by Glen | Sep 25, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, Private Lending, Real Estate economic trends, real estate investing, Real Estate Trends, recession, recession impact on real estate, student loan impact on real estate

As part of a debt-ceiling agreement forged by President Joe Biden and House Speaker Kevin McCarthy, monthly student loan bills will resume September first. What does the restarting of student loans mean for real estate, interest rates, and the overall economy? How...

by Glen | Sep 18, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Biden tax plan, Colorado Hard Money, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money

For years interest rates were the number one indicator for real estate prices. In this cycle interest rates have more than doubled yet real estate prices have barely budged. If we look back at 2008, the impetus for the large real estate crash was rising interest...

by Glen | Sep 4, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans, if there is a recession what happens to real estate

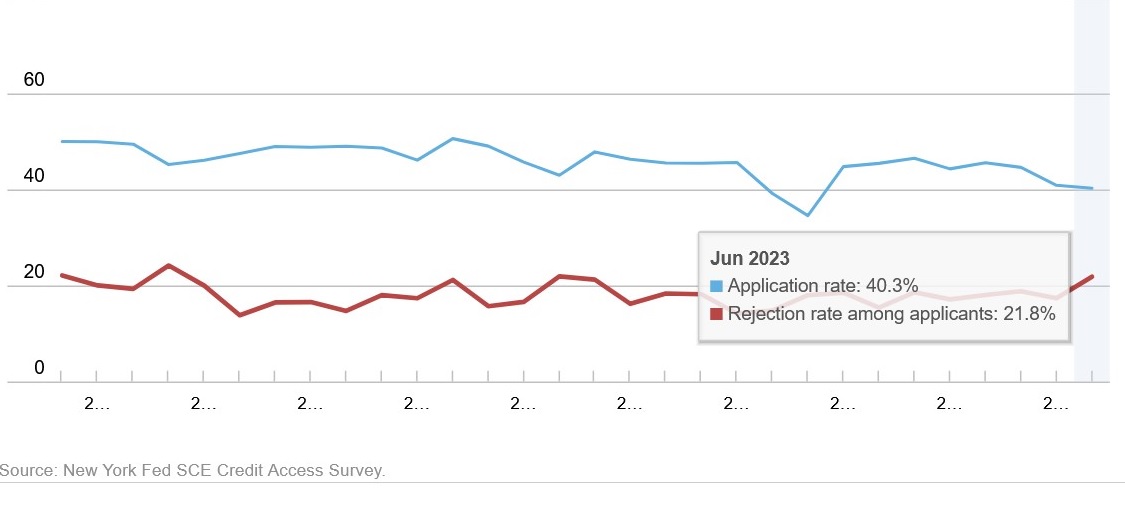

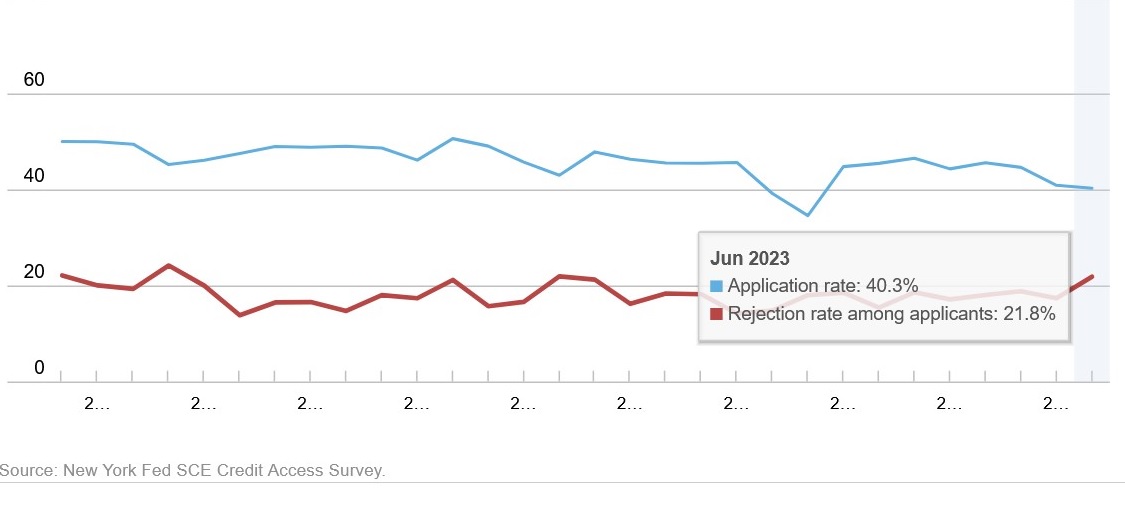

It was already difficult for businesses and households to borrow money earlier this year — but after the collapse of three US regional banks and a cascade of rate hikes by the Federal Reserve, getting money has become considerably harder. What does the decline in...

by Glen | Aug 28, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Housing Price Trends / Information, interest rates, mortgage rates

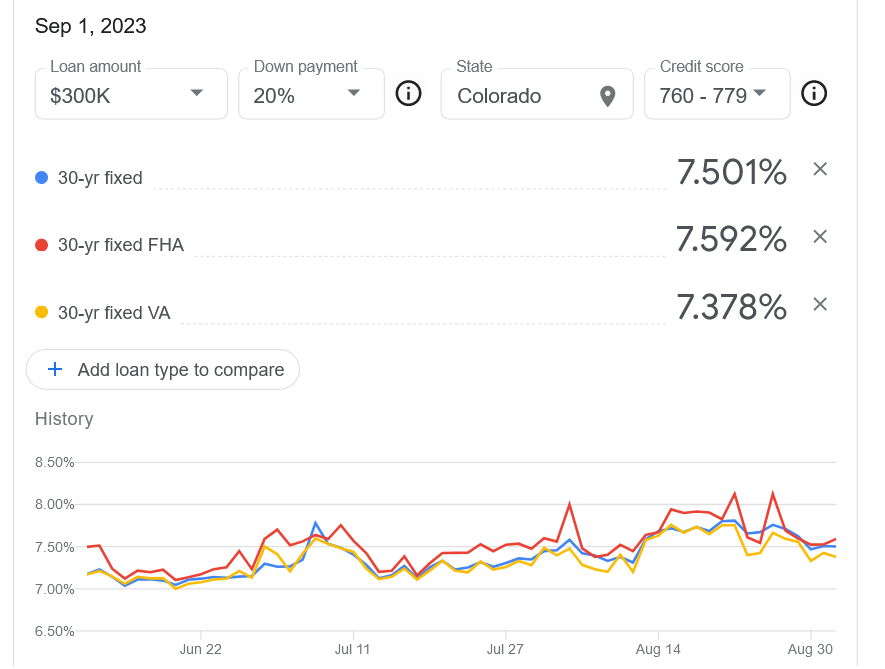

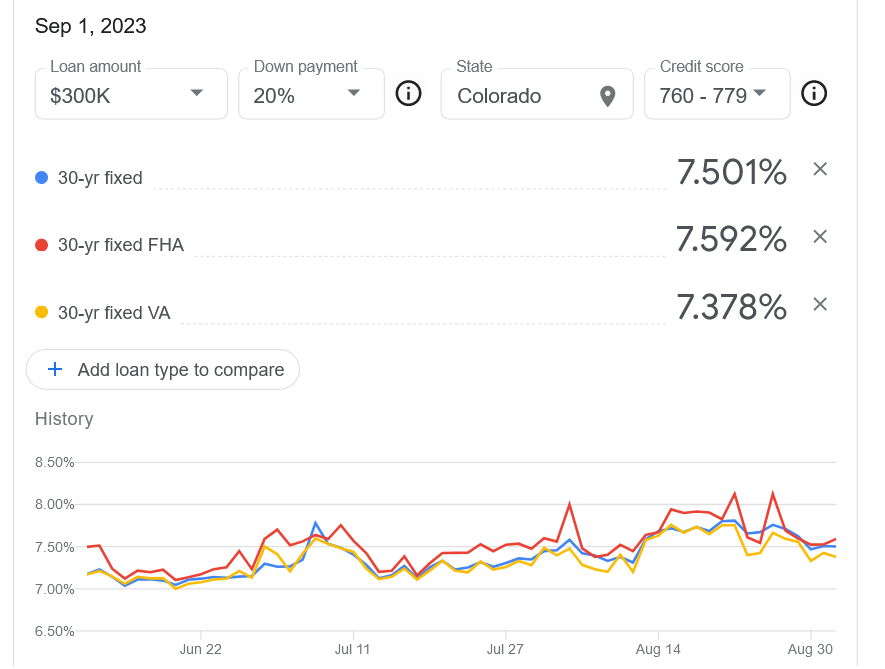

In almost every real estate advertisement I receive, there is a common theme that prospective buyers should not focus on the rate as they will be able to refinance relatively soon at a much lower rate. How true is this theory? Are rates going to drop quickly like in...

by Glen | Aug 21, 2023 | 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates

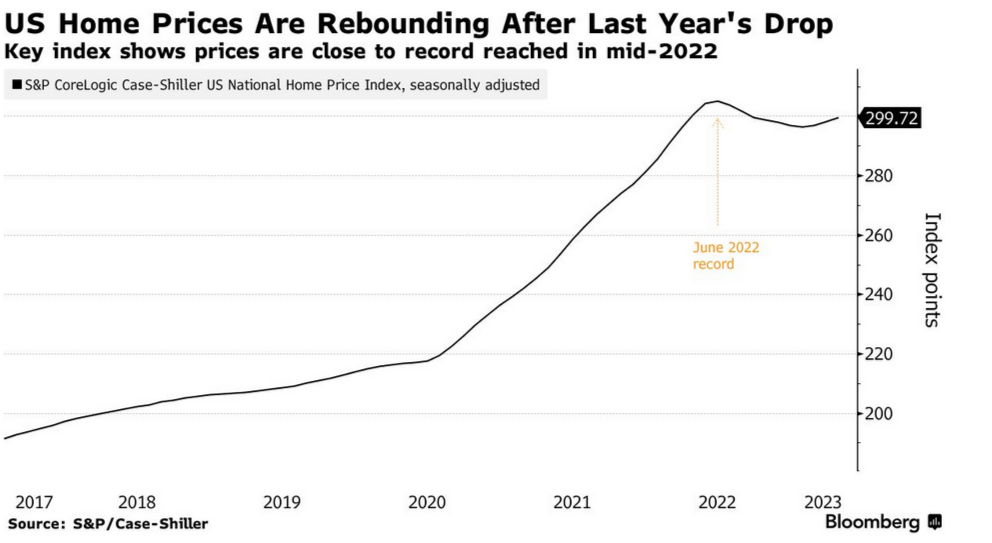

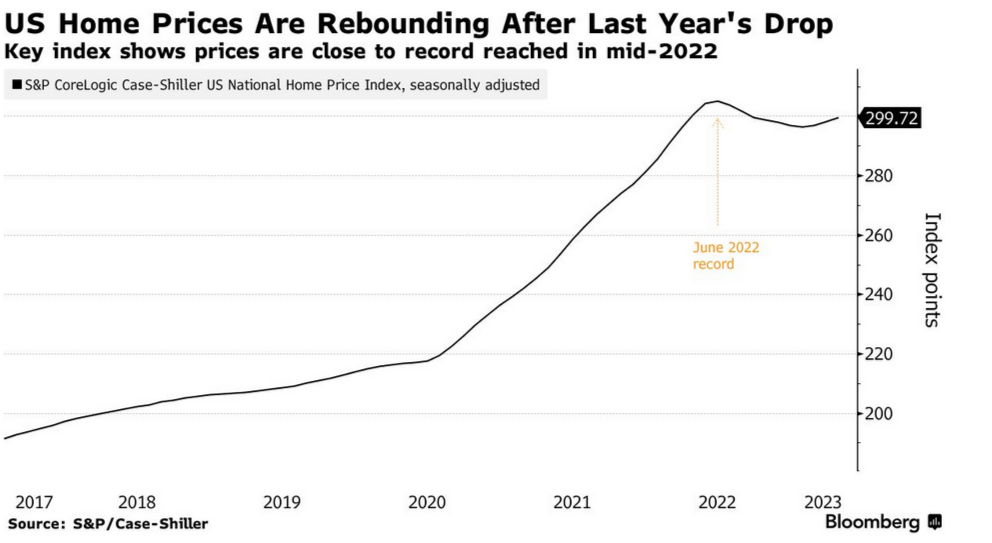

Like most, I have been surprised at the recent upward movement in prices. Did we just experience the shortest housing cycle ever? Are housing prices going to continue their recent upward swing? Why are housing prices now moving higher after a very shallow decline...

by Glen | Aug 14, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, Hard Money Lending, interest rates, mortgage rates

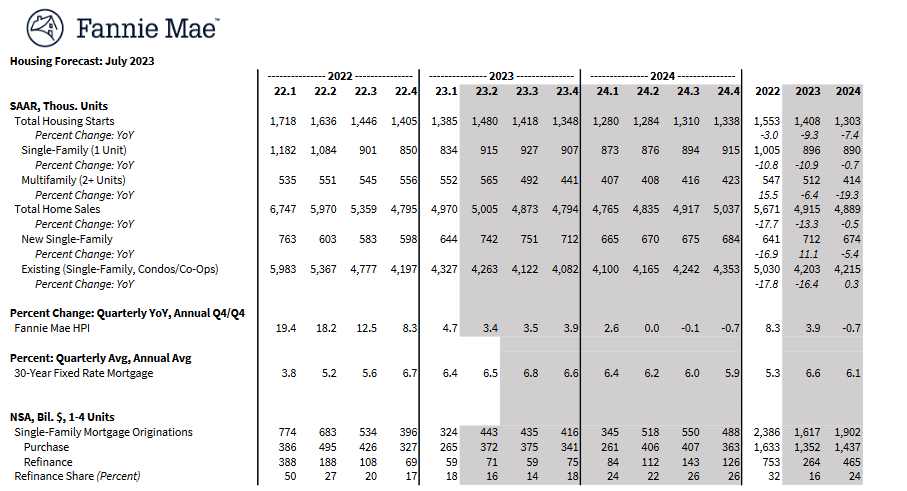

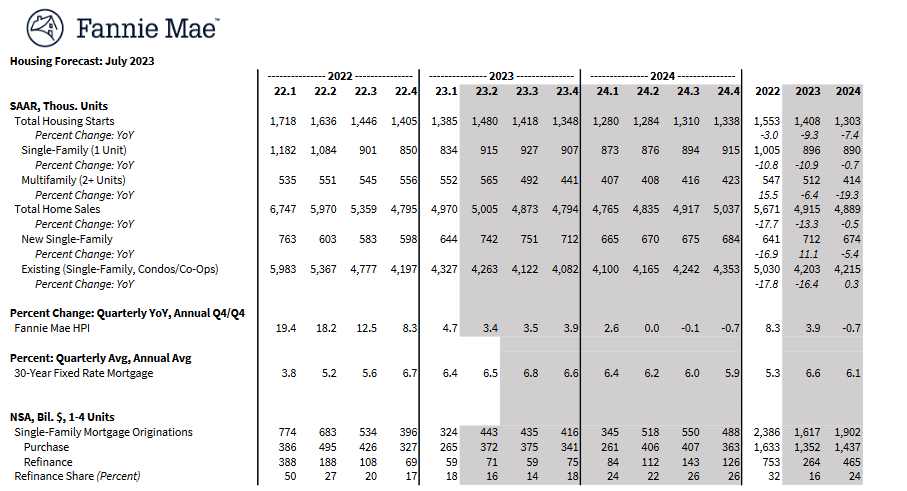

Both the stock and bond markets are partying like its 99 again. Fannie Mae, the largest buyer of US mortgages, is not buying into the theory that a soft landing is the base case for the economy. What is Fannie Mae predicting for inflation and in turn interest rates? ...