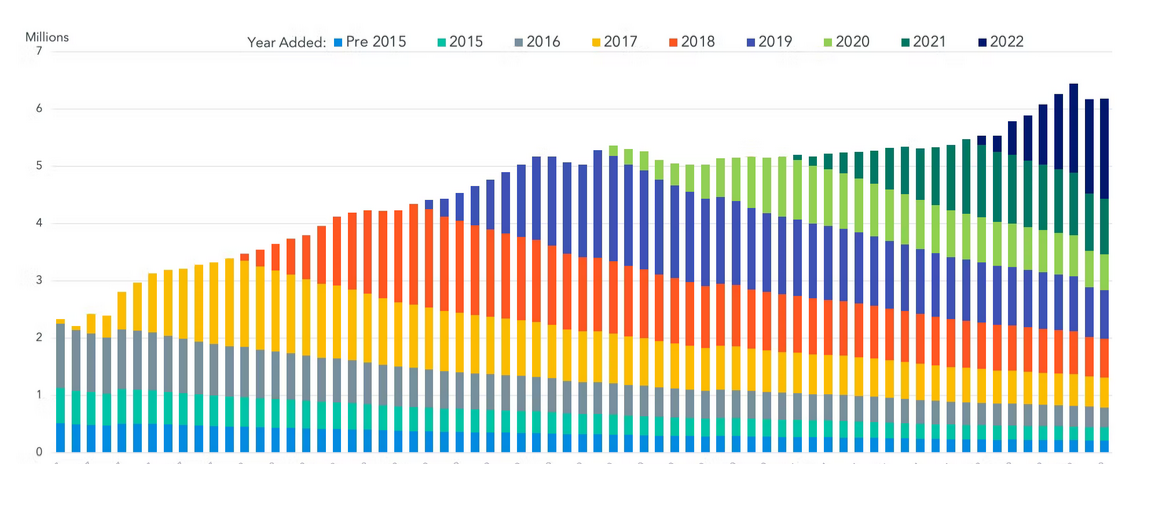

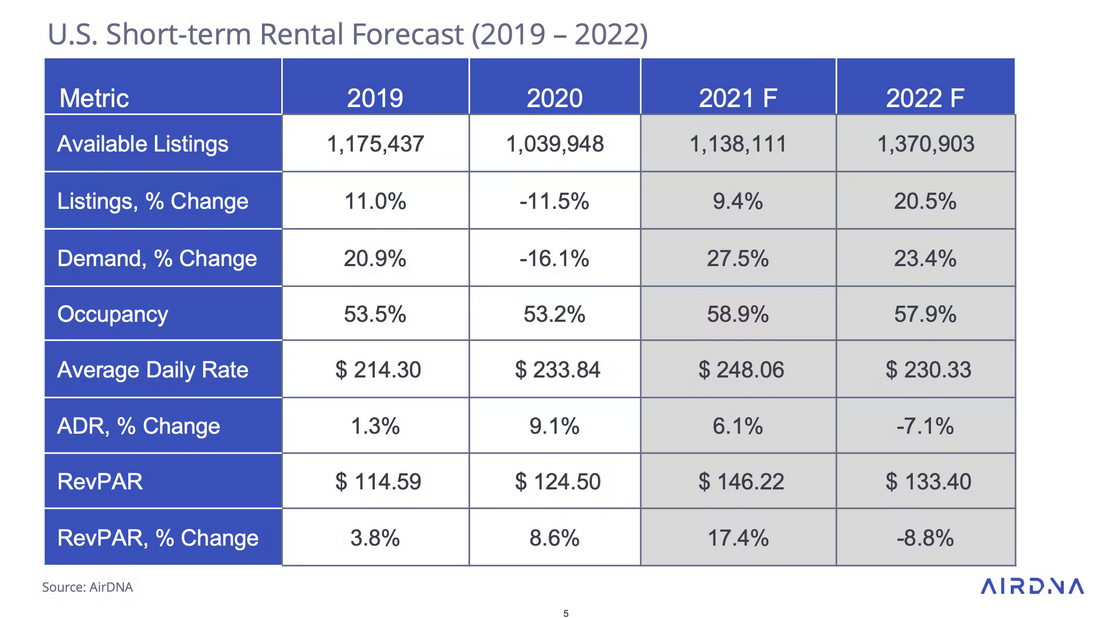

Data from AirDNA, a short-term rental analytics firm, show as of October 2022, the number of future nights booked—a real-time indicator of the health of the short-term rental industry—was up 15.8% year-over-year. At the same time, anyone in the short-term rental...