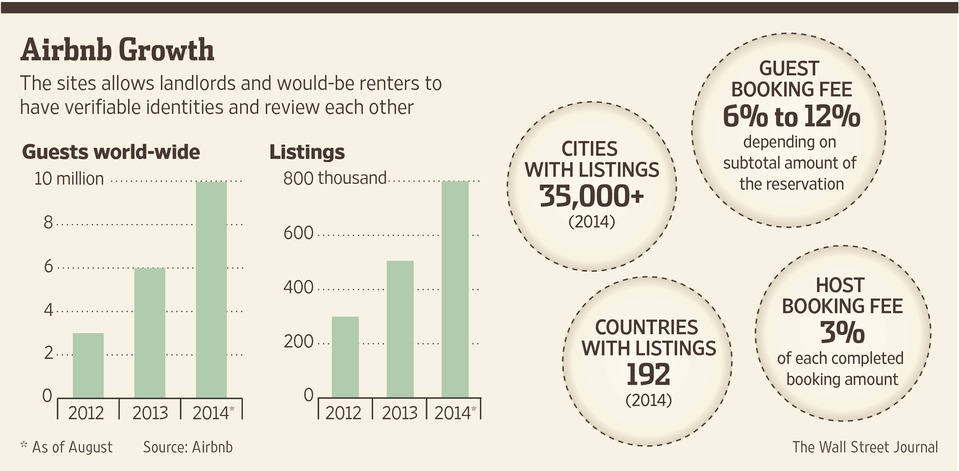

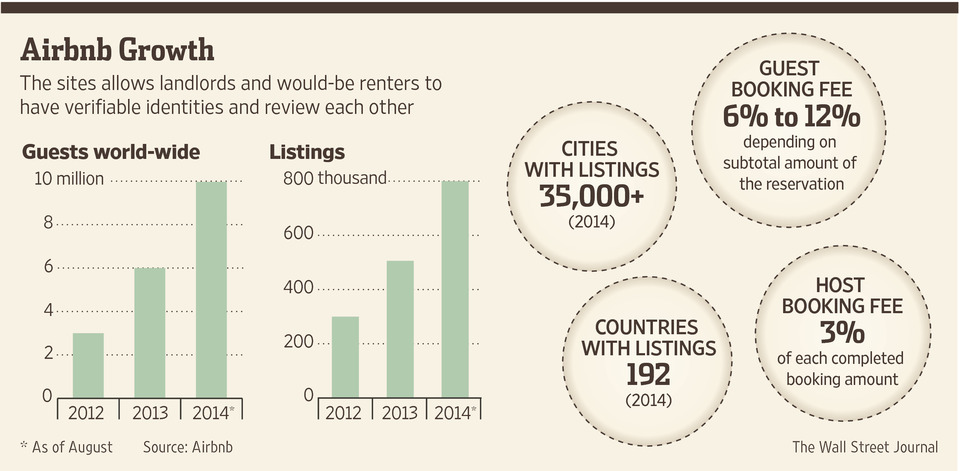

Disney World closes, ski resorts shut down, Hawaii quarantines all visitors , and travel comes to a screeching halt. What happens to the “sharing economy” when people stop sharing? What does this mean for Airbnb and companies like WeWork? For almost 60% of people...