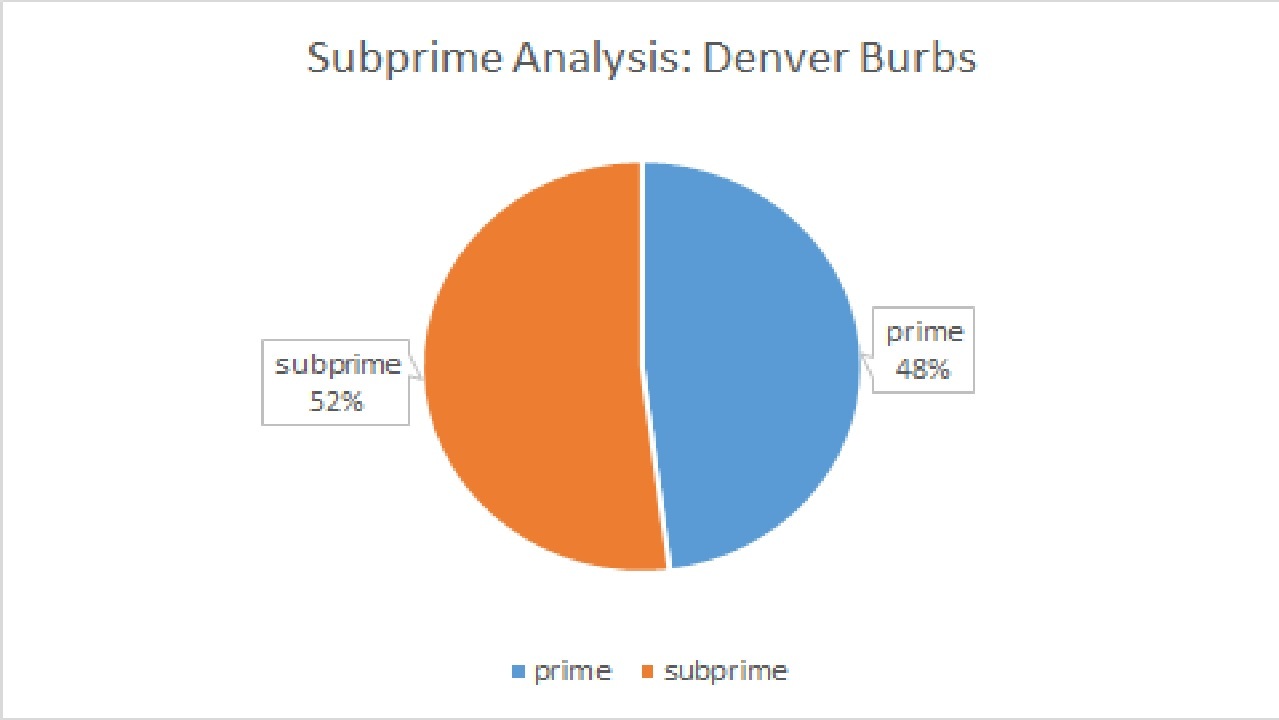

Last week I wrote about the large increase in flips in Atlanta. I was surprised that Atlanta was above its pre-recession peak. This got me thinking about Denver. In the Denver news today, it was reported that foreclosures recently increased for the first time since 2007? What caused this increase? Is your neighborhood more at risk than others? Denver doesn’t have nearly as many flips as Atlanta due to the median house price being almost 450k, but did this high home price trigger another issue? In the chart above you can see over 52% of recent sales in a neighborhood outside of Denver used subprime loans. In the last recession, according to the Colorado bankers association subprime foreclosures made up 77% of all foreclosures. What will the trigger be for the next wave of defaults?

Background:

After looking at the Trulia house flipping data on Atlanta, I started looking at the Denver region. I live in a suburb of Denver and looked at the recent sales in my neighborhood and classified each sale as prime or subprime. I got this information from a data provider we subscribe to that enabled me to look at an area and see what the house sold for and who the lender was, and how much financing was utilized for the sale. After classifying as prime vs subprime I also looked at who the lender was. A subprime loan was classified as less than 10% down.

What did I find out from the study I did?

Due to the high price of houses in the Denver metro area, people are more likely to use a “subprime” loan which enabled them to put less money down on the mortgage. Over 52% of the last sales in this particular suburb were considered subprime and therefore at a much higher risk of default. A few of the loans I looked at even had 100% financing where the borrower put zero down; I saw a handful that had financing as high as 102% of the purchase price.

The new batch of subprime loans are different than in the last crisis.

In the last crisis, the vast majority of subprime loans were originated by non bank lenders and sold on wall street via mortgage backed securities. Today when I looked at the subprime loans, many were made by government entities (VA, FHA, HUD) along with several banks.

If you look at the last crisis, loans with < 10% down were the first loans to default and most likely to end up in foreclosure.

In Colorado subprime loans were less than 40% of all loans, but accounted for 77% of all the foreclosures. Why were properties with less than 10% down at greater risk of default. I f a borower has little or no equity in a property and values fall 10 or 20% like they did in Colorado in the last crisis these borrowers are underwater and have a financial incentive to “walk away” from the property since they really have nothing financially to lose. These areas are at much greater risk of a correction during the next downturn.

What will the trigger be for defaults?

Just like in the last crisis, a rise in rates started the downward cycle. What will cause the interest rate rise. We have already seen rates rise as the federal reserve begins tightening monetary policy. Bloomberg did an interesting article titled “The mortgage bond whale” where the government will start divesting mortgage backed securities. This in turn will increase supply and purchases will demand higher margins. In a nutshell this could spur rates to rise even further.

Who cares about rates if borrowers are not in adjustable rate mortgages?

In this case, less borrowers are in adjustable rate mortgages so why will this cycle be impacted the same? Although the clear majority of mortgages made today are not adjustable mortgages like in the past, the borrower is still highly impacted based on interest rates including car loans, student loans, medical, etc… basically any consumer loan will be impacted by rising rates. This rise in rates will undoubtedly trickle through to mortgages. Just today I saw an article that foreclosures have increased in Denver

What should you do?

First, identify if your neighborhood is seeing an increase in “subprime” loans. You can look at many county websites to see what has sold and the amount of debt placed on the property. If your neighborhood has a higher percentage of subprime loans and you had any thoughts of moving, now could be the time to make the change. Personally, I saw this trend in my neighborhood and asked my wife if she was ready for a change and we sold two properties to limit our downside exposure when the next correction occurs

Wait, aren’t you a subprime lender and at greater risk of defaults?

I’m commonly asked if I have a ton of defaults in our portfolio. Although we are not credit score driven, our default rate is considerably less than a traditional lender. How is this possible? At Fairview, we are an “asset based lender” that lends 50 to 60% off what we determine the value of the property to be. This enables us to make conservative loans that are unlikely to be “underwater” vs. traditional subprime loans. We also portfolio and service all of our own loans so at the end of the day we have the “risk” on every loan we make which ensures we make good loans that are going to meet the borrowers needs and perform.

In summary, many markets like Denver are getting lofty. Now is the time to evaluate your neighborhood to see if it is at risk of a correction. If you determine it is high risk, now could be the time to put plans in motion to sell and move to a lower risk area.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).

Resources:

- Colorado Bankers Association: http://c.ymcdn.com/sites/www.coloradobankers.org/resource/resmgr/imported/Fact%20Sheet.pdf

- Bloomberg: what will drive interest rates up? https://www.bloomberg.com/news/articles/2017-02-06/the-mortgage-bond-whale-that-everyone-is-suddenly-worried-about

- The Wall Street Journal: Easier Financing for flips: https://www.wsj.com/articles/where-house-flippers-can-get-financing-1485965598

- The Denver Channel: Denver see increase in foreclosure filings: http://www.thedenverchannel.com/news/local-news/denver-sees-first-increase-in-foreclosure-cases-since-2007