by Glen | Apr 17, 2023 | 1031 exchange, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, what happens to real estate if long term capital gains eliminated

Presidential nominee Biden has rolled out his proposed tax plan with two major pillars that will impact real estate: 1) Elimination of the 1031 exchange provision 2) elimination of long term capital gains. These two changes, if passed, will have huge implications for...

by Glen | Mar 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

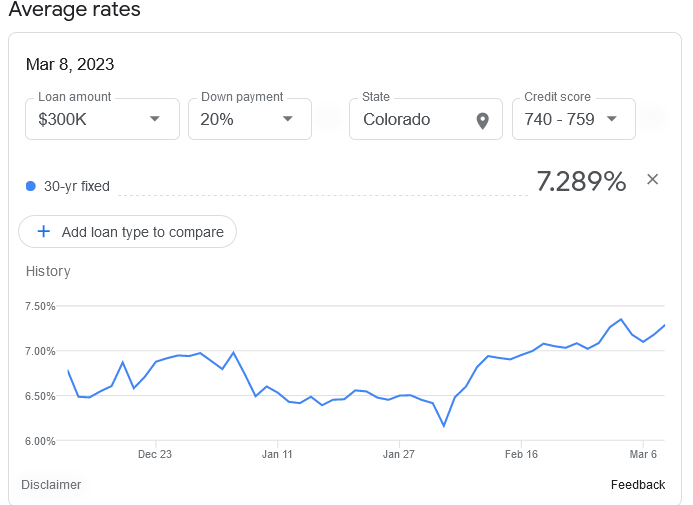

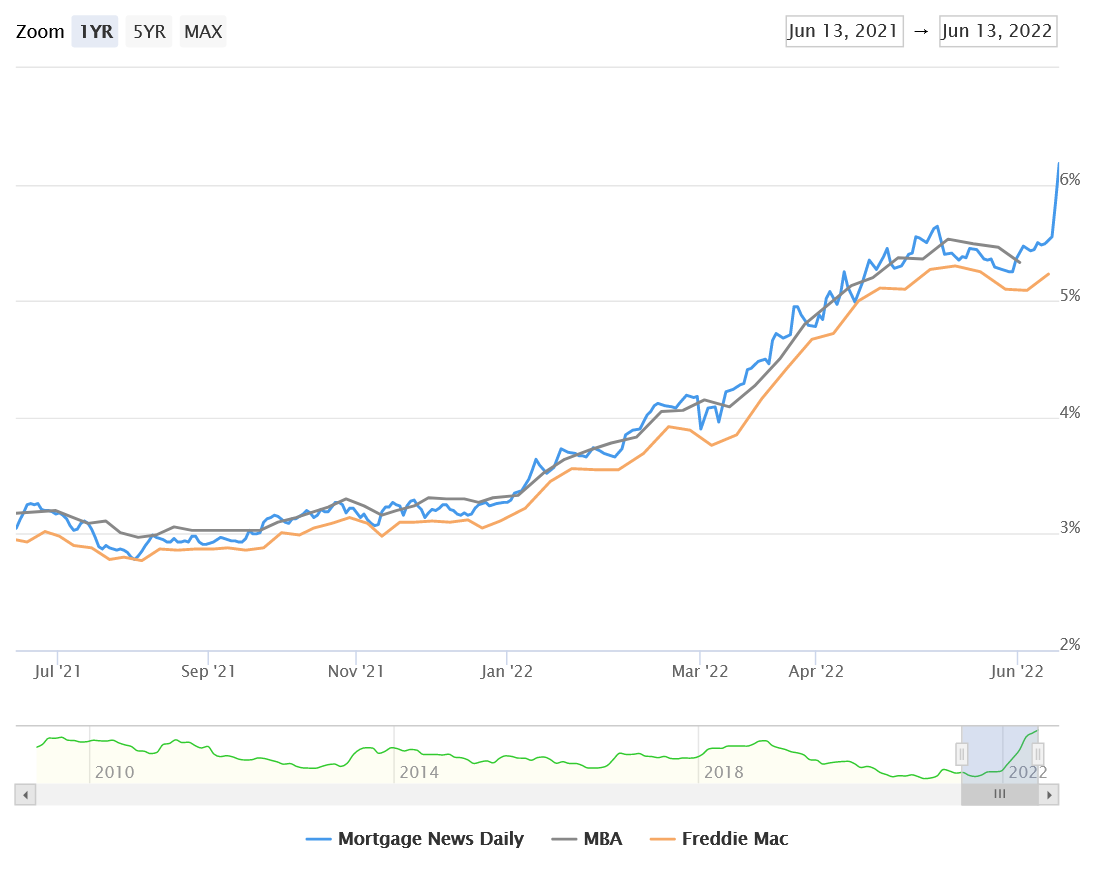

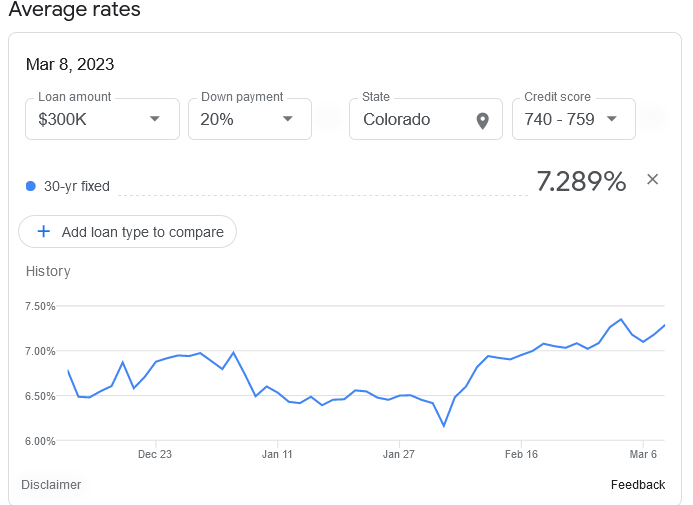

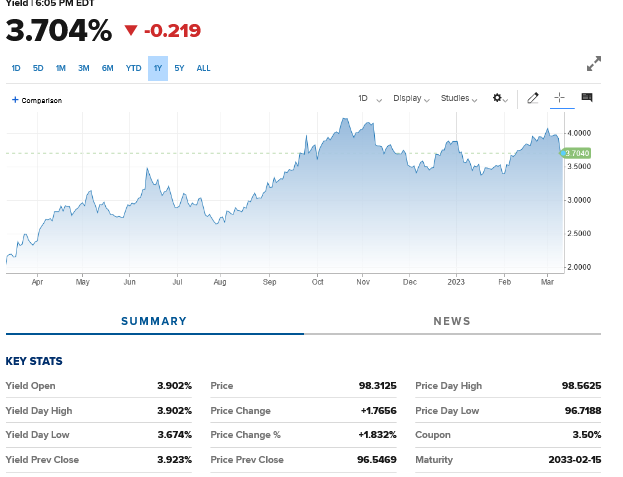

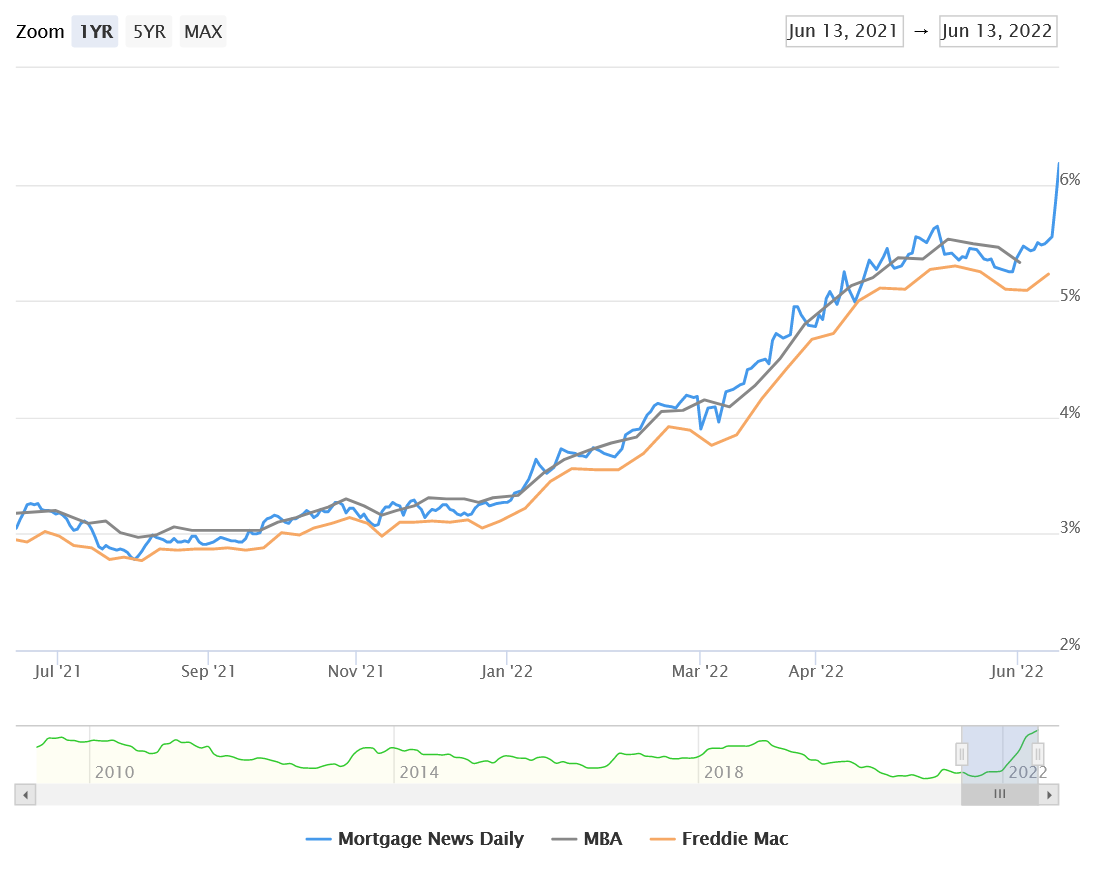

Wow, a few weeks ago rates had fallen from a peak of over 7% to almost 6%. Unfortunately the party was short lived as rates are now heading much higher. The recent jobs report was another blow out upping the odds of another half point increase at the next Fed...

by Glen | Mar 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, Hard Money Lending, Housing Price Trends / Information

Over 48 hours two banks failed for very different reasons. There is a saying in banking that when rates rise and easy money runs out, we will find the skeletons that have been lurking in plain sight. Are we in for a 2008 rerun? What caused the sudden...

by Glen | Feb 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks

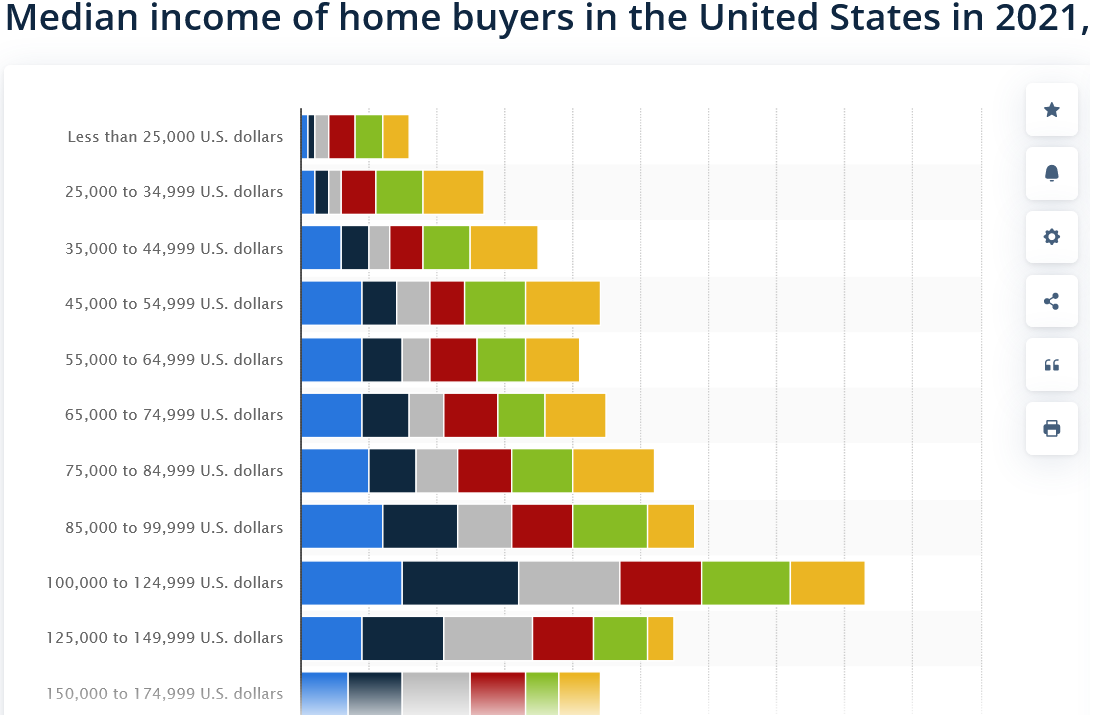

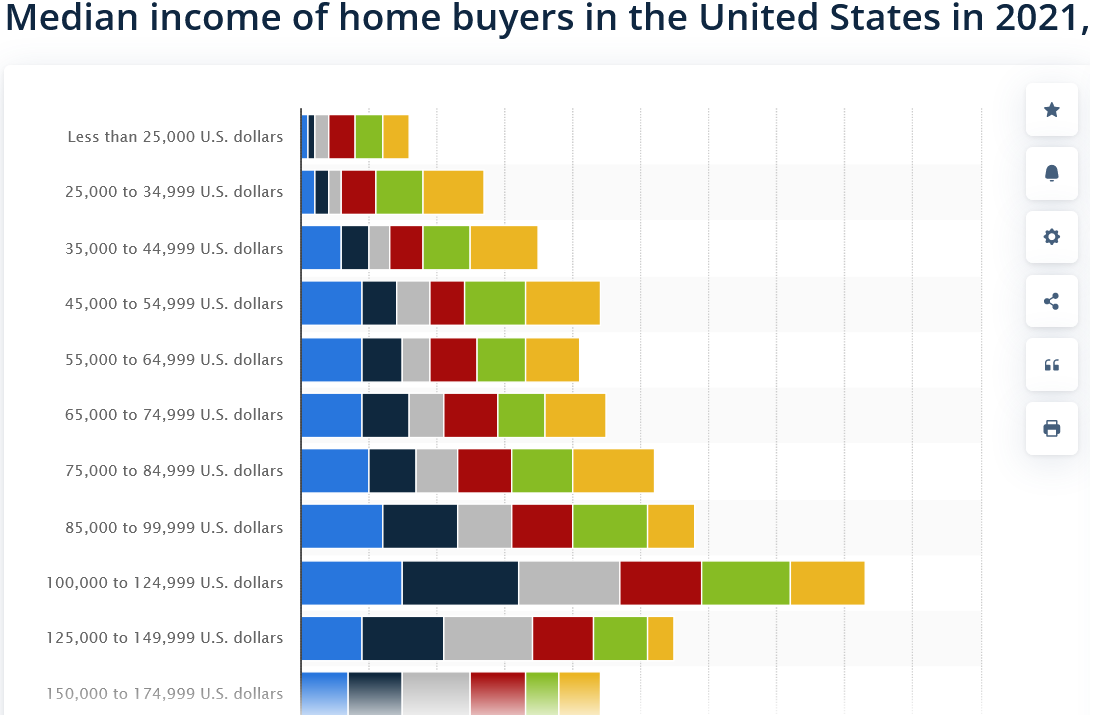

Purchasing power from paychecks fell 2.9% for middle-income households in 2022 compared with 2021, while rising 1.5% for the bottom fifth of households and 1.1% for the top, according to the Congressional Budget Office study. Furthermore, nearly 40 percent of...

by Glen | Feb 13, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates

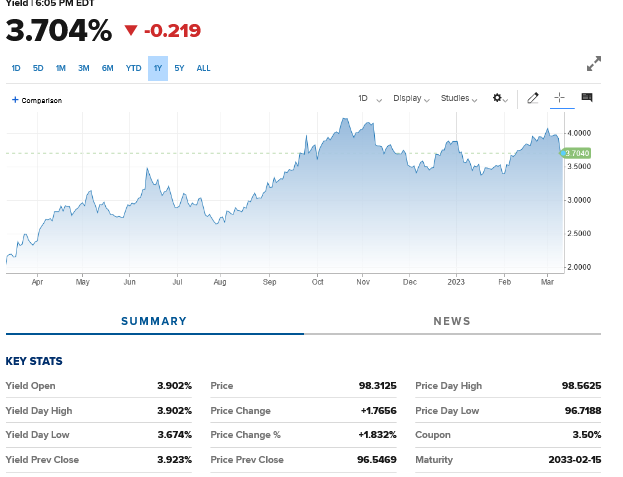

The market currently has a fixation on interest rates. Essentially whatever interest rates do the market reacts accordingly. For example if rates rise, sales fall and vice versa. Are rates really the driver of the slow down in real estate sales? If rates...

by Glen | Feb 6, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Georgia hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates

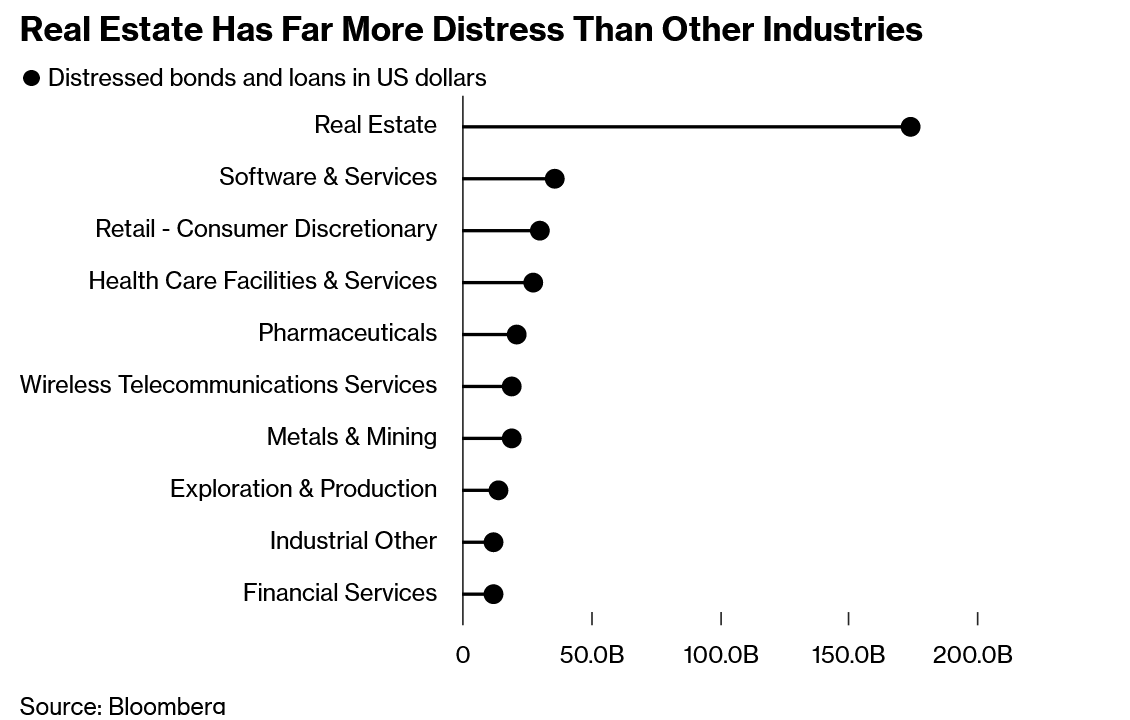

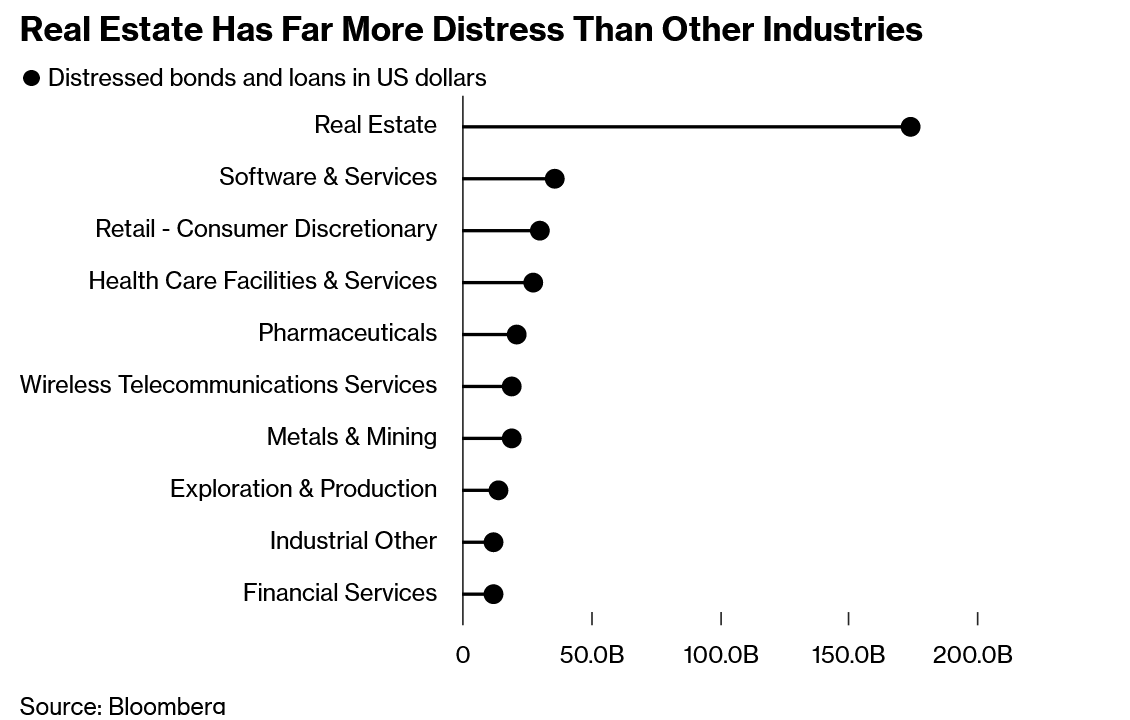

I rarely say that Covid caused radical changes in behavior but the commercial property sector is bucking this trend. This is not because of return to office or lack thereof, but leverage and the central bank. In every cycle in recent memory as the economy started to...