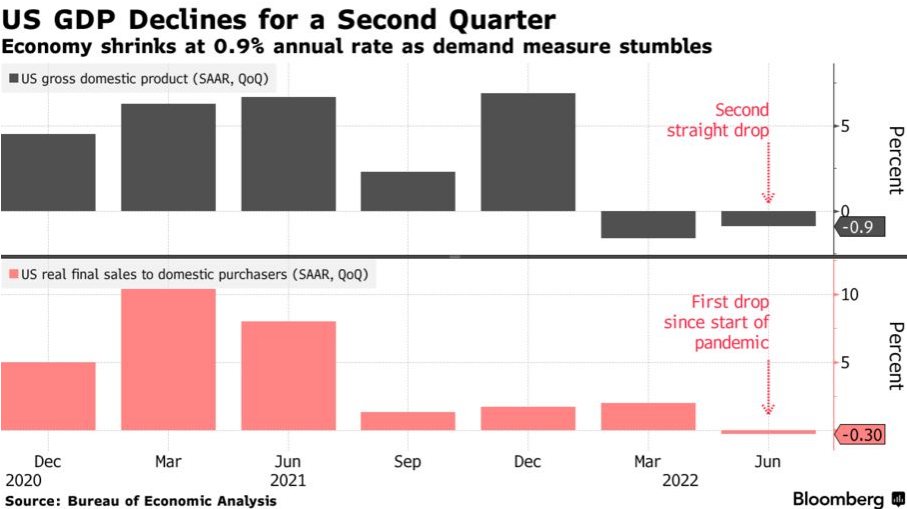

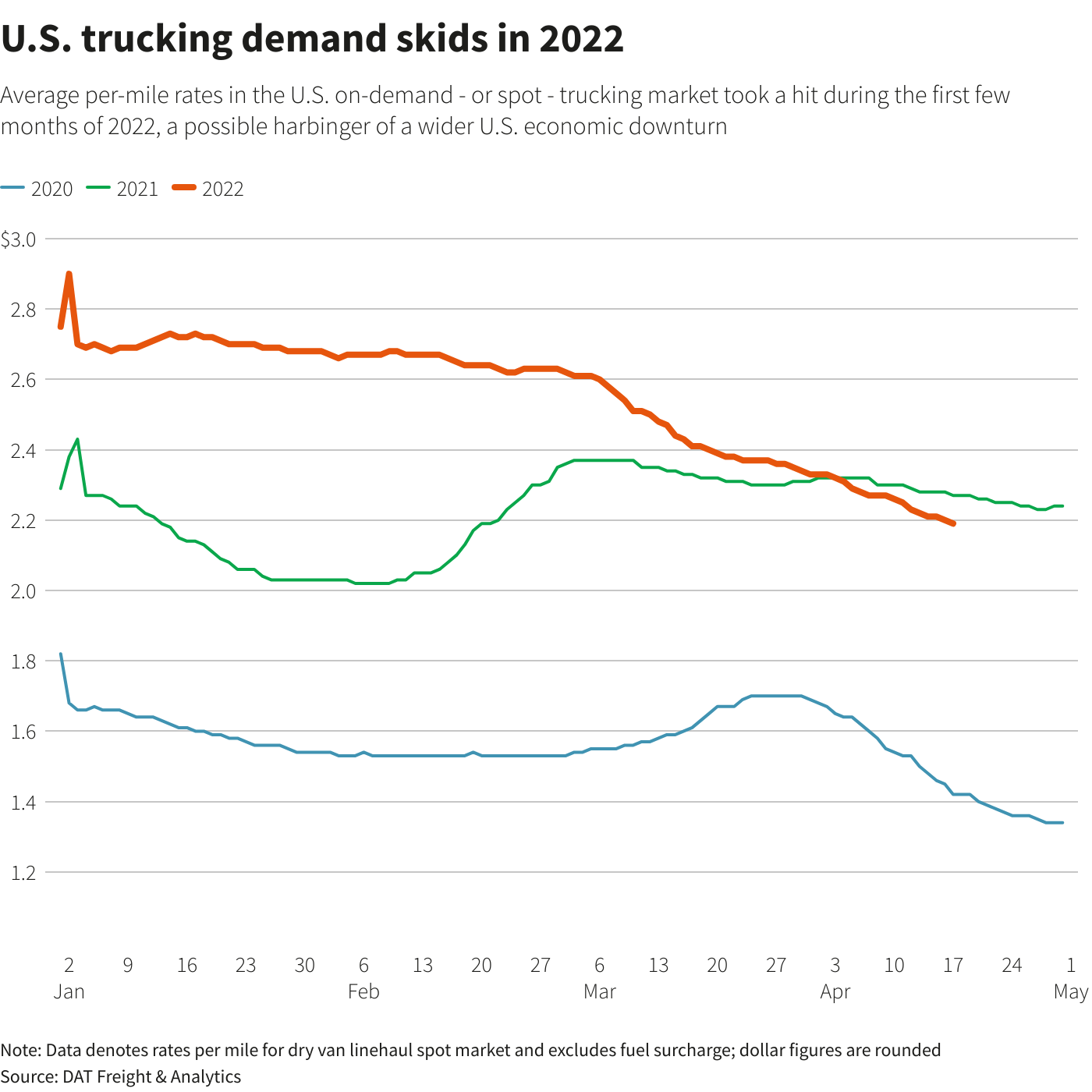

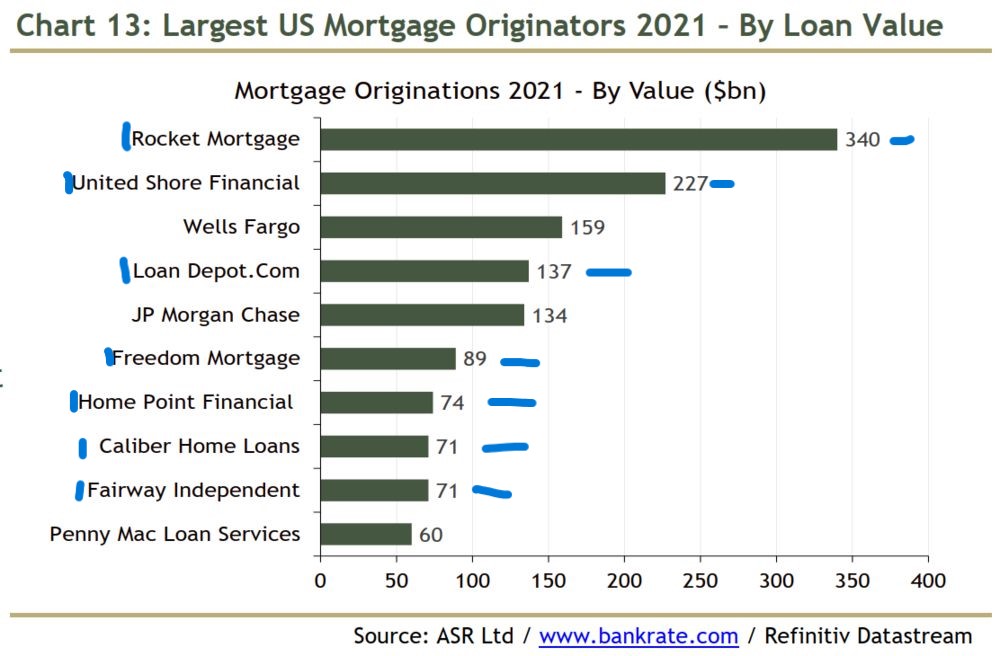

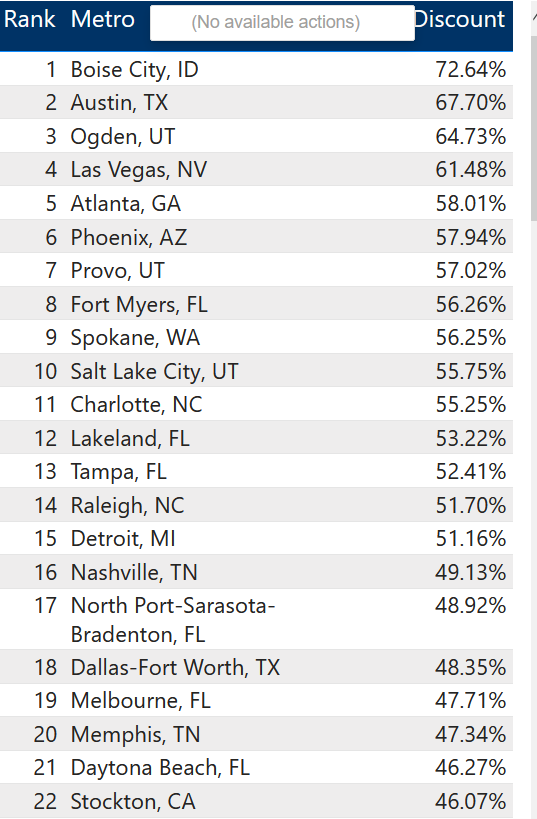

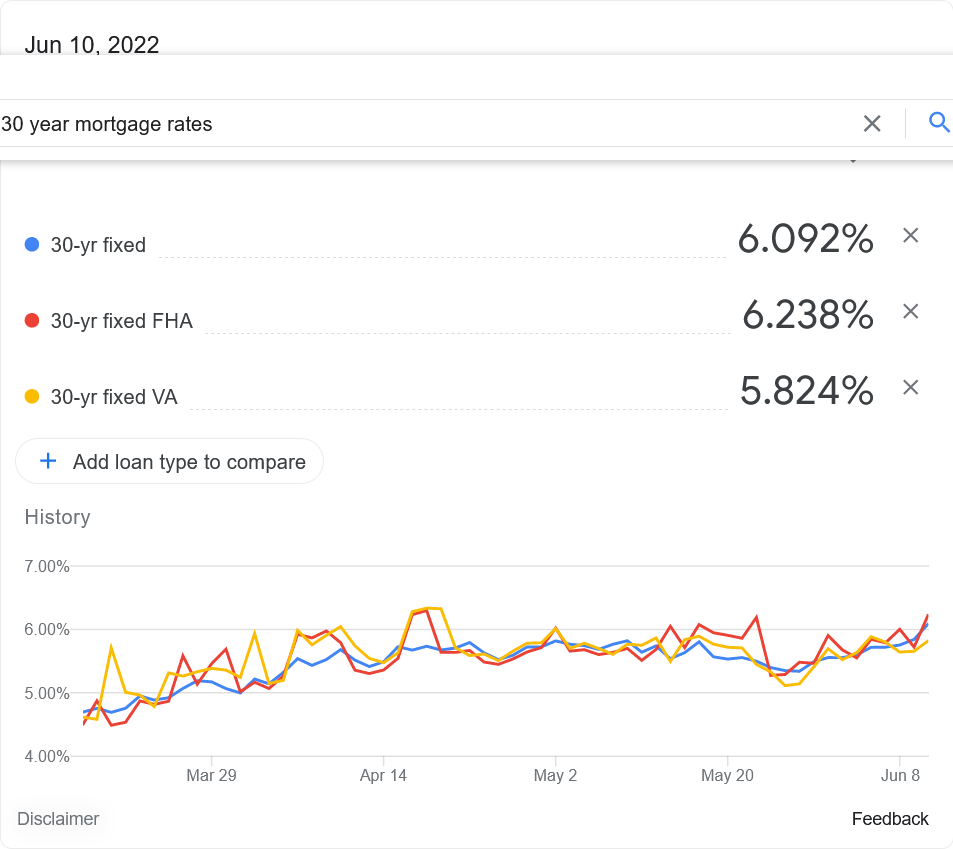

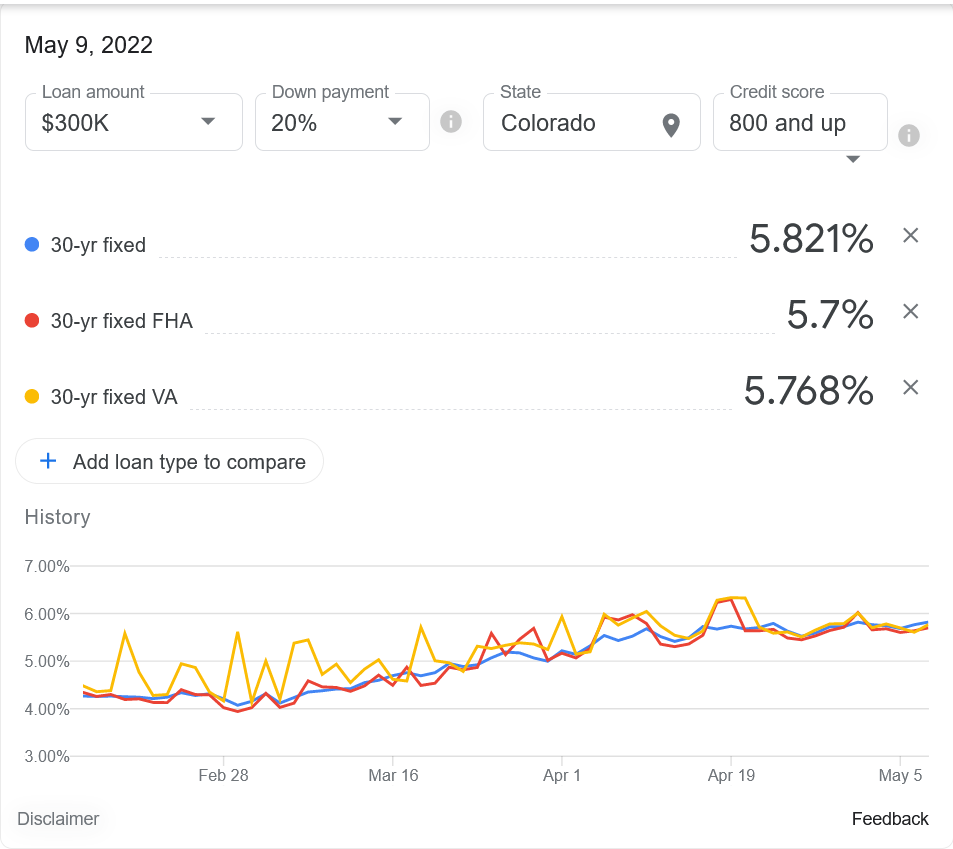

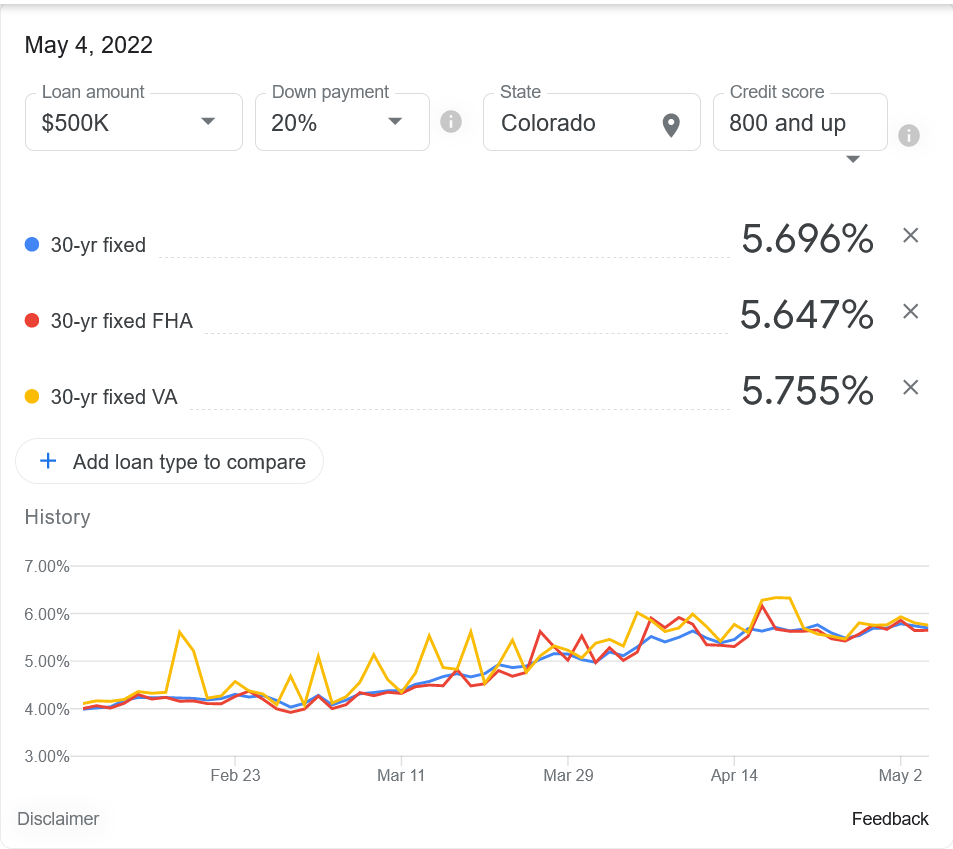

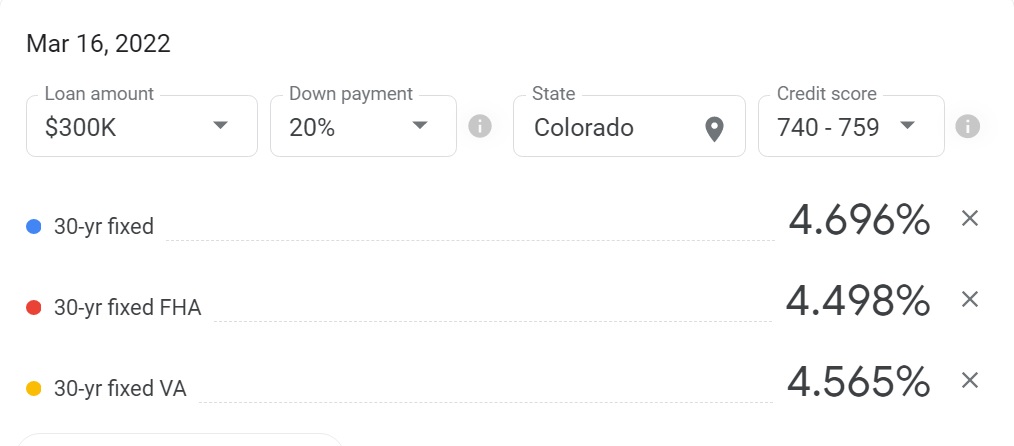

What a week it has been in the economy. The federal reserve is still struggling to contain inflation and as a result increased the fed funds rate .75%. After the announcement stocks roared back in a huge “relief” rally and mortgage rates plummeted. Shortly after,...