Beginning in March of 2023, Freddie Mac, the largest buyer of mortgages is drastically changing the seasoning requirements for any loans it purchases which basically means any new conventional conforming loan will have to follow the new rules. What big changes are there to payment history? What is in the new rule? How will this impact the housing market? What mortgages are now ineligible?

What is in Freddie Mac’s new seasoning rule?

The new rule doubles the amount of time from 6 months to one year for seasoning of loans before it can be refinanced.

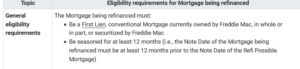

- The Mortgage being refinanced must:

- Be a First Lien, conventional Mortgage currently owned by Freddie Mac, in whole or in part, or securitized by Freddie Mac

- Be seasoned for at least 12 months (i.e., the Note Date of the Mortgage being refinanced must be at least 12 months prior to the Note Date of the Refi Possible Mortgage)

- Ineligible Mortgages

- The Mortgage being refinanced must not be:

- A Freddie Mac Relief Refinance Mortgage℠

- A Freddie Mac Enhanced Relief Refinance® Mortgage

- A Refi Possible Mortgage

- A Mortgage subject to an outstanding repurchase request

- A Mortgage subject to recourse, indemnification, or another credit enhancement other than mortgage insurance unless requirements in Section 4302.6 are met

- Payment history

- The Mortgage being refinanced must have a payment history that indicates the following:

- The Mortgage has not been 30 days delinquent in the most recent six months, and

- The Mortgage has not been 30 days delinquent more than once in the most recent 12 months, and

- The Mortgage has not been 60 or more days delinquent in the most recent 12 months

Why are seasoning requirements for Freddie Mac loans changing

Freddie Mac is getting concerned about the market and wants to ensure that in a rising value market that borrowers do not continue to strip equity from their house over a short period of time. A good example is if you look at a market like Denver, in one year in some neighborhoods prices went up 30%, someone could by a house and then 6 months later refinance and basically pull all of the cash they put into the house out.

What does this mean for the market?

Unfortunately Freddie Mac is a dollar short and a day late to the party. The scenario above has been playing out the last 10 years and really accelerated the last three during the covid real estate frenzy. The seasoning requirements will not have much of an impact on the market as prices are stagnating in most markets. As prices stagnate or fall there is not the opportunity to cash out equity as equity is best case staying the same or worst case declining

The changes to payment history also will not be monumental. If a borrower has more than one 30 day late, the credit score would be impacted so that they would likely not qualify anyway.

Summary

Long and short, Freddie Mac rolled out “monumental” changes to help protect its balance sheet when there is a downturn. Unfortunately the rules above are going to do nothing at this point in the cycle as they are a dollar short and a day late. Prices are holding steady/declining which would eliminate the quick refinances and mortgage lates already impact credit scores so the new rules do not really move the mark much. Sadly, these rules should have been in place years ago. At the end of the day all taxpayers will be on the hook when the market does finally adjust.

Additional Reading/Resources

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender