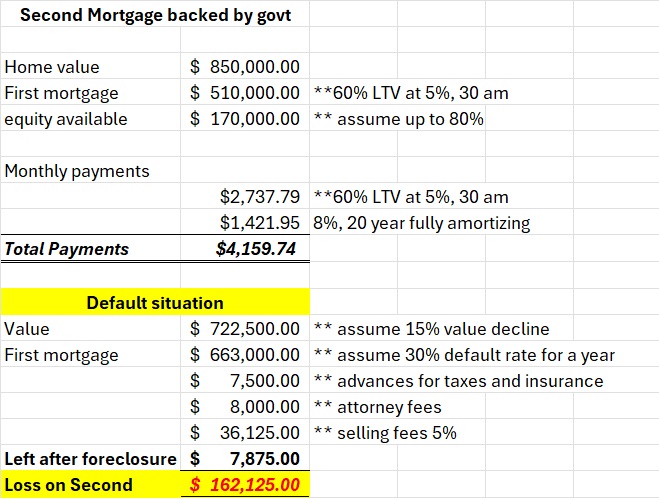

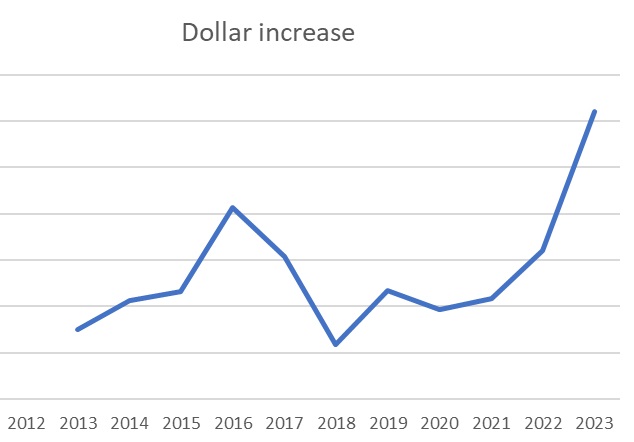

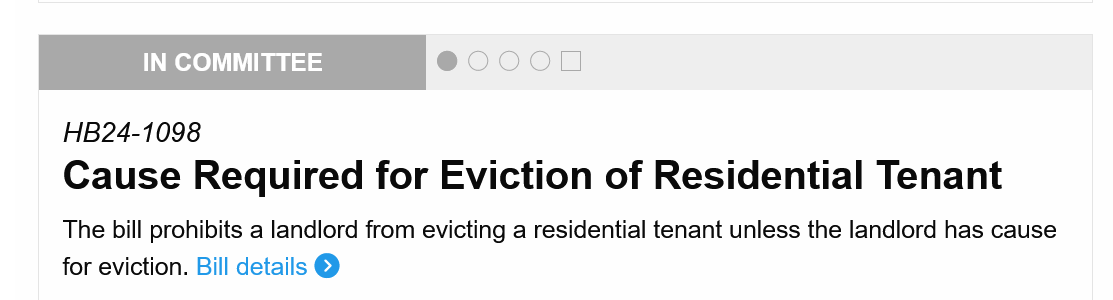

You have to hand it to the Federal government, they are always working to solve problems that do not exist. Currently there is a new proposal from the federal government (via Freddie Mac) to insure second mortgages/home equity lines of credit similar to first...