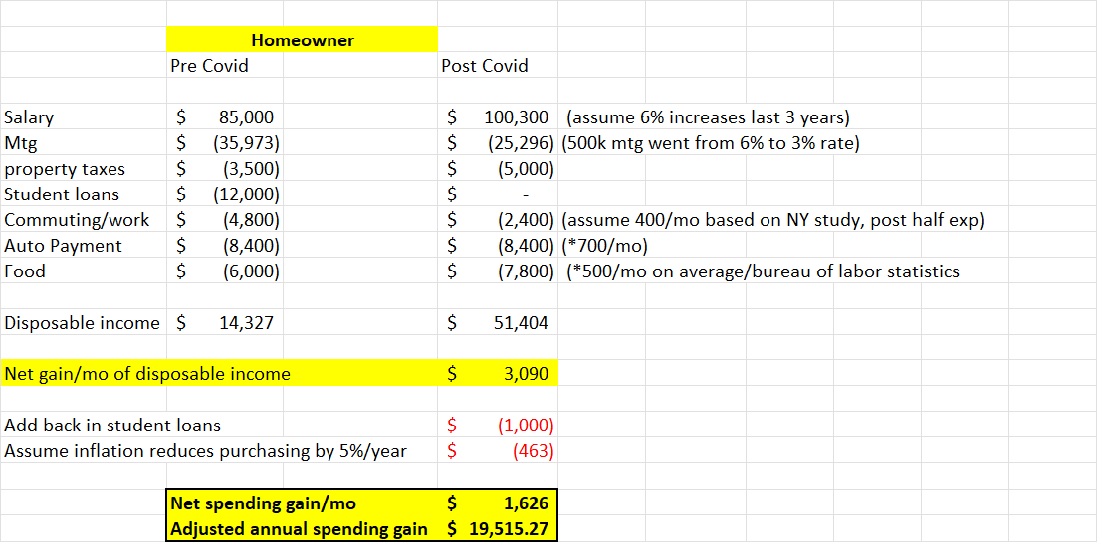

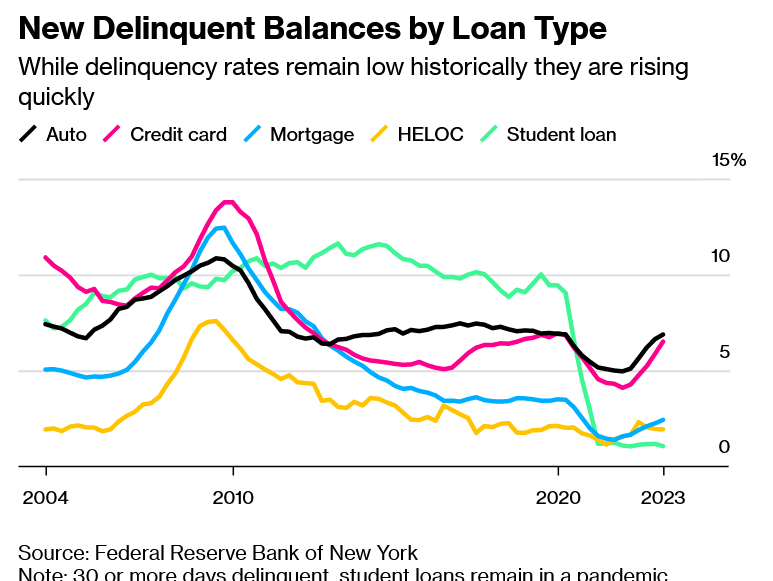

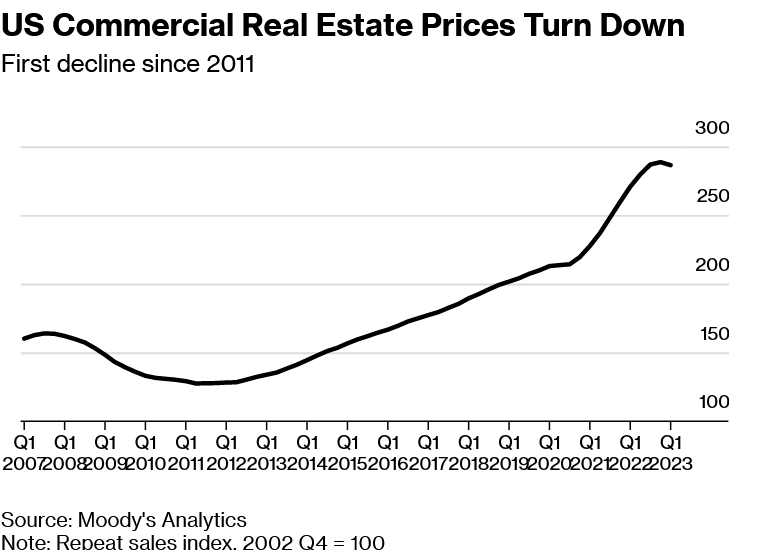

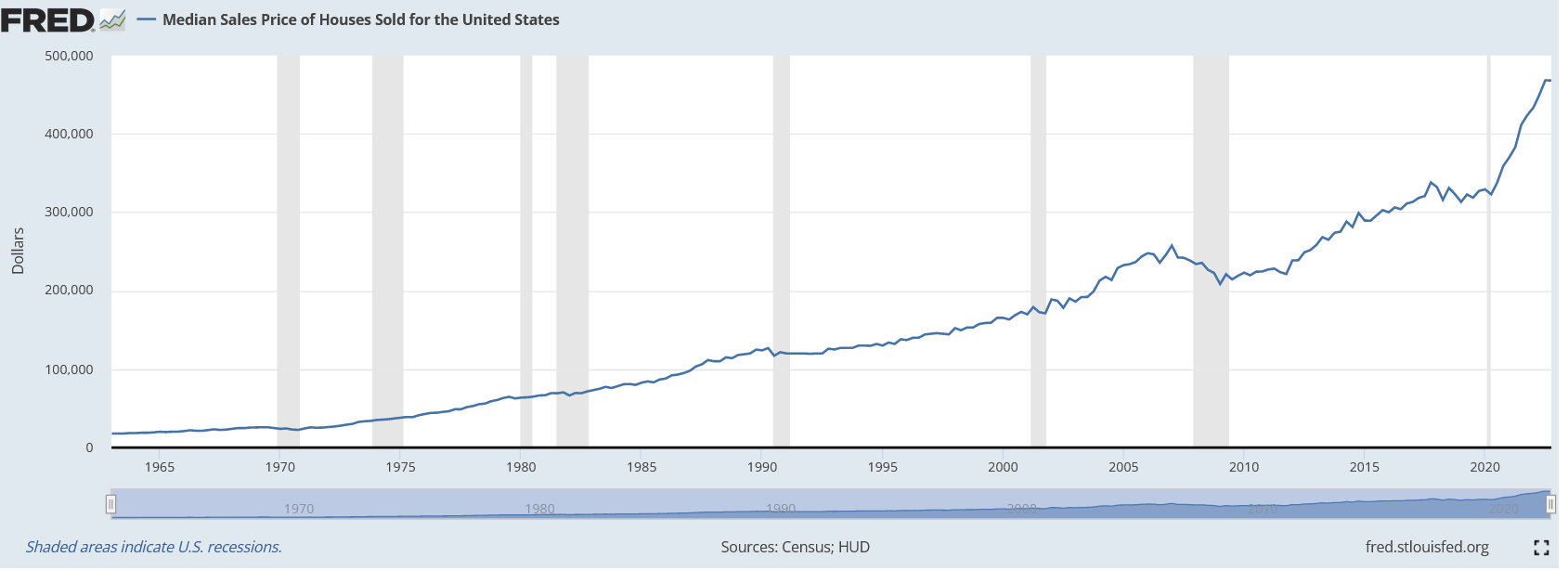

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...