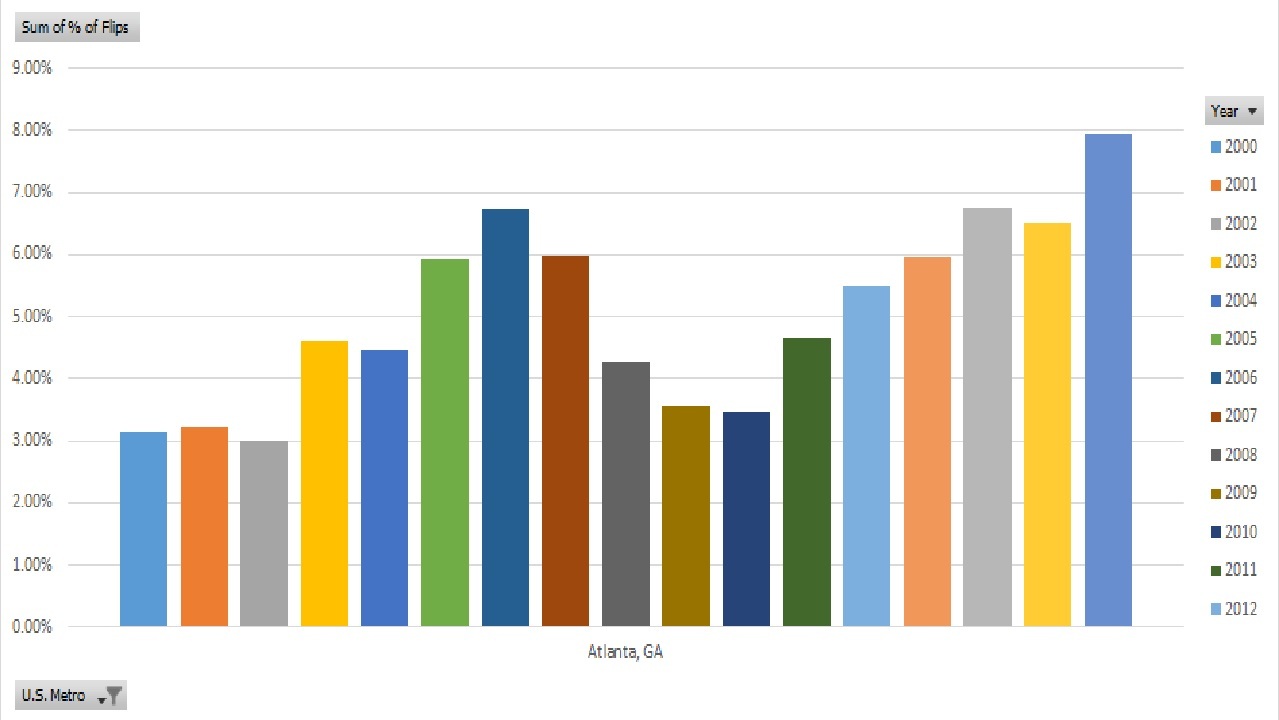

There was an article in the Atlanta Journal and Constitution this morning highlighting Atlanta as the number 8 metro market for flipping. Why should you care? Do you remember 2008 and how badly it ended for markets like Atlanta. I did an analysis of the raw data from Trulia (chart above) and was floored at what I saw. In Atlanta there were 20% more flips in 2016 than at the peak of the last cycle (2006). This is one of the few times when more is definitely not better! Why is this important?

Before beginning it is important to define what a flip is. A flip is defined as any property that has had two arm’s length transfers within a 12-month period. If you look at the chart above, you can start to see clear cycles. I plotted out the last 16 years of flips in the Atlanta metro area and you start to see a trend. Starting in 2000 the market averaged 3-5% of all sales as flips which in my opinion a healthy number. When the market started heating up (look at the almost 50% jump from 04 to 05) the flips increased until their peak in 06 (6.7% of all transactions at the peak were flips). Then the recession hit and the flips dropped in half. Fast forward to 2016, the percent of flips is almost 8% of all sales (7.95%). This is almost a 20% increase from the prior peak in 2016!

It is interesting because in the article in the Atlanta paper, the lead economist from Trulia seemed optimistic: “After all, there is no epidemic of foreclosures, no tidal wave of defaults. And a house-flip may remove a home from the market and push its price up quickly – but that’s not bad when it is because the investor-owner has made improvements.”

If you go back in your magic time machine, this sounds just like a quote you would hear in 06, immediately preceding the biggest real estate correction in recent history. Based on the chart above, it clear that we will have a repeat of 2007/2008 in the Atlanta market.

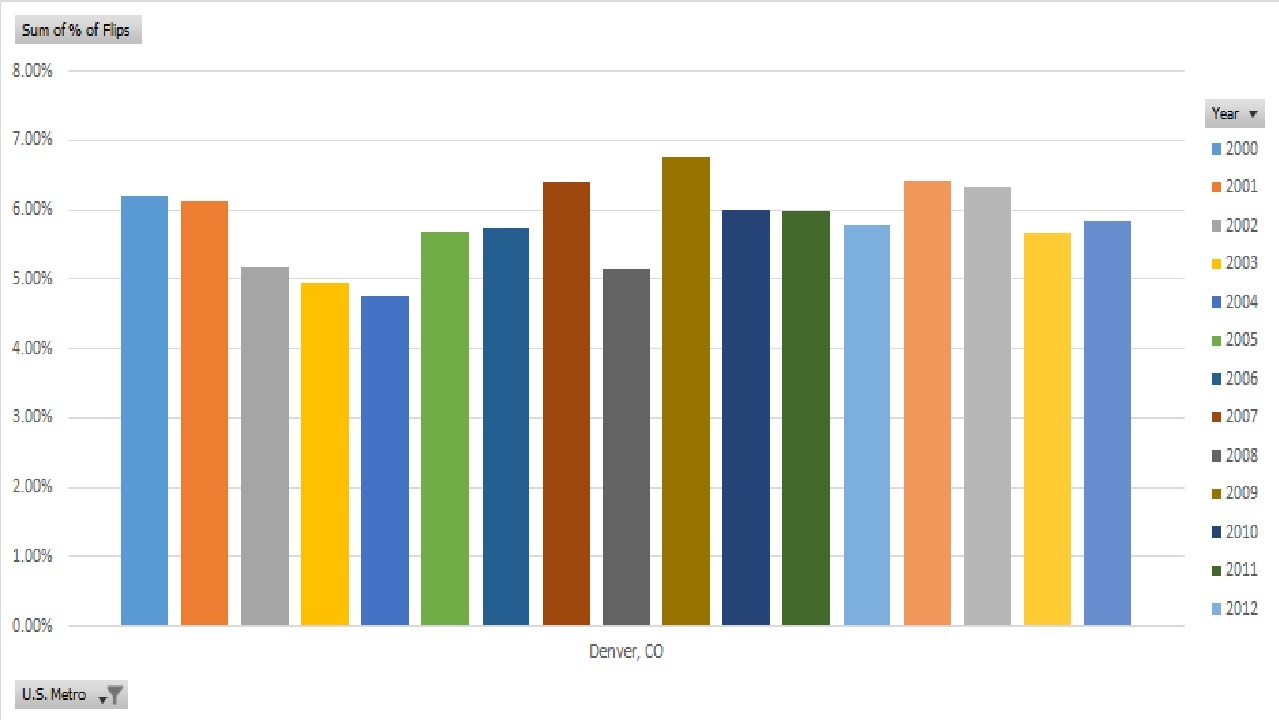

What about place like Denver with rapid price appreciation?

Based on the Atlanta chart, I also wanted to look at this for Denver, Colorado to see if I saw the same worrying trends. In the last cycle Denver experienced pain, but not nearly the same amount of foreclosures as cities like Atlanta. Why? One explanation could be the % of flips is significantly less along with the change in the percentage of flips. I interpret this to mean that Denver is a more stable market. Why are their less flips in Denver? There are two reasons: 1) the average sales price in Denver is substantially higher (400k median price in Denver vs. 260k median in Atlanta) which makes it more difficult to do a flip (tie up more capital on each deal) 2) Limited capacity: in Denver there is little if any available land to build on. In metro Atlanta the suburbs have much less stringent zoning than Denver and therefore considerably more available supply at lower price points. Does this mean Denver is immune? Absolutely not, with higher home prices small increases in interest rates will have a much larger impact which is just one of the many risks facing Denver

I made an excel sheet with all of the Trulia data with filters so you can see what the trends look like for your particular city and play around with different variables

Sources:

- Trulia Data with filters and analysis by City: https://www.fairviewlending.com/wp-content/uploads/trulia-flipping-data.xlsx

- Trulia article on house flipping trends: https://www.trulia.com/blog/trends/house-flipping-2017/

- Atlanta Journal and Constitution: Atlanta near the top again for home flipping: http://www.ajc.com/business/atlanta-near-top-again-for-home-flipping-should-worry/u7rWQKQaFuRpuEZq1mYVgP/

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).