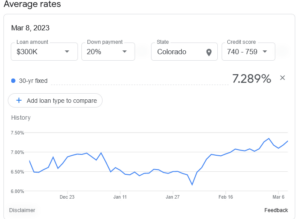

Wow, a few weeks ago rates had fallen from a peak of over 7% to almost 6%. Unfortunately the party was short lived as rates are now heading much higher. The recent jobs report was another blow out upping the odds of another half point increase at the next Fed meeting. What do higher rates mean for real estate? Will certain price points get hit harder than others?

Why are interest rates rising now?

Long and short, the “market” is not believing that the federal reserve can effectively control inflation without substantially higher rates and there is further worry about how entrenched inflation has become. The last 90 days, data has continued to come in well above the market and federal reserve estimates for job growth, wage growth, CPI, etc….

- Federal reserve must act more aggressively today: The federal reserve and current administration kept pitching the idea of inflation as transitory primarily due to supply chain shocks. Unfortunately this narrative could not be further from reality. Inflation is broad based with rising wages and rent growth continuing substantially higher with no end in sight. As a result the fed much act much more aggressively on their rate hikes to “reset” market expectations. Furthermore the recent jobs report above 311k jobs (predictions were 225k) all but seal the deal of a half point rate hike.

- Inflation is much more entrenched than anticipated: With inflation becoming more entrenched through rent and wages the federal reserve will have to not only hike rates higher in the short term but likely keep them higher for longer to squash inflation. The market had substantially underpriced the inflation risk.

How are mortgage rates “set”?

First, it is important to note that the federal reserve does not directly control mortgage rates. The fed controls the “federal funds rate”. The federal funds rate is the rate at which banks and credit unions lend reserve balances to other banks and credit unions overnight. In a nutshell this is the rate banks get on the money they are holding in cash/reserves. Here is a more detailed explanation from Wikipedia .

So how are mortgage rates set? Unfortunately, mortgage rates are not “set”. There is no government or private party that can set rates per se. Mortgage rates are typically based on the 10-year treasury yield. So how does this work?

Before discussing rates, it is important to understand how bond yields work. The most important piece of this equation is the relationship between a bond price and its return. For treasuries, it is critical to note that a bond price and its yield move in inverse. What this means is that a higher bond price results in a lower yield and vice versa where a higher yield results in a lower bond price. For simplification purposes, I will not get into the full details of why bonds function the way that they do. Rest assured that it works this way and will always work this way.

With this key piece of information, we can now understand why mortgages do not move in direct correlation with the federal funds rate and they are “pegged” off the 10 year treasury. This week, bonds have plunged taking the 10 year treasury to new highs and in turn interest rates above 6%.

Where will mortgate rates go from here

Up! Mortgage demand has fallen to its lowest level in over two decades. Rates have taken off since the cycle lows, rising from 3.29% to 7.25% now,. Rates shot up considerably in the last 90 days, as concerns over inflation hit the bond market. At the beginning of the year, I was talking about rates cresting around 7%, that number will likely be closer to 8% by the end of the year and stay there for a while. Companies are following suit and taking action with redfin and compass announcing large layoffs:

.

“Due to the clear signals of slowing economic growth we’ve taken a number of measures to safeguard our business and reduce costs, including pausing expansion efforts and the difficult decision to reduce the size of our employee team by approximately 10%,” a Compass spokesperson said.

The Redfin filing had an attachment from CEO Glenn Kelman, who writes a regular blog on the company’s website. In the blog posted Tuesday, Kelman wrote, “With May demand 17% below expectations, we don’t have enough work for our agents and support staff, and fewer sales leaves us with less money for headquarters projects.”

What price points will get hit the hardest

I’m going to break the housing market into three tiers: standard houses, luxury houses, and ultra luxury. The definition of each will depend on the particular market. For example, in Denver, under 850k is considered standard, 850-1.5 or 2m is luxury, and above 2m is ultra luxury. It is important to look at each sector to see what is happening in the market because they are reacting differently.

Luxury market

The luxury-housing market, which experienced a meteoric surge last year, is coming back down to earth amid a slumping stock market, rising mortgage rates and economic uncertainty.

Sales of luxury U.S. homes fell 17.8% year over year during the three months ending April 30, the largest drop since the onset of the coronavirus pandemic sent shockwaves through the housing market. There are only two instances in the past decade when there were steeper declines: the three months ending June 30, 2020 (-23.6%) and the three months ending May 31, 2020 (-21.6%).

The pool of people qualified to purchase luxury properties is shrinking because the stock market is falling and mortgage rates are rising,” said Elena Fleck, a Redfin real estate agent in West Palm Beach, FL. “The good news for buyers is the market is becoming more balanced and competition is easing up. Of course, that doesn’t help the scores of Americans who have been priced out altogether.”

Ultra Luxury

The interesting part of rates rising is the “ultra luxury” market is still performing well. In various ski towns throughout Colorado properties priced above 3 million are still flying off the shelf going under contract very quickly. I think the current driver is the purchases are a hedge against inflation and buyers have no other “safe haven” where to park their money. I don’t think this trend will last indefinitely and even the ultra luxury market will slow by year end but I don’t see a cliff drop as many ultra luxury homes (especially in ski towns of Colorado) are bought in cash and furthermore there is limited ability to build more in high demand locations. Ultra luxury homes in more rural areas or not in typical luxury markets will be considerably riskier.

Standard houses

There continues to be demand at the lower price points both from investors looking for rentals along with people that need a more “affordable” house and have been priced out of the luxury category due to the huge surge in prices along with increasing interest rates. Furthermore, there is considerable wall street money and smaller investors ready to buy into the market when there are some declines. Currently the lower price points are the safest bets in the market as buyers are forced to trade down to own a home and investors clamor for properties with higher returns.

Summary

With the recent surge in rates, there will be a reset coming and it is already beginning in the luxury market. The reset will then continue down the price points until it hits “affordable” prices in the respective market. This trend has been drastically accelerated with the jump in mortgage rates above 7%

We are already seeing the impacts of the higher rates, with mortgage demand dropping 50% and real estate sales continuing to slow. Look for this trend to continue throughout the year with the best-case scenario being prices softening of prices (in the 5-10% range). As rates rise to 8% and possibly crest higher this trend will be accelerated.

Remember any action by the federal reserve takes months to flow through the economy so we likely will not see the full impacts until late this year or early next year when a “reset” in the market occurs. Although I am not predicting a 2008 rerun there will be some pain in the market as prices come off around 20% in some markets with the luxury and higher price points bearing the brunt of the declines.

Additional reading/Resources

- https://www.cnbc.com/2023/03/10/jobs-report-february-2023.html

- https://www.bloomberg.com/news/articles/2023-03-09/asia-stocks-to-fall-after-bank-rout-on-wall-street-markets-wrap?srnd=premium

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender