by Glen | Nov 27, 2023 | 2023 real estate prediction, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

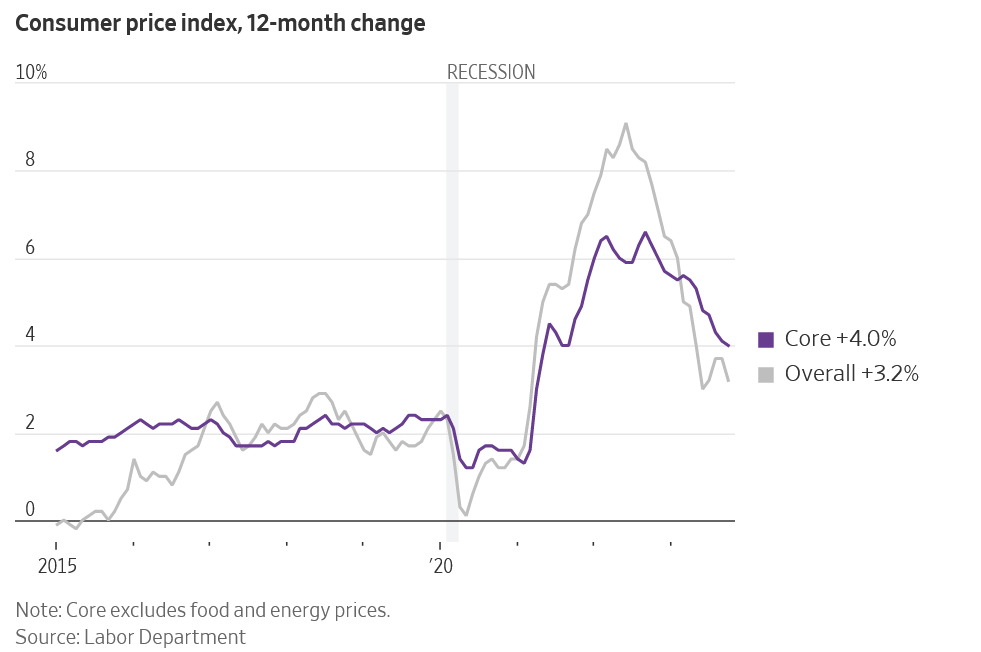

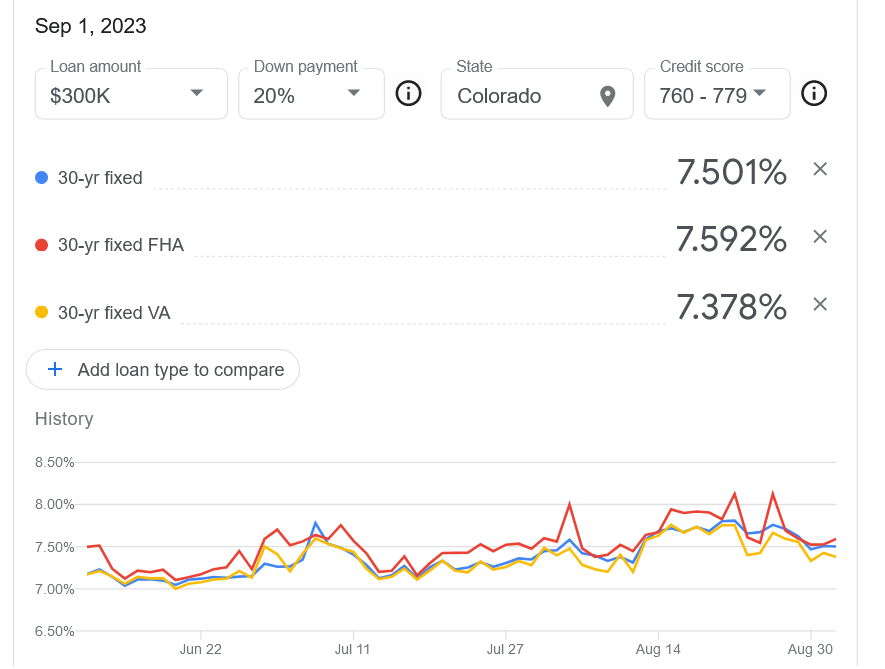

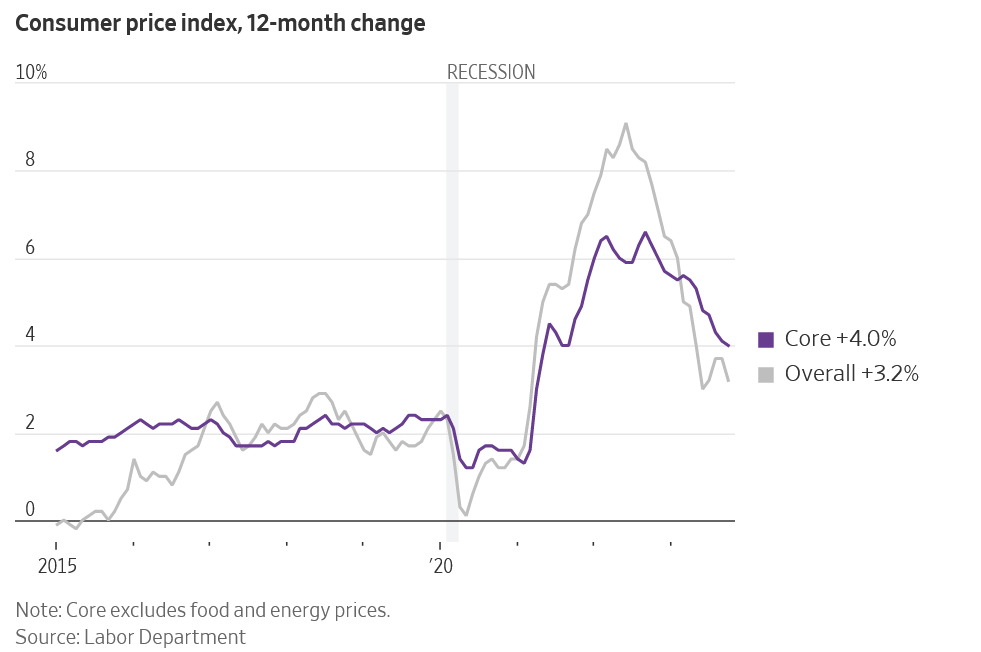

What does the recent CPI fall mean for mortgage rates and real estate prices? A broad slowdown in inflation continued in October, likely ending the Federal Reserve’s historic interest rate increases. The slowdown came below most median estimates and the...

by Glen | Oct 23, 2023 | 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Property Valuation, Real Estate economic trends, real estate investing, Real estate Valuation, recession, recession impact on real estate

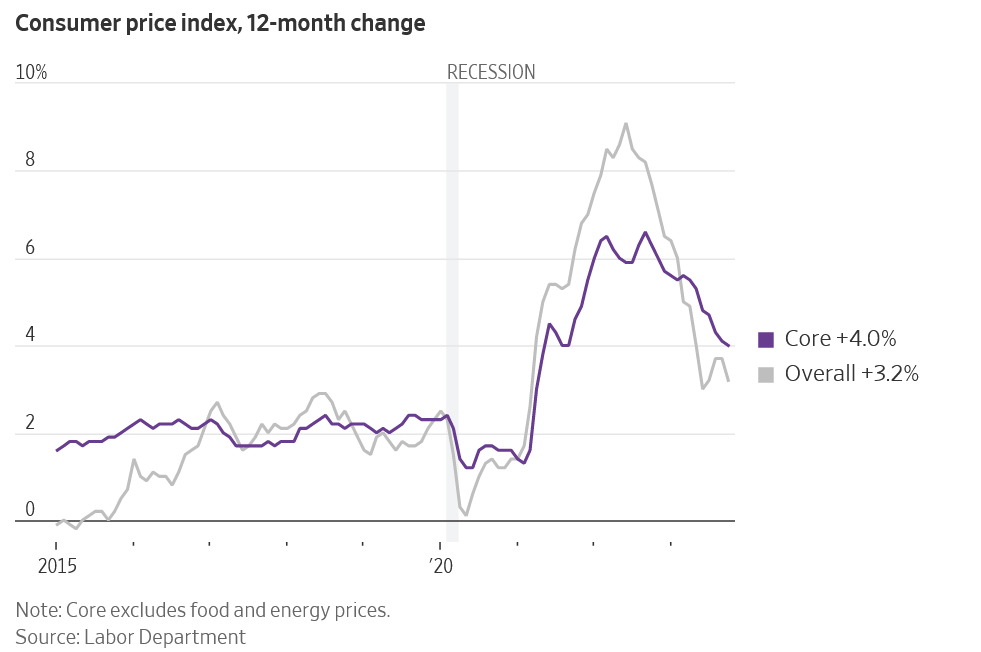

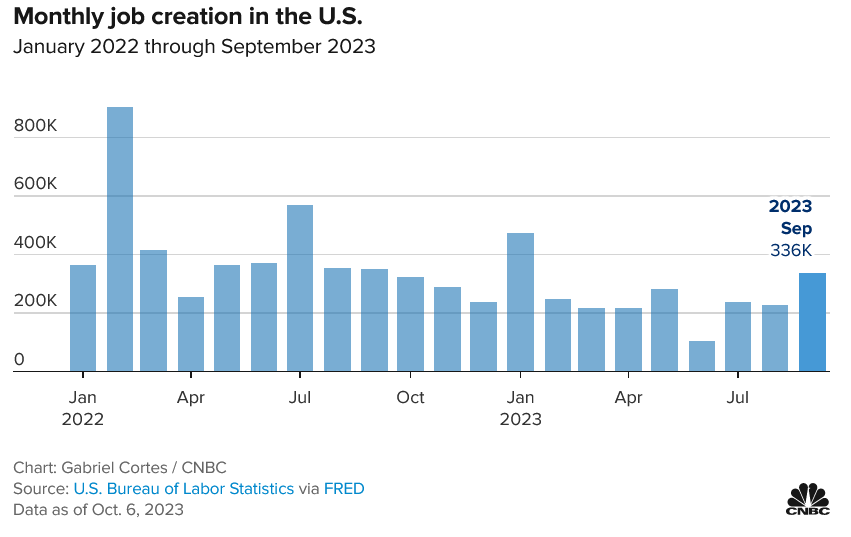

The economists forecasting the jobs data missed big time, with the recent jobs report almost double their predictions. Why is job growth still surging while interest rates hit 20 year highs. What does this mean for future interest rate increases? Does this change...

by Glen | Sep 18, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money

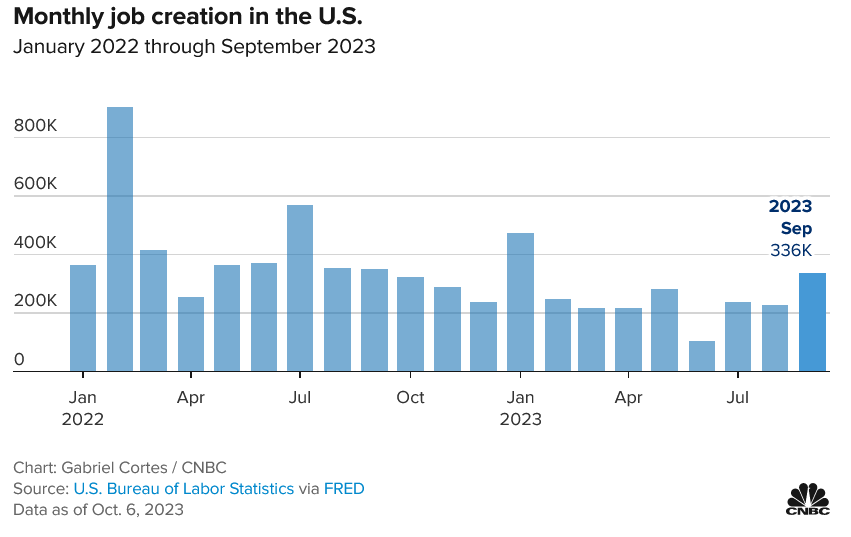

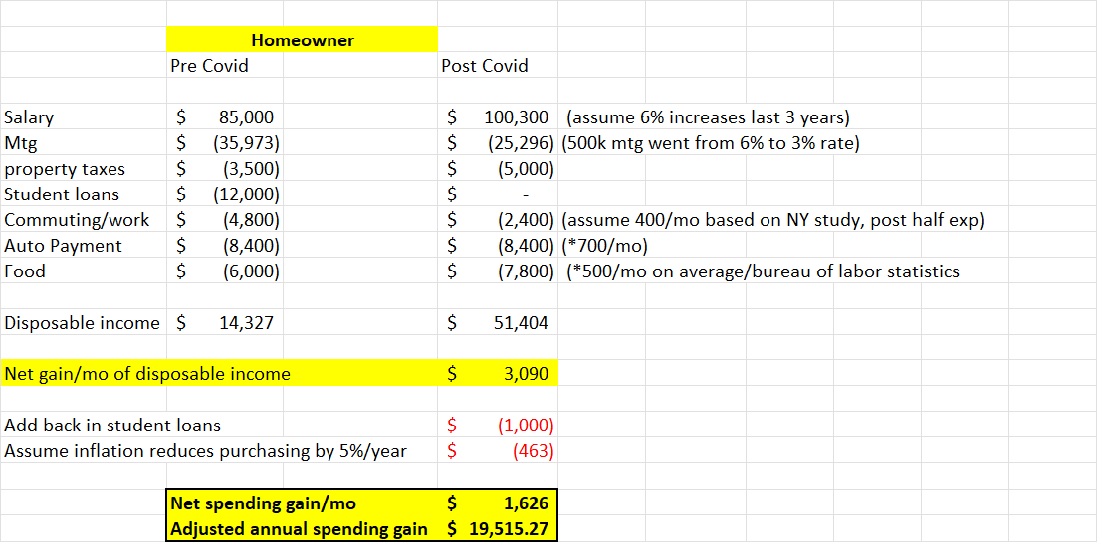

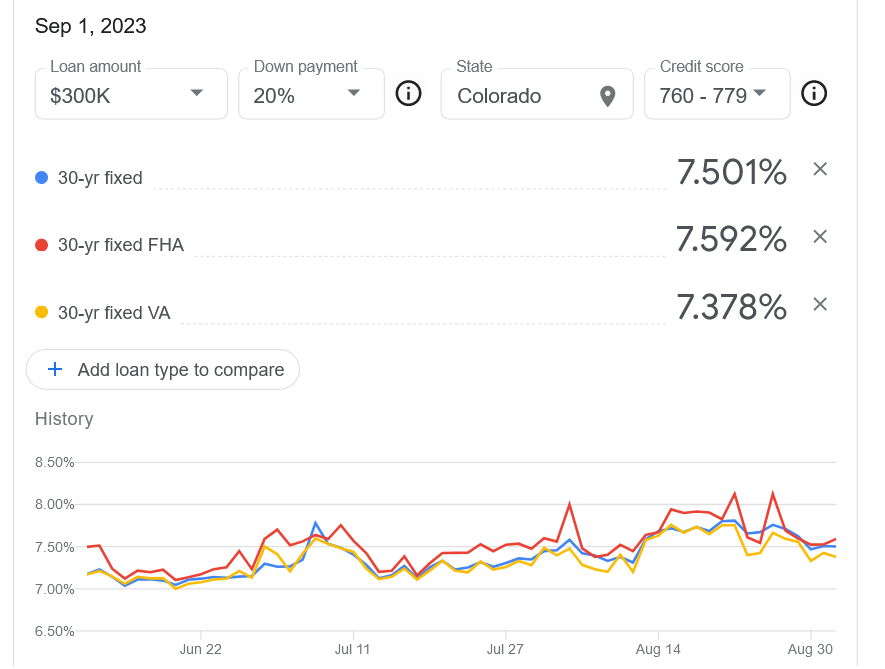

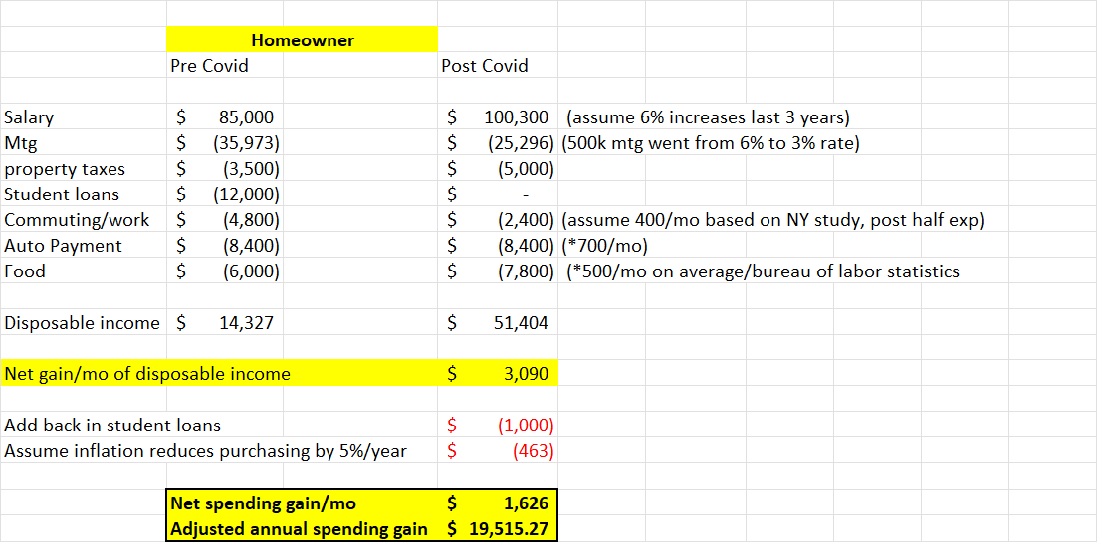

For years interest rates were the number one indicator for real estate prices. In this cycle interest rates have more than doubled yet real estate prices have barely budged. If we look back at 2008, the impetus for the large real estate crash was rising interest...

by Glen | Sep 4, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans, if there is a recession what happens to real estate

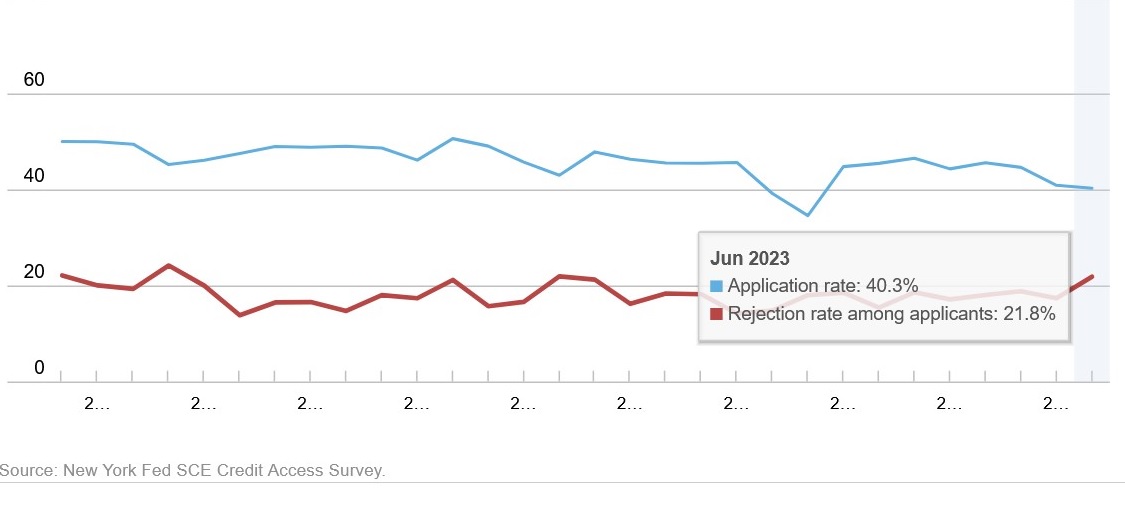

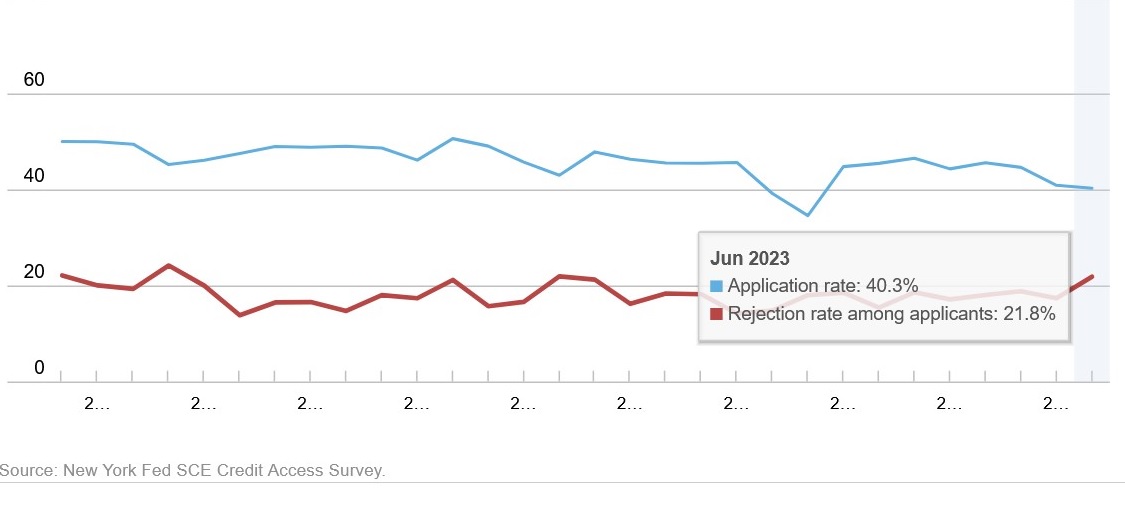

It was already difficult for businesses and households to borrow money earlier this year — but after the collapse of three US regional banks and a cascade of rate hikes by the Federal Reserve, getting money has become considerably harder. What does the decline in...

by Glen | Jul 17, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Bankruptcy, Colorado Hard Money, Colorado private lender, commercial private lending, commercial property trends, Denver Hard Money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate

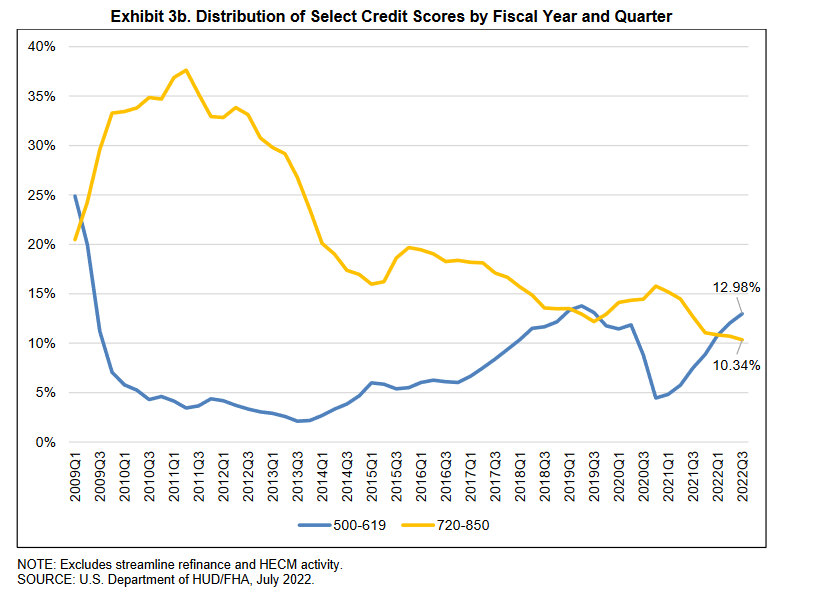

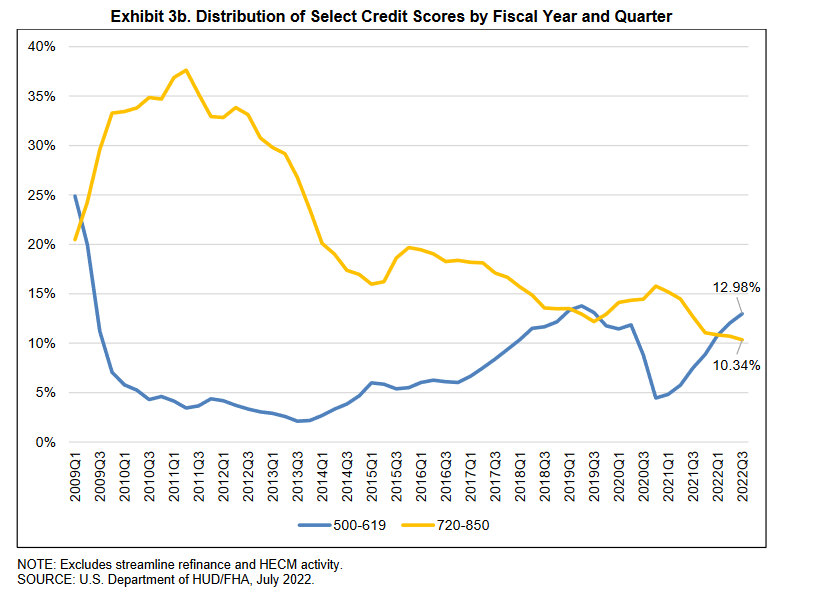

I always cringe when I see a press release that “regulators” have a solution! FHA has yet another new proposal that sounds great on the surface, but as typical misses some very important items that will cost taxpayers millions or considerably more as government...

by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...