by Glen | Jul 31, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, Government Bailout, Hard Money Lending, hard money loans, Housing Price Trends / Information, real estate investing, Real Estate Trends

Lawmakers introduced a bill Tuesday aimed at curtailing investor activity in the housing market that they say is driving up home prices. The Stop Predatory Investing Act is targeting single family investors. What is in the newly proposed bill and how will this impact...

by Glen | Jul 24, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Housing Price Trends / Information, interest rates, mortgage rates

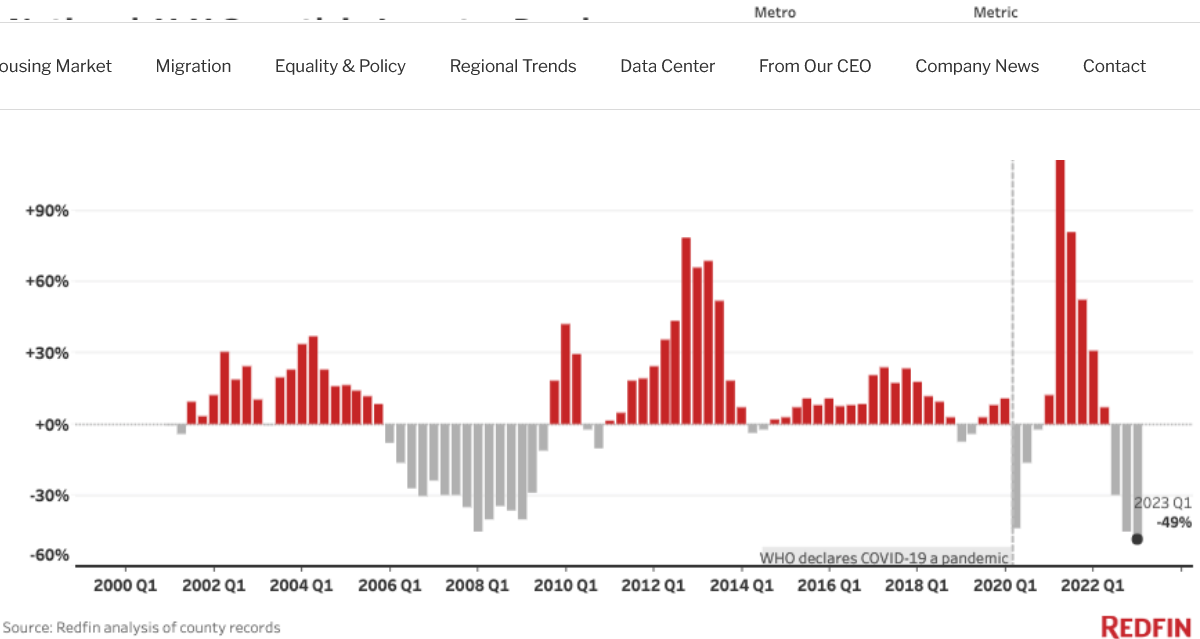

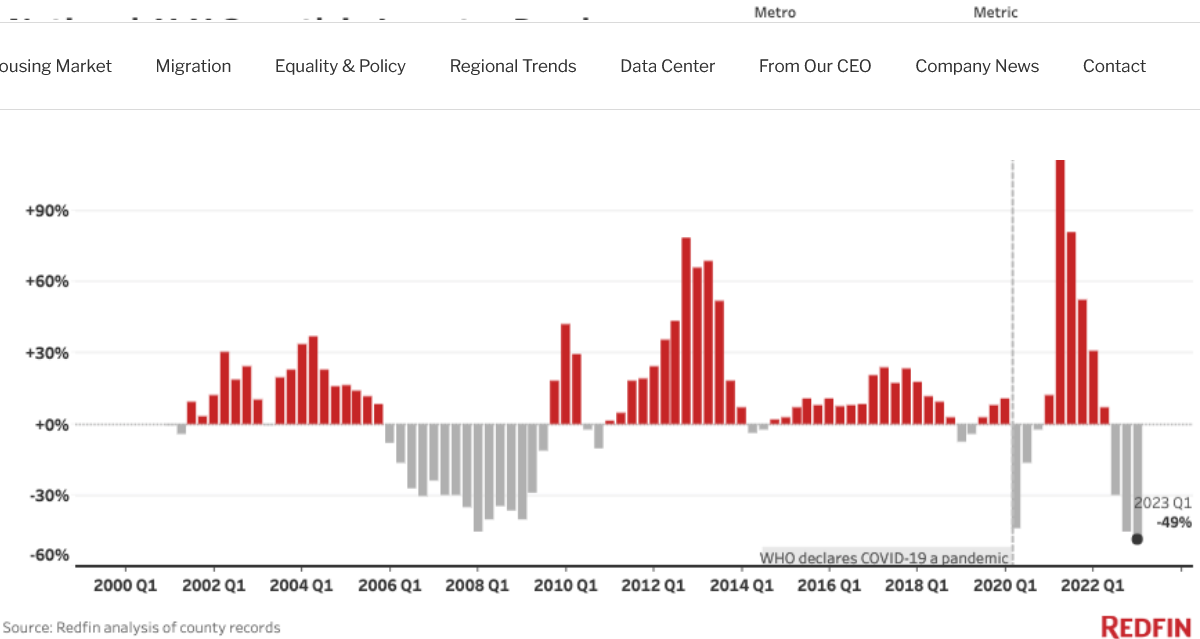

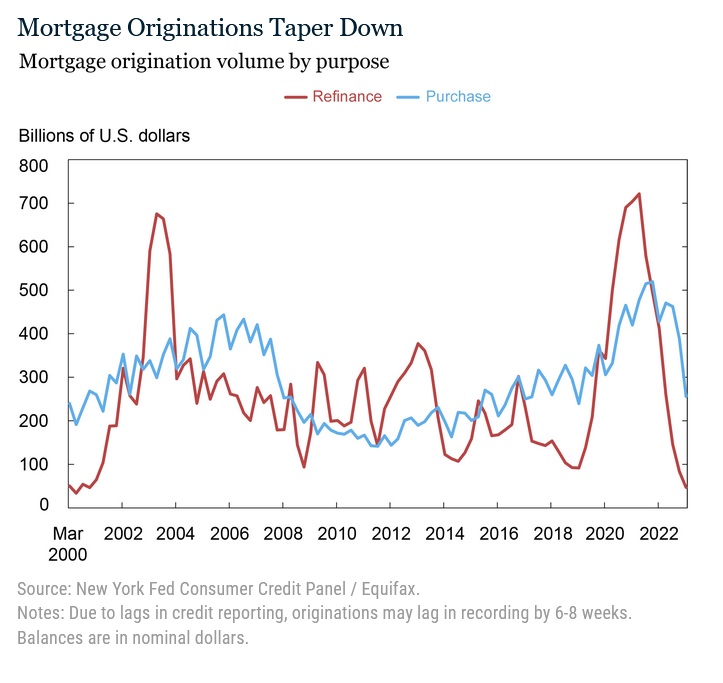

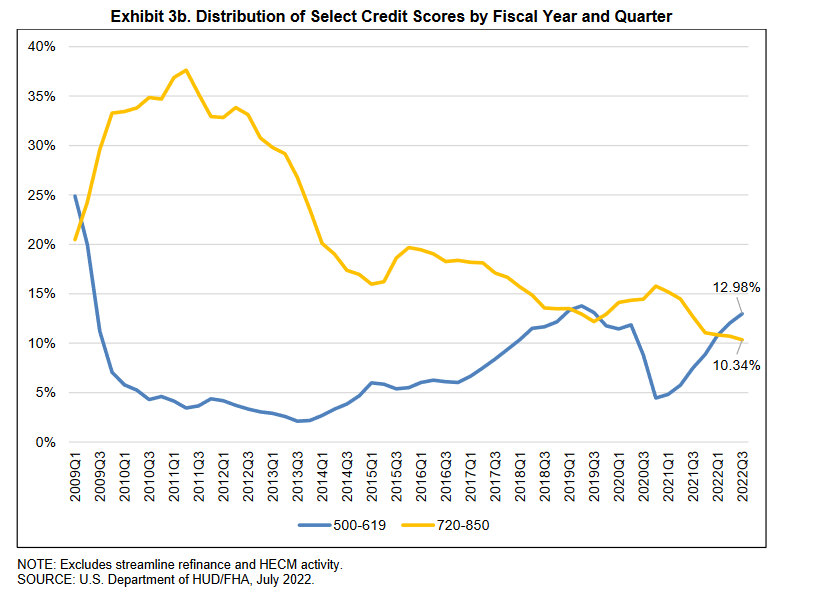

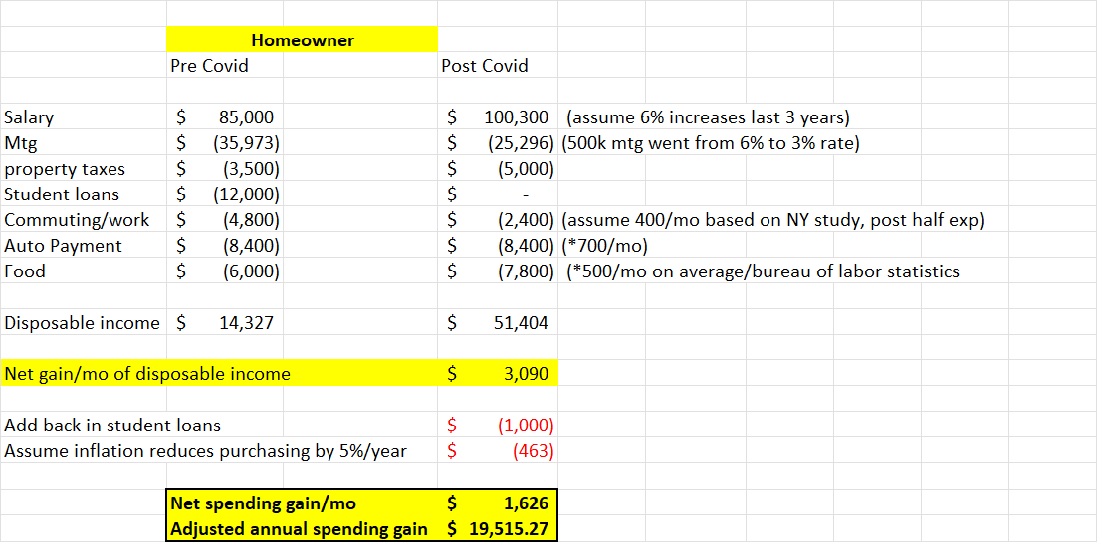

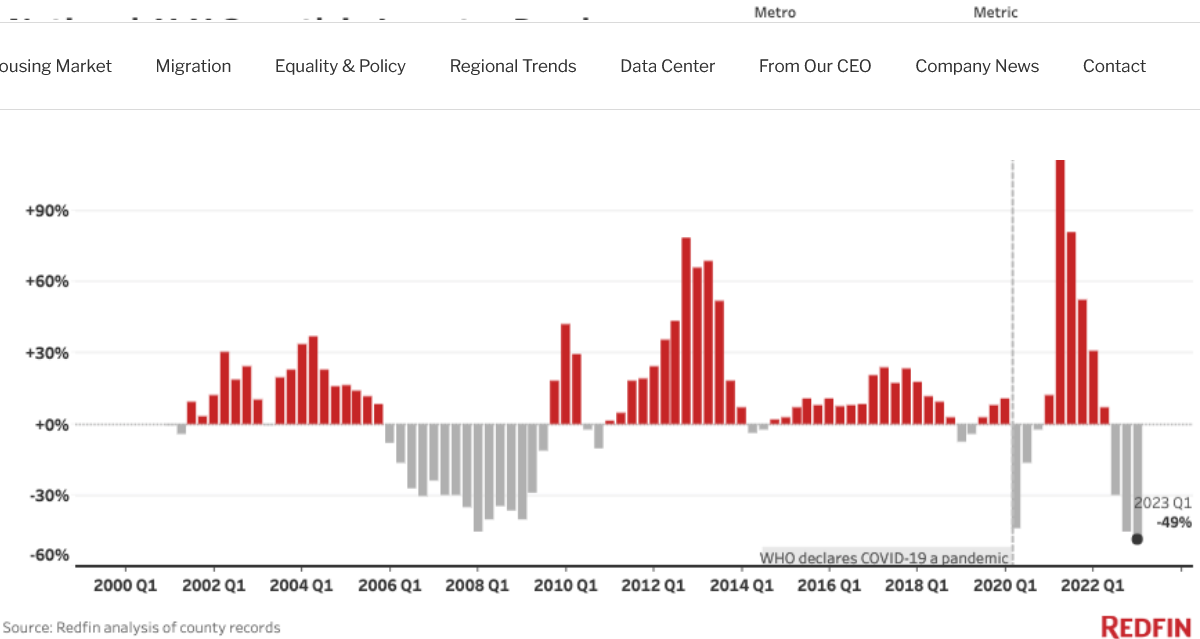

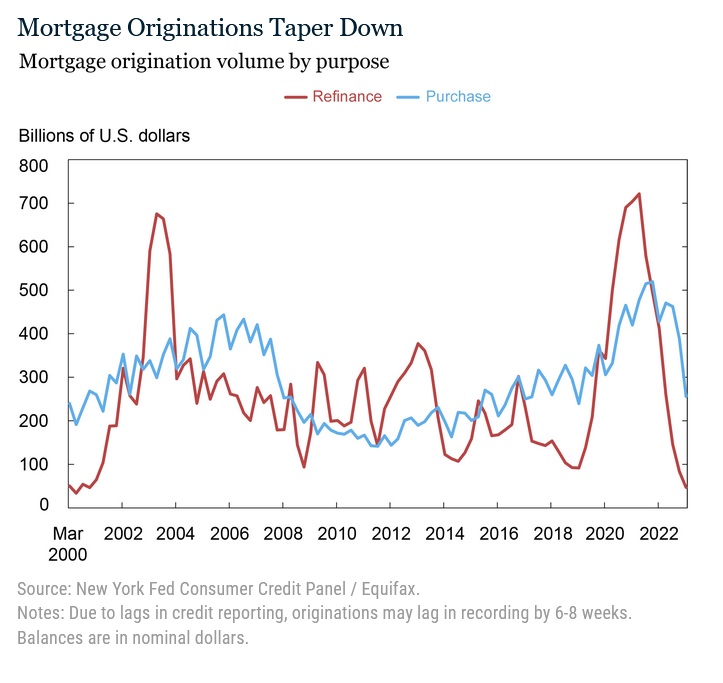

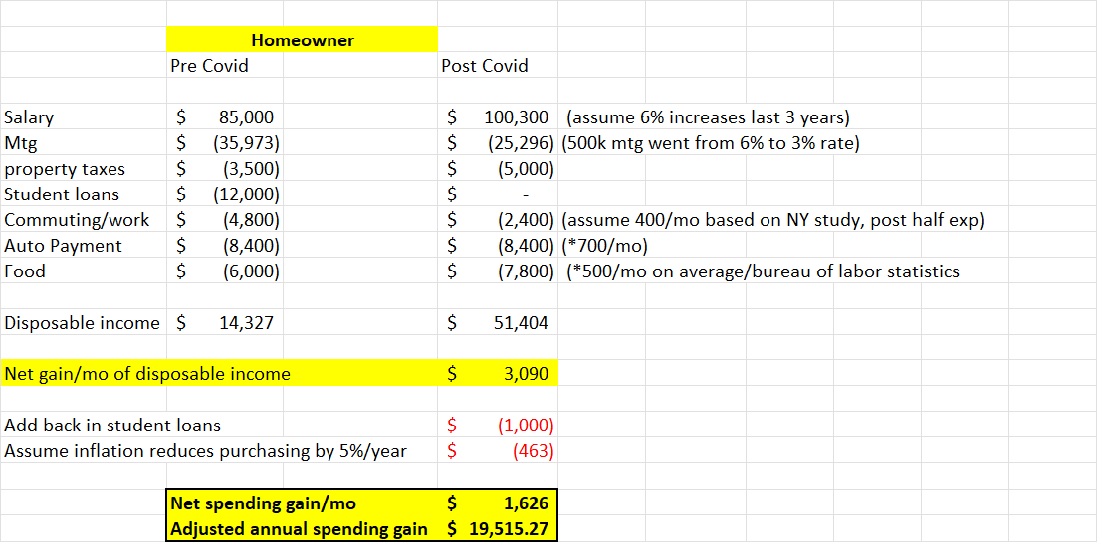

According to a recent Federal Reserve Report, fourteen million mortgages were refinanced during the COVID refinance boom, and these refinances will have effects on the mortgage market, real estate, and the general economy for years to come. An astonishing 430 billion...

by Glen | Jul 17, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, Bankruptcy, Colorado Hard Money, Colorado private lender, commercial private lending, commercial property trends, Denver Hard Money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, if there is a recession what happens to real estate

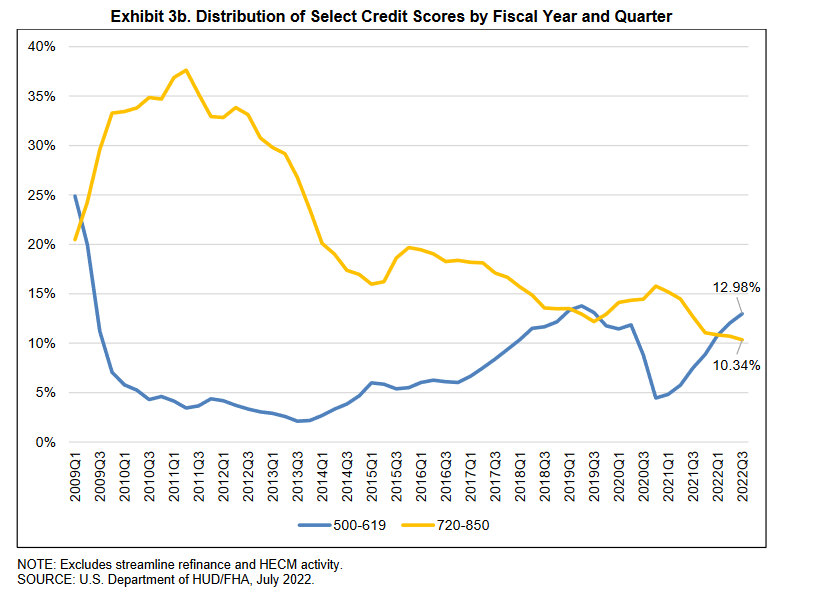

I always cringe when I see a press release that “regulators” have a solution! FHA has yet another new proposal that sounds great on the surface, but as typical misses some very important items that will cost taxpayers millions or considerably more as government...

by Glen | Jul 10, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates

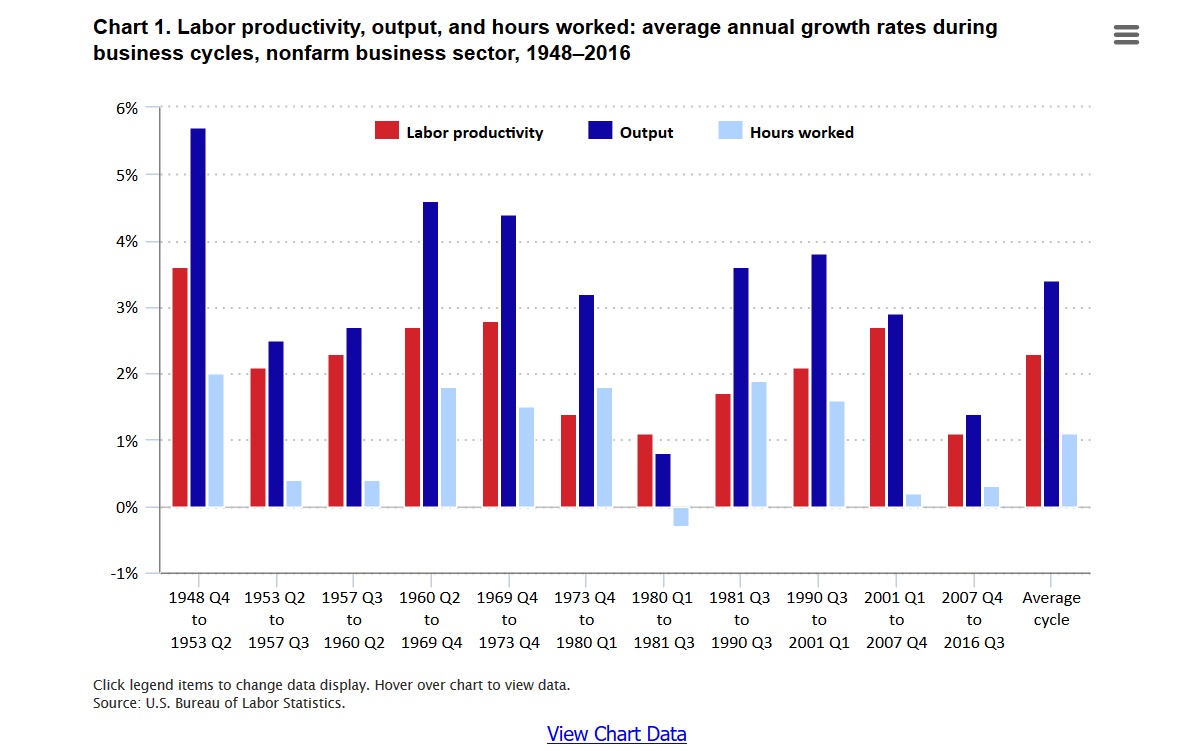

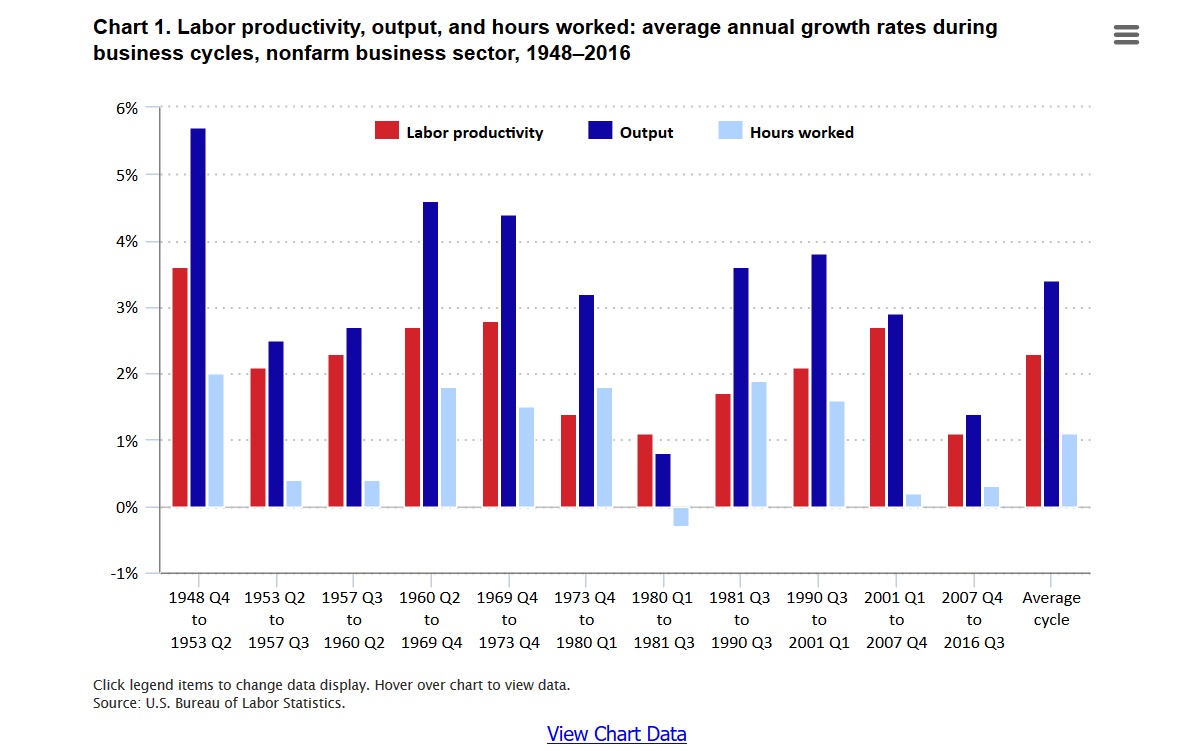

US labor productivity tumbled by 7.5% in the first quarter of 2023 – the largest decline in worker output per hour since 1947, according to Labor Department data released Thursday. What does declining productivity mean for interest rates, commercial and residential...

by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...

by Glen | Jun 12, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending

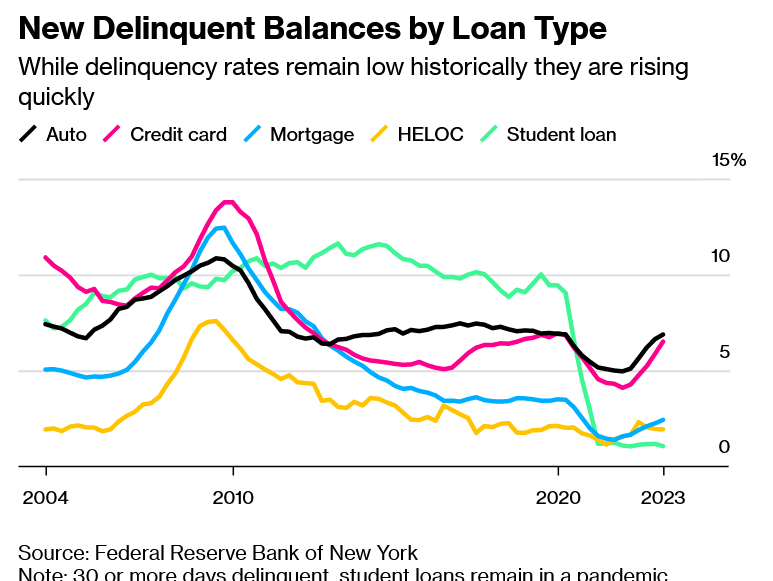

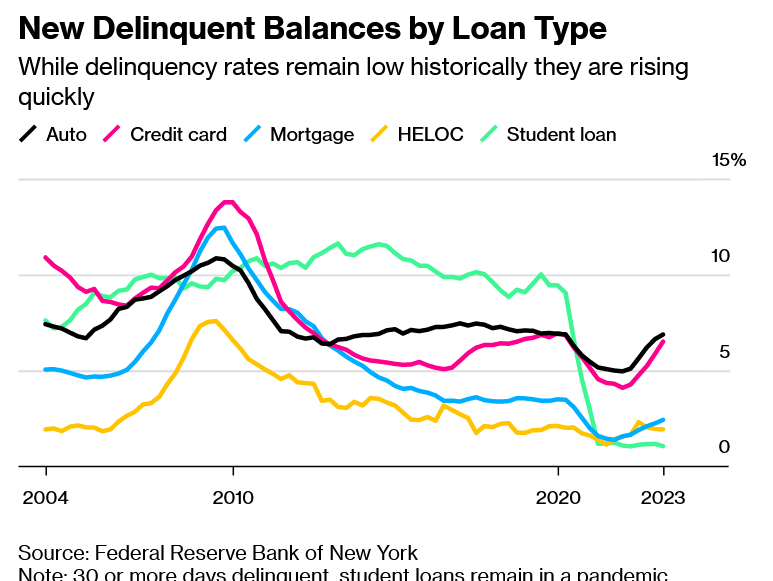

Households added $148 billion in overall debt, bringing the total to $17.05 trillion, according to a report released by the Federal Reserve Bank of New York on Monday. Balances are now $2.9 trillion higher than just before the pandemic. What categories are...