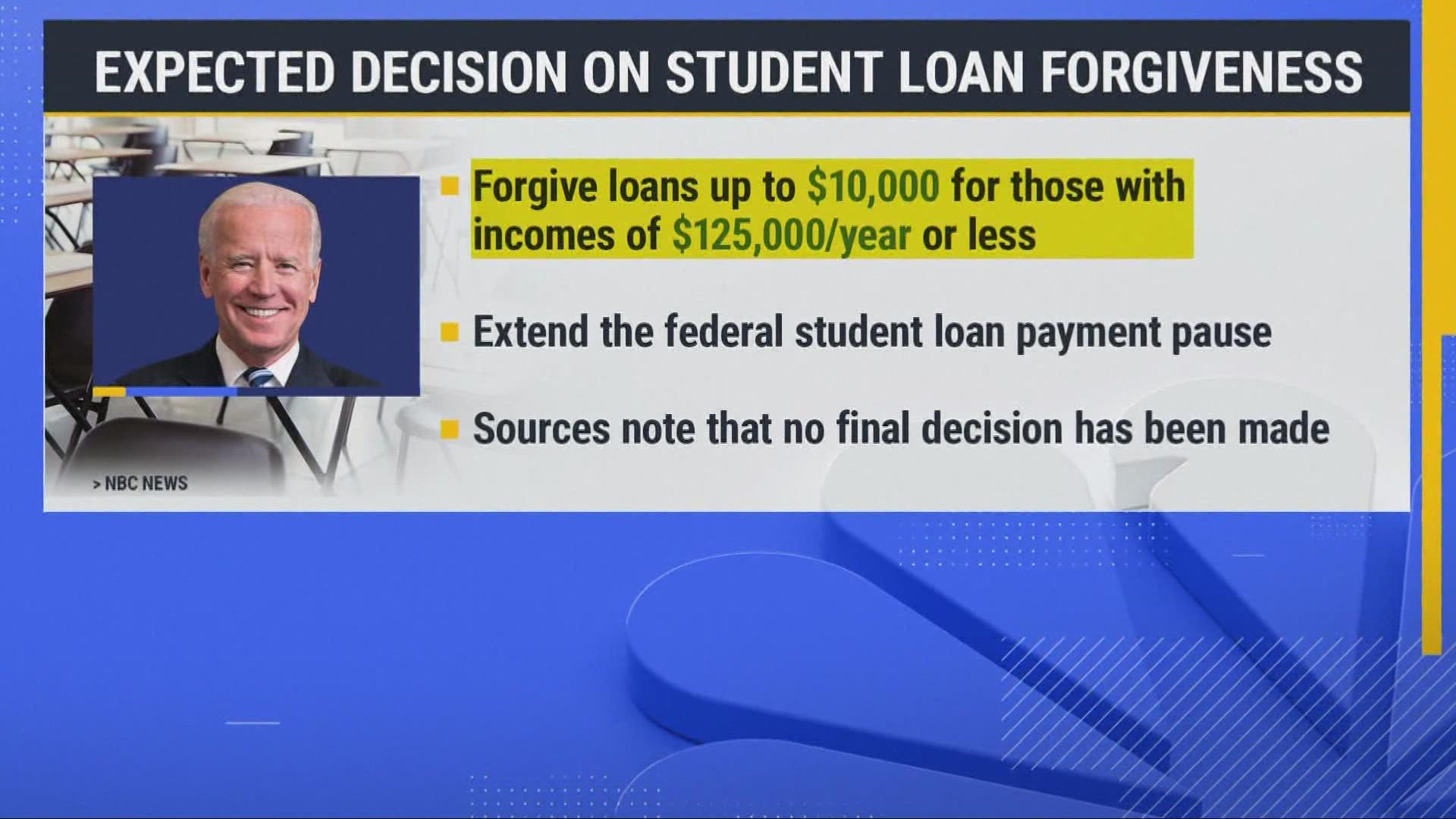

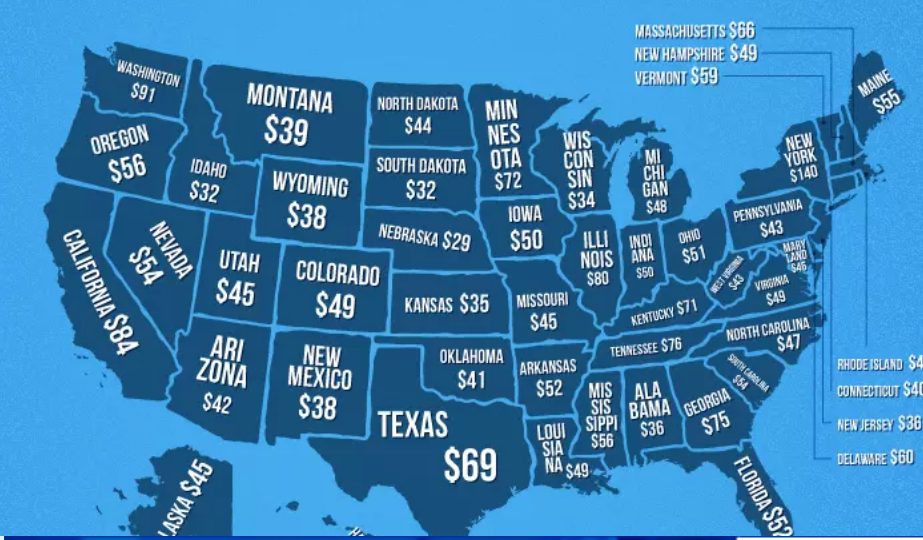

As of the writing of this article, President’s Biden’s plan is to forgive 10k in student loan per each borrower and further extend the payment pause until year end. How will this forgiveness impact real estate prices, mortgage rates, and prospective purchasers? What...

by Glen | Aug 22, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Colorado Hard Money, Commercial Lending valuation, commercial property trends, coronavirus 2021 real estate impacts, Denver Hard Money, Denver private Lending, General real estate financing information

When I looked over my shoulder and saw these two fellows staring at me, it made me wonder if they were trying to tell me something. I definitely got the hint! I don’t think anyone would debate that real estate is now entering a bear market. The million dollar...

by Glen | Aug 15, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, hard money, Hard Money Commercial Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

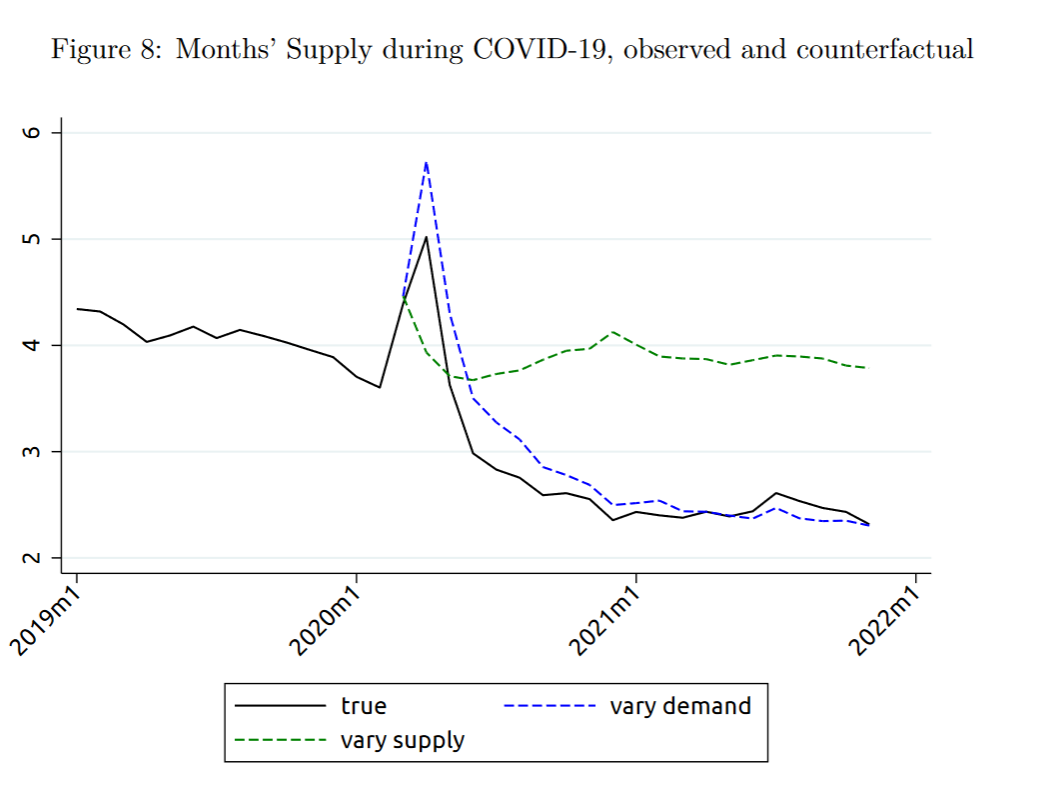

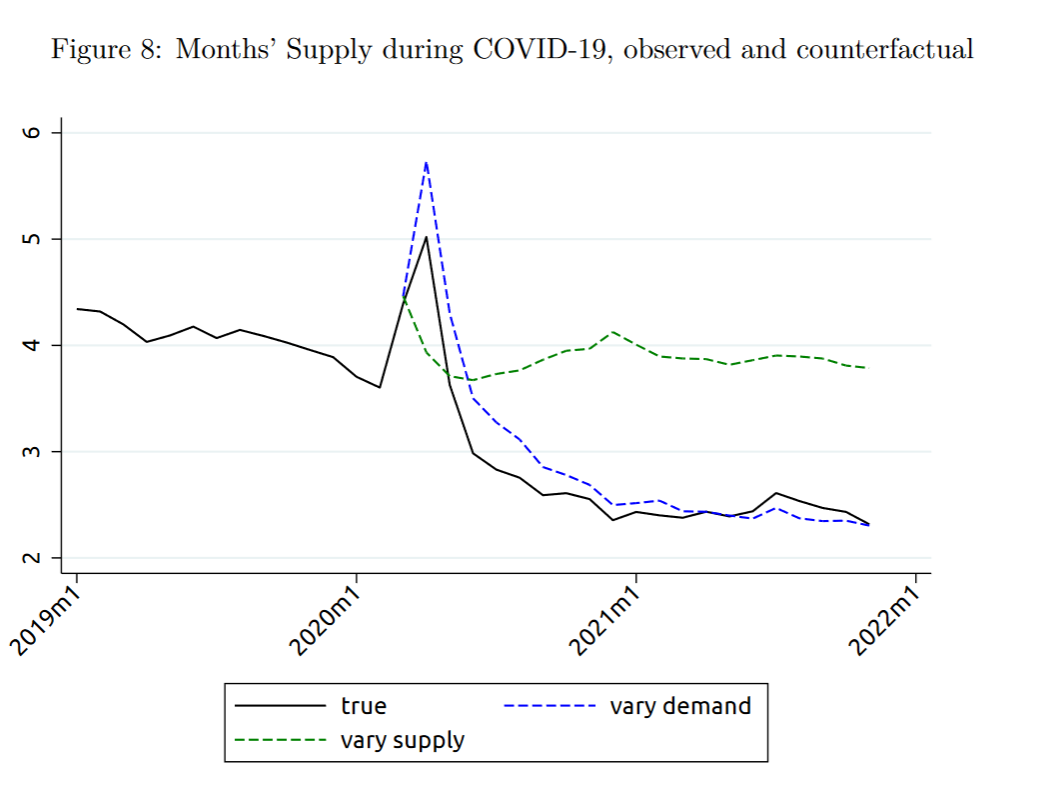

The federal reserve did an analysis of what has led to the surge in housing prices and has a conclusive answer; the driver of high prices is not that we don’t have enough houses as the media has been claiming. What is the real culprit behind soaring prices? Is there...

by Glen | Aug 8, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Commercial Lending in the news, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

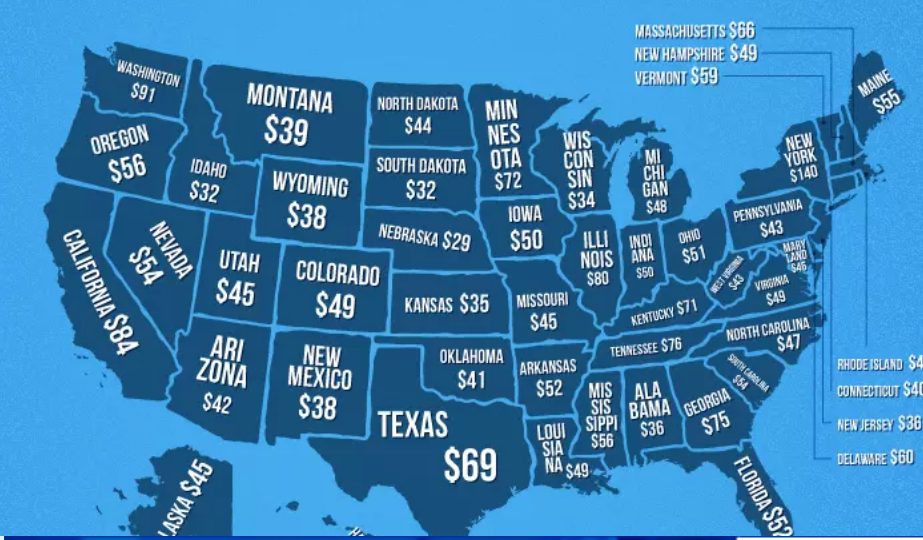

If you haven’t gotten a haircut in a while, you are in for a surprise. Haircut prices like many other services in the economy are experiencing large increases. What does the increase in haircut prices mean for the economy and in turn real estate? Why are haircuts...