by Glen | Feb 3, 2025 | 2024 mortgage rates, 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Other Questions, Process/Loan Submittal, Program Details, Questions Regarding Fairview, Realtor, Underwriting/Valuation

Wow, 2024 was definitely a surprise, at the beginning of the year, there were huge predictions of a rapid decline in rates, fast forward to 2025 and now rates are actually rapidly increasing even after the federal reserve cut short term rates. Why are rates...

by Glen | Jan 20, 2025 | 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Brokering Loans to Fairview, Closing, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Denver Hard Money, Georgia hard money, interest rates, mortgage rates, Other Questions, private lender, Process/Loan Submittal, Program Details, Questions Regarding Fairview, real estate investing, Real Estate Trends, Realtor, Underwriting/Valuation, will house prices continue to increase

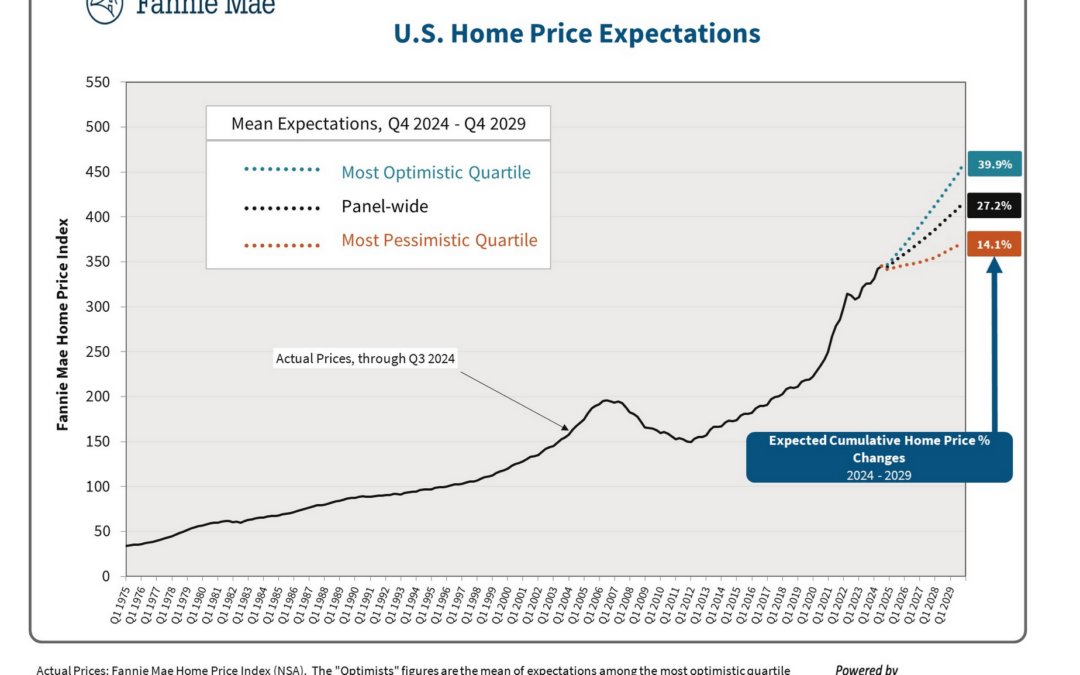

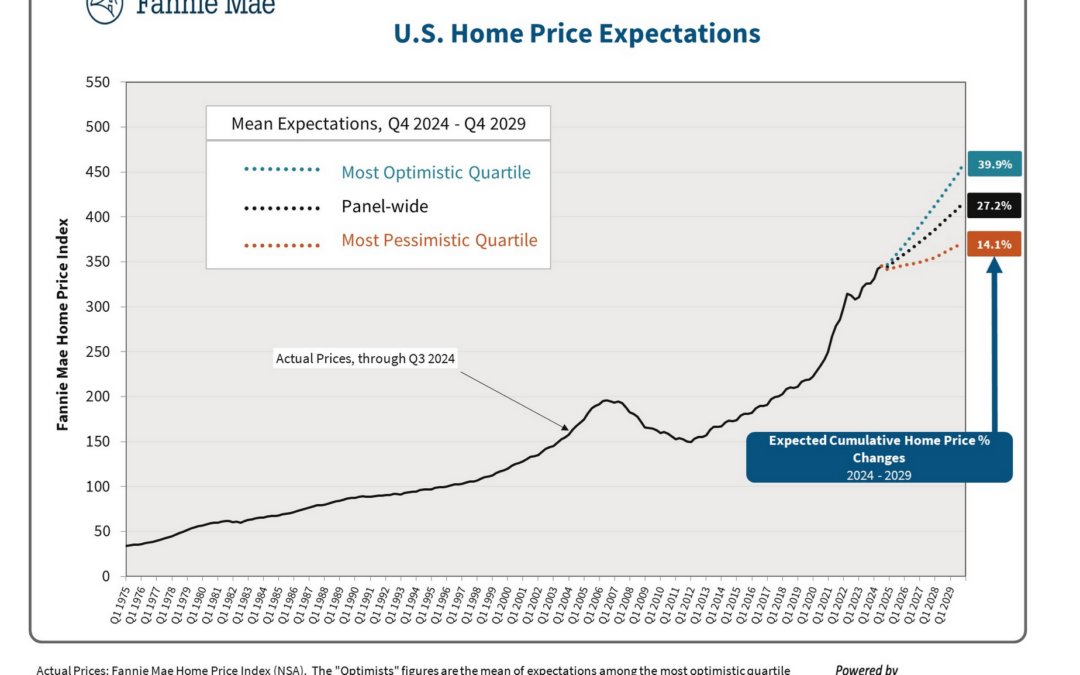

Fannie Mae, one of the largest buyers of residential mortgages has some profound predictions. Will house prices continue their upward trend through 2030? How accurate are the predictions below? How can house prices continue in such a linear fashion? Will...

by Glen | Jan 6, 2025 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, About Fairview Commercial Lending, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Denver Hard Money, General real estate financing information, Georgia hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, private lender

The above is a picture of my windshield after a chance early morning encounter with an elk; I walked away while my car was basically totaled. Why is 2025 the year of the elk as elk should typically be the least of your worries? What does this mean for the upcoming...

by Glen | Dec 30, 2024 | 2025 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado private lender, commercial hard money, Denver Hard Money, Denver private Lending, Georgia hard money, Harris housing plan, Housing inflation, Housing Price Trends / Information, Housing shortage

We all know rents have increased, but the reason seems to be alluding our elected officials. The new scapegoat for rising rents is being pinned on artificial intelligence as the root cause of high rents and one company in particular. Why is the government now...

by Glen | Dec 23, 2024 | 2025 real estate predictions

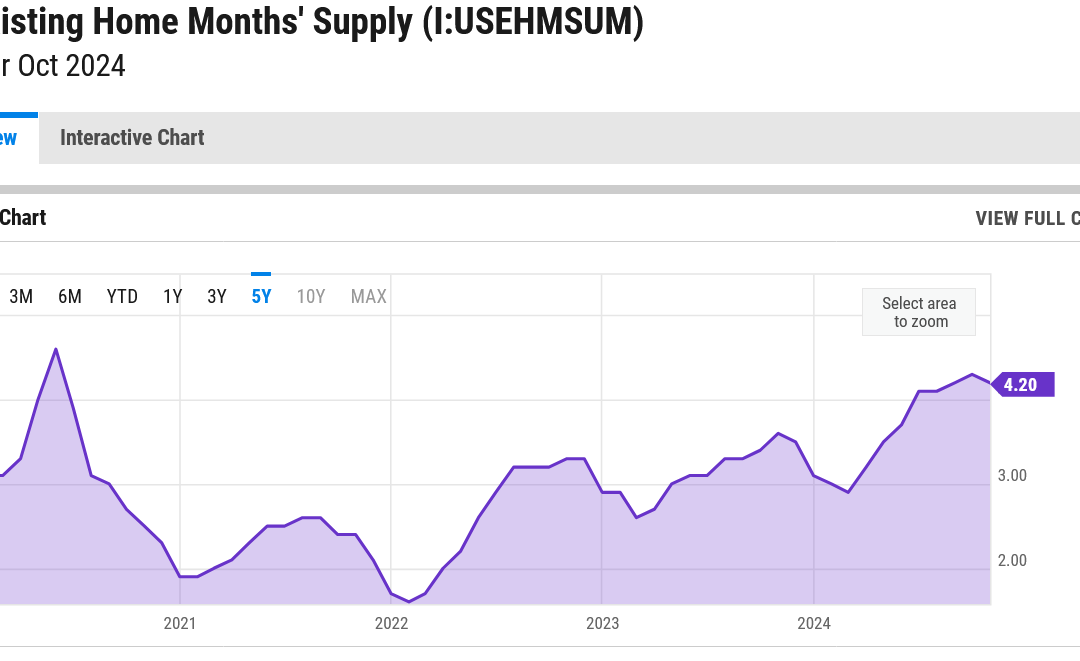

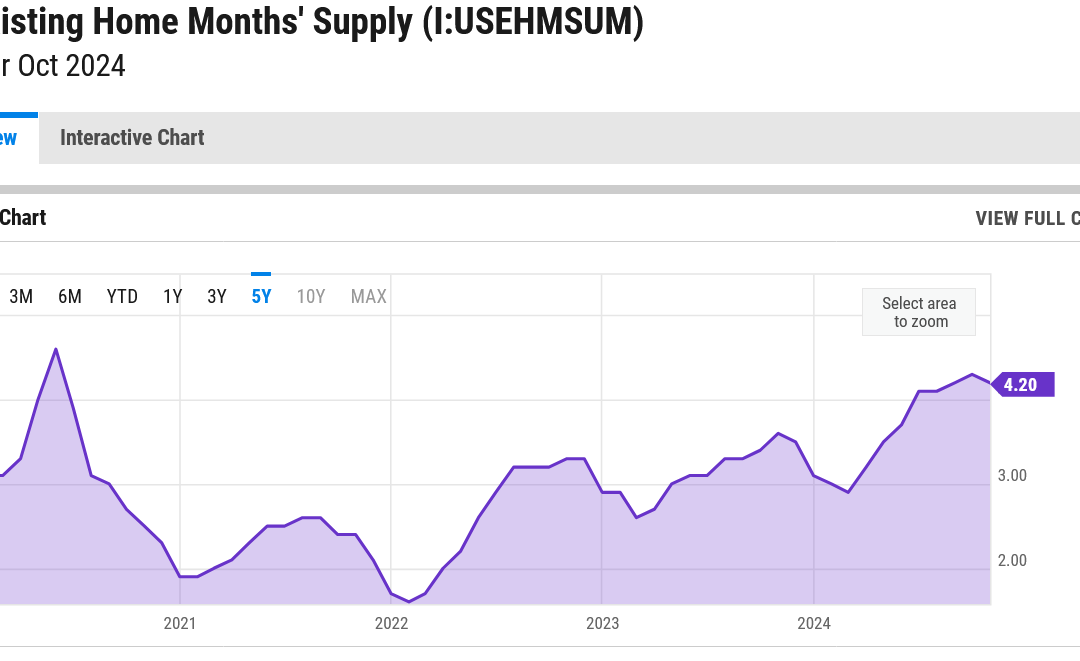

2024 was set to be the big recovery in real estate with rates lowering setting us up for a great 25. Instead, rates are hovering around 7%, inventory is rising, and long term treasuries are pointing to higher rates for longer. What does this mean for 25? ...

by Glen | Dec 16, 2024 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, if there is a recession what happens to real estate, mortgage rates, Private Lending, real estate investing, Real Estate Trends, Real estate Valuation

When I was writing this article mortgage rates were hovering right around 7%. At the same time economists had been predicting a sharp decline in mortgage rates and a booming 2024 real estate market as the fed has cut rates. On the other hand, the chart above...