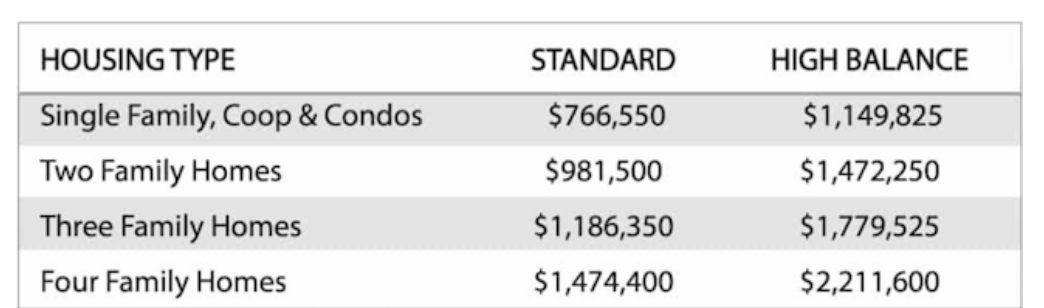

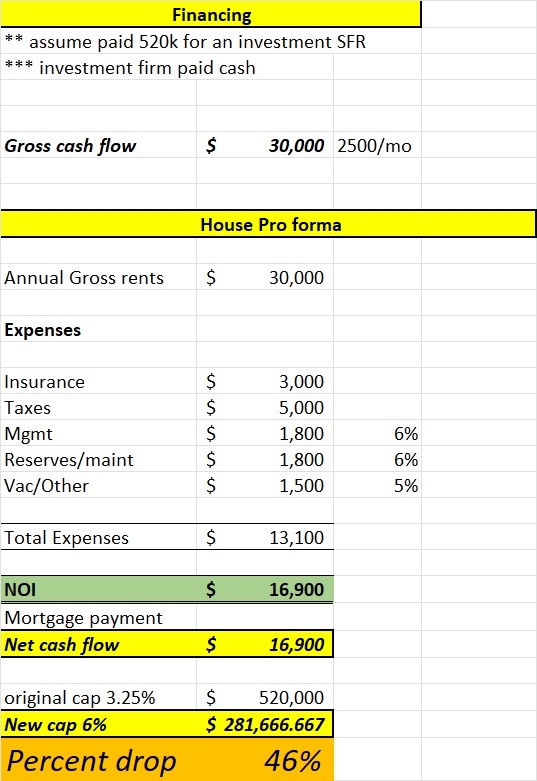

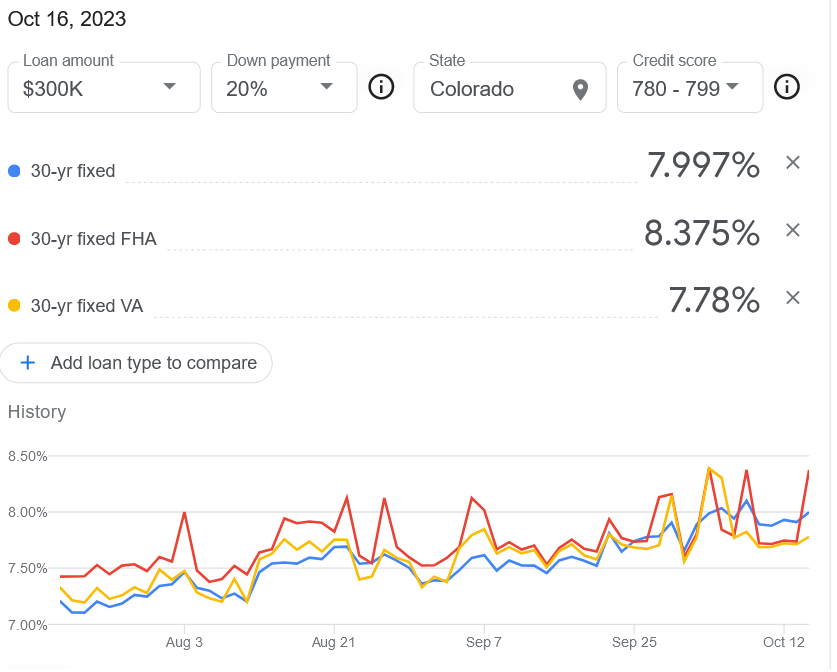

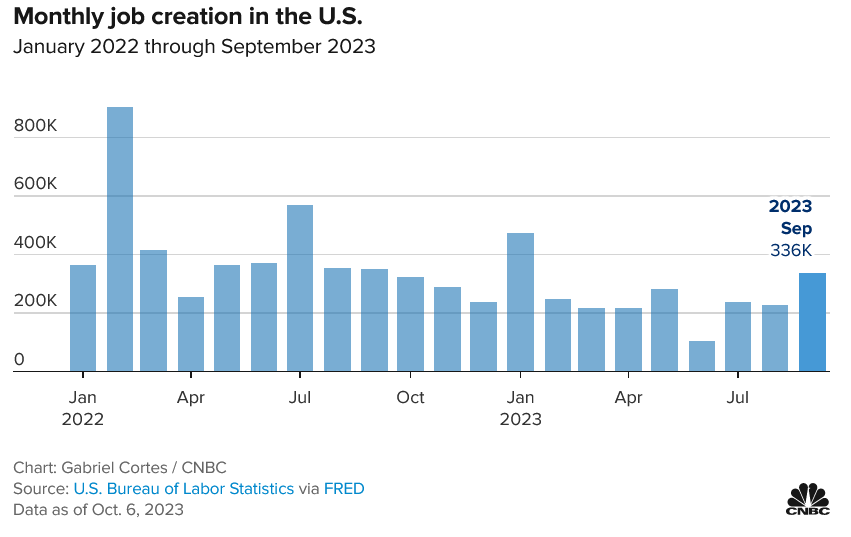

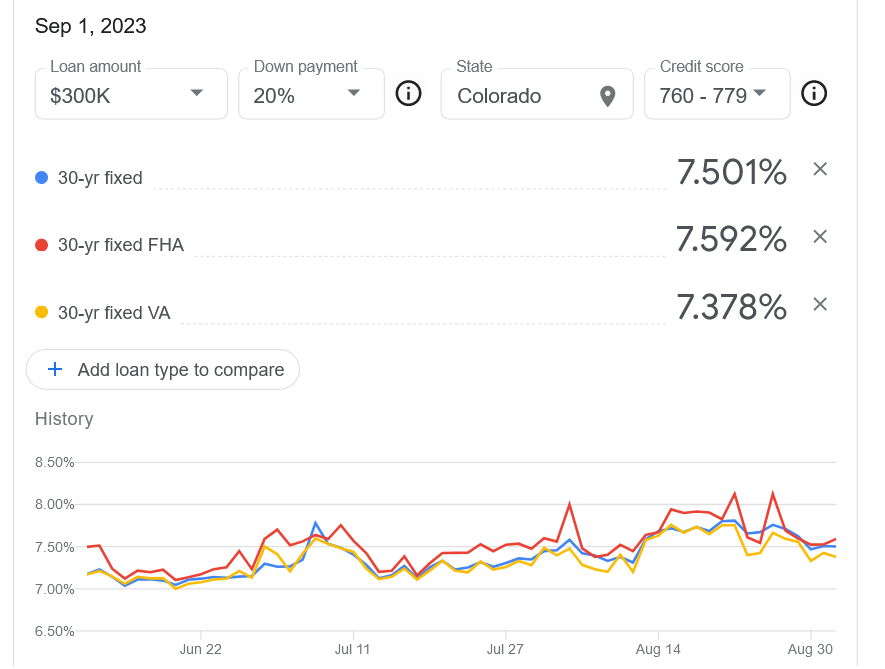

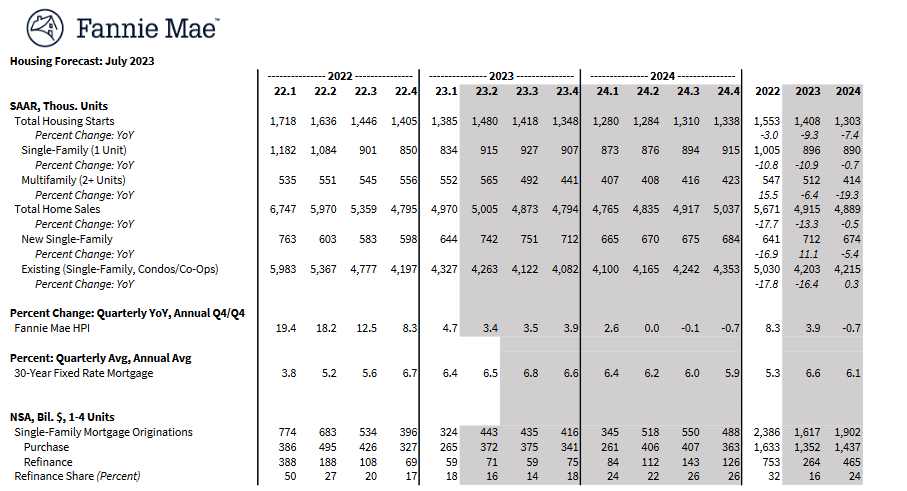

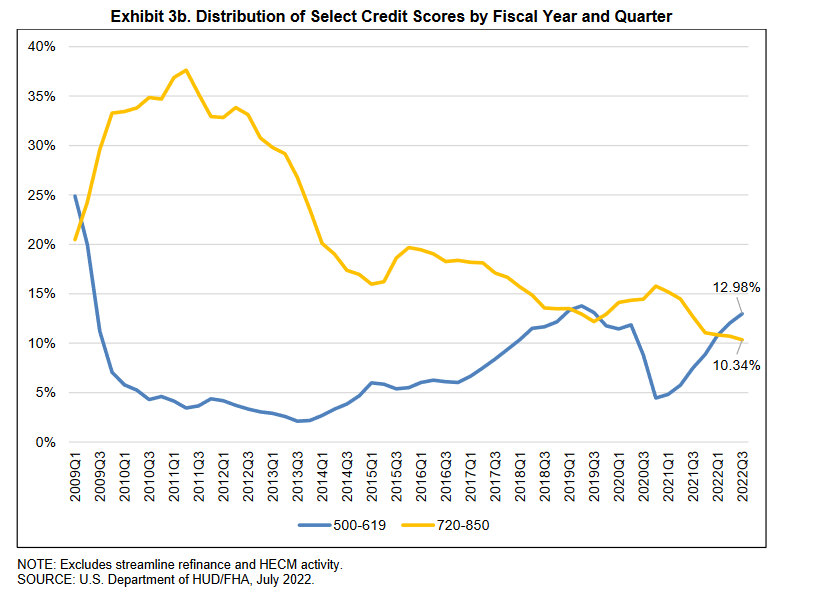

What do the increased conforming loan limits mean for real estate? The federal government (aka you the taxpayer) now backs mortgages up to 1.15m. The maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac has jumped sharply over the...