It is no secret that housing prices and in turn rents have skyrocketed throughout the country. President Biden, announced a major new action to: “ lower housing costs by limiting rent increases”. Essentially the proposal is nationwide rent control. What is in Biden/Harris proposal? What does the federal reserve say about these policies? Will rent control solve the “rent inflation” or make matters even worse? What does this mean for property owners and renters? Who wins and what are the unintended consequences as a result?

President Biden/Harris nationwide rent control

“President Biden is calling on Congress to pass legislation presenting corporate landlords with a basic choice: either cap rent increases on existing units to no more than 5% or lose valuable federal tax breaks. Under President Biden’s plan, corporate landlords, beginning this year and for the next two years, would only be able to take advantage of faster depreciation write-offs available to owners of rental housing if they keep annual rent increases to no more than 5% each year. This would apply to landlords with over 50 units in their portfolio, covering more than 20 million units across the country. It would include an exception for new construction and substantial renovation or rehabilitation.” (Whitehouse press briefing)

Essentially the proposal would disallow depreciation write offs if rents are increased by more than 5%, there is not an exception for big increases in taxes, insurance, etc… that will easily exceed 5% increases/year.

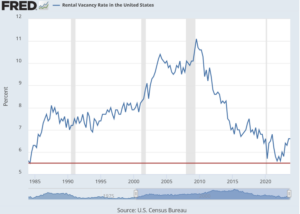

What has caused the skyrocketing rents?

Before getting into the impacts of National rent control, it is important to understand exactly what is causing rents to increase in the first place. There are the four key causes of National rent inflation: basic economics of supply and demand coupled with ultra low interest rates, costs, and real estate prices

- Basic economics never fails, supply and demand have gotten out of balance. Demand has increases as prices of houses have gotten more expensive, furthermore with Covid more people wanted larger spaces or their own space due to quarantines. Unfortunately supply has not kept up for a few reasons. First, it is expensive to build due to land costs, labor, and zoning/taxes. As all of these items have increased builders have gravitated towards higher end properties since this is the only way for them to make a return on their investment. Zoning and taxes have exacerbated the situation. For example as taxes increase, rents have to increase to account for the taxes. Furthermore, zoning has limited the number of new properties coming online. All these factors have led developers to focus on higher tier properties further driving up the rent.

- Ultra low interest rates have also caused issues with the supply/demand equation. Low rates have allowed more homes to be bought for investment purposes. Investors bought 24% of all single-family houses sold nationwide last year, up from 15% to 16% annually going back to 2012, according to a Stateline analysis of data provided by CoreLogic, a California-based data analytics firm. The issue is especially acute in some Sun Belt states amid evidence that investors often can outbid other buyers, keeping starter homes out of the hands of would-be owners. Ultra low interest rates have supercharged the purchase of homes by investors as leverage can substantially increase returns.

- Costs: Everything is more expensive for property owners from labor costs, property taxes, insurance costs, appliances, repairs, etc… Just like in the rest of the economy, inflation has hit the real estate sector hard with huge increases in costs that are being passed on to renters.

- Real Estate prices: as real estate prices have risen so have rents, let’s take a simple example if you bought a property that is worth 400k, you would charge more than a property that has a value of 250k. On a macro level prices have increased about 40% from Covid which is leading to the price increases in rents as property owners must get a return on their investment. If they can’t get the return then they will sell the property and invest elsewhere. This is playing out in Cities throughout the Country.

What dos the federal reserve say about rent control

The Federal Reserve bank of St. Louis earlier in 2024 released a study on rent control and here are the findings:

“Despite innovations to rent-control laws meant to maintain the housing supply, economists have found that following the introduction of these policies, rental stock typically declines through channels like the conversion of rental units to owner-occupied units and major unit renovations.2 In the long run, such policies may lead to a permanent change in the housing supply mix, which could also make renting less affordable. For example, economist Daniel Fetter argued in a 2016 article that when cities responded to rent inflation during World War II with rent control, housing supply was pushed into the owned market and out of the rental market, undermining the policy’s original goal of protecting renters from fast-growing wartime housing costs. Fetter found that this supply response permanently shifted the balance of owned versus rented housing stock and increased homeownership rates over the ensuing years, sometimes to the detriment of the renters that the policy was designed to protect.

Rent-control policies can have other downsides beyond dampening the growth of rental housing stock. Several economists found negative effects on housing quality; their studies show rent-controlled buildings or areas with large concentrations of rent-controlled units tend to have more dilapidated units, suggesting that rent control reduces landlords’ incentives to maintain their units.3

How has rent control worked in other cities?

Rent control is not widespread in the U.S. According to a recent study by the Urban Institute, 182 municipalities in the U.S. out of about 89,000 have rent control regulations, and all of them were in New York, New Jersey, California, Maryland, or Washington D.C. The reason it is not widespread is that rent control doesn’t work and over the long term has the opposite effect.

Rent Control reduces supply:

According to the Brooking institute, a liberal leaning organization:

DMQ find that rent-controlled buildings were 8 percentage points more likely to convert to a condo than buildings in the control group. Consistent with these findings, they find that rent control led to a 15 percentage point decline in the number of renters living in treated buildings and a 25 percentage point reduction in the number of renters living in rent-controlled units, relative to 1994 levels. This large reduction in rental housing supply was driven by converting existing structures to owner-occupied condominium housing and by replacing existing structures with new construction.

Rent Control reduces value:

To calculate the value of a commercial property, you take the Net Operating income by the rate of return (cap rate). With rent control the net operating income is reduced drastically (less rents) and therefore the property is worth less. Furthermore without profit motivation and a built in tenant base property owners are considerably less likely to take care of the properties. Cambridge is a unique study as they had rent control and passed legislation to remove rent control. The impacts on the market were profound:

From December 1970 through 1994, all rental units in Cambridge built prior to 1969 were regulated by a rent control ordinance that placed strict caps on rent increases and tightly restricted the removal of units from the rental stock. In November 1994, the Massachusetts electorate passed a referendum to eliminate rent control.

Author, Palmer, and Pathak (2014) (APP), studies the impact of this unexpected change and find that newly decontrolled properties’ market values increased by 45 percent. In addition to these direct effects of rent decontrol, APP find removing rent control has substantial indirect effects on neighboring properties, boosting their values too. Post-decontrol price appreciation was significantly greater at properties that had a larger fraction of formerly controlled neighbors: residential properties at the 75th percentile of rent control exposure gained approximately 13 percent more in property value following decontrol than did properties at the 25th percentile of exposure. This differential appreciation of properties in rent control–intensive locations was equally pronounced among decontrolled and never-controlled units, suggesting that the effect of rent control had been to reduce the whole neighborhood’s desirability.

The economic magnitude of the effect of rent control removal on the value of Cambridge’s housing stock is large, boosting property values by $2.0 billion between 1994 and 2004. Of this total effect, only $300 million is accounted for by the direct effect of decontrol on formerly controlled units, while $1.7 billion is due to the indirect effect. These estimates imply that more than half of the capitalized cost of rent control was borne by owners of never-controlled properties.

Rent Control increases taxes:

It is well established that rent control reduces values but nobody is talking about how rent control will increase everyone else’s taxes. As property values decline, so does the amount of property taxes collected as taxes are based off values. With steep declines in values caused by rent control to not only the apartment owners but entire neighborhoods, how will local governments continue to provide the services now. Either services will be cut (which never happens) or taxes will need to be increased on all property owners to make up for the lost revenue due to the decline in values.

New York Case Study:

When I think of rent control, the first city that comes to mind is New York (hopefully everyone remembers the sitcom friends based in rent-controlled apartments). So how has NY fared as a result of their rent control ordinance? Not so well. According to the NY Daily: Median apartment rents in the city have increased 75% since 2000 — a rise 31 points greater than in the rest of the country, according to a report released by the city controller’s office. Over the past decade, 400,000 affordable housing units renting for $1,000 or less have disappeared, Stringer said.

Summary

To counteract the skyrocketing rents, the federal government has come up with a worn-out idea to implement rent control. Who doesn’t want to see rent stay constant? Unfortunately, someone must pay. Countless studies on both the right and left have shown that rent control only addresses the symptoms not the root causes.

If there’s any consensus in economics, it’s that rent control achieves the opposite of its intended goal. It leads to housing shortages by discouraging new development and maintenance of existing properties. The Federal reserve came to the same exact conclusions this year in a policy paper.

Furthermore, rents rise faster in properties not subject to controls. The real solution is to increase supply which rent control would only make worse. Unfortunately, rent control is the wrong tool to fight the housing challenges facing cities throughout the country.

Resources/Additional reading:

- https://www.whitehouse.gov/briefing-room/statements-releases/2024/07/16/fact-sheet-president-biden-announces-major-new-actions-to-lower-housing-costs-by-limiting-rent-increases-and-building-more-homes/

- https://www.stlouisfed.org/on-the-economy/2024/feb/what-are-long-run-trade-offs-rent-control-policies

- https://www.nmhc.org/news/press-release/rising-rent-control-leading-to-falling-development-and-investment/

- https://www.npr.org/2022/11/28/1138633419/rent-control-economists-tenants-affordable-housing-ballot-measures

- https://www.wsj.com/articles/nationwide-rent-control-congress-democrats-progressives-housing-president-biden-11674233540?mod=mhp

- https://www.nydailynews.com/new-york/nyc-rents-soar-incomes-decline-article-1.1765445

- https://www.westword.com/news/one-bedroom-rent-in-denver-rose-79-percent-in-under-a-decade-11072121

- https://www.denverpost.com/2019/04/15/colorado-rent-control-regulations/

- https://www.brookings.edu/research/what-does-economic-evidence-tell-us-about-the-effects-of-rent-control/

- https://fair.org/extra/brookings-the-establishments-think-tank/

- https://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2022/07/22/investors-bought-a-quarter-of-homes-sold-last-year-driving-up-rents

- https://www.rent.com/research/average-rent-price-report/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender