Take a look at this chart above, focus on the bottom two lines, in Pink is Vail (MTN) and in Green is Target (TGT). Why are they trending the same way? Now look at the purple line Costco, notice a huge divergence? What type of skier/snowboarder are you? What does all this mean for ski real estate? Can the chart above guide you on where to invest in ski real estate? Are some ski markets considerably better than others? Why?

Target, Costco, Whole foods; which skier are you? How does this impact real estate?

The ski industry, at its core, is like many other consumer companies, instead of selling jeans like target or anything you want at Costco they are selling a service, skiing. Take a look at the chart above; the correlation between Vail and Target is uncanny. They have trended almost in lockstep for the past 5 years. Why are they trending together and what happened after the pandemic? What does this mean for the ski industry and ski real estate in particular?

Target and Costco rule skiing throughout the World.

Vail and Alterra own the worldwide ski industry with the epic and Ikon passes the largest in the world. Resorts throughout the US and in turn the world are getting on one of the two trains. For example, Telluride is on the Epic Pass train and Copper/Eldora got on the Ikon pass train. The two passes are approaching consolidation much differently. Every major resort in the United States is either owned or affiliated with one of the two passes.

The Target model:

Vail resorts epic pass is going for the mid market model to drive volume to its resorts. Think of Breckenridge; it is one of the busiest resorts in the country. Vail might be heading towards a “Spirit Airlines” model where getting on the plane is inexpensive and they make their money by the add Ons (assigned seats, bags, etc…). Vail resorts is beginning this shift. For example, the cost of food at Breckenridge is almost double Steamboat (Alterra resort). My wife was at Breckenridge with our daughter and got chicken nuggets for lunch… the cost $50 dollars for lunch! At Breckenridge parking is also 10-20 bucks whereas at Steamboat there are several free lots close to the base area.

The Costco Model:

Alterra’s Ikon pass is adopting the Costco model. It focuses on a bit higher demographic than Target, but you get better service and a higher end experience with mountains like Steamboat and Snowmass. Like Costco, the Ikon pass isn’t trying to be the low-cost volume leader and then nickel and dime you on everything… at least not yet.

The Whole Foods Model:

Resorts like Aspen and Telluride are focusing on the ultra-high net worth markets by pricing their products substantially higher. For example, a season pass to Aspen is almost 2500 for an adult versus 900-1000 for an Ikon or Epic pass. They are using pricing to limit volume and ensure a better guest experience with limited crowds.

What happens now?

Epic: Vail resorts is the largest ski operator relying heavily on the “all you can eat buffet” to drive substantial volume to their resorts. Ikon: Alterra is going a different route by pricing its passes just a bit higher than Vail to try to limit volume and increase the user experience. Aspen: Aspen which is affiliated with the Ikon pass is going a different route by raising the price of tickets to 2500 for a season pass to substantially reduce volume. They don’t want or need the volume of a Vail or even Alterra, although you do get 7 days to Aspen on the premium Ikon pass.

Why did they each implement different models?

The beauty of America is that each company can decide for themselves how to maximize goodwill and return on their investment. It is well known that drive up traffic is substantially less valuable than destination traffic so each resort is trying to ensure they protect the destination traveler who is going to spend more money as opposed to the all you can eat buffet skier.

What is the correct solution?

Looking at the three models which solution will be the “best model”. Unfortunately, “best” will be dependent on where you fit in the skiing paradigm. For example, if you live in Denver and would come up every weekend, the Vail model works great as you have a low cost option for the all you can eat buffet of Breckenridge or Keystone. On the other hand, a destination skier might prefer a different product like a Steamboat or Snowmass.

The markets have spoken

Alterra is privately held so we don’t have details on their financials, but if you look at Vail’s stock price, clearly the market does not like their model that is targeting the same demographics as Target (pun intended). Vail’s stock is almost in lockstep with Target. On the other hand, take a look at Costco where coming out of the pandemic there is a huge divergence with Target and Vail. Costco has continued to increase while Target and vail have declined.

Real estate outperforming Vail’s stock

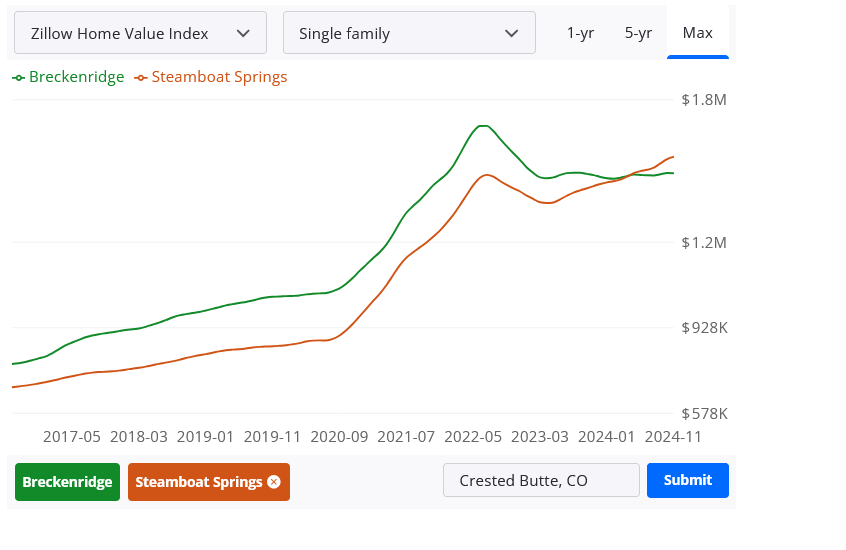

Real estate in all the mountain towns has vastly outperformed Vails stock price (see chart below). Even with prices off their highs in Breckenridge, it still has handily beat Vail’s stock!

What impact will this have on real estate?

Look at this chart of Steamboat (an Alterra owned resort) vs Breckenridge (a Vail owned resort). There is a huge divergence where Steamboat has continued to increase while Breckenridge is off about 10% off their peak. Why? Steamboat is a destination resort and does not have drive up traffic, this helps the user experience in Steamboat as opposed to the mass market/Target approach of Breckenridge. Furthermore, just as people on the consumer side are trading down from Target to Walmart for the price (in the ski industry maybe they are trading for other experiences like the beach or cruise or ??), they are also trading up to stores like Costco for the user experience. On a side note, each ski market is unique, if you look at Vail (also a Vail owned resort), they are almost lock step with Steamboat as they also are a world-renowned destination. Also most mountain towns have become world class destinations for other activities like hiking, fly fishing, mountain biking, etc… which insulates them from the ups and downs of the ski industry.

Summary

Target or Costco or Whole foods, which is the best ski model? According to the stock market, the market is rewarding Costco and Whole Foods (owned by Amazon) considerably more than Target. Unfortunately Vail resorts is getting stuck in the mid market like Target which is causing heartburn for its stock along with real estate in places like Breckenridge. Fortunately even in Breckenridge, the sky is not falling. Although it is underperforming destinations like Steamboat which is owned by Alterra, it is still drastically outperforming most other real estate markets throughout the country. Which begs the question, where should you buy ski real estate? Check out my recent blog on best ski real estate that I wrote and also this article in the Denver Post that I was quoted in on Vail resorts Note we have an office in Colorado and do a ton of lending throughout the ski towns, Denver, etc… along with your home office in Atlanta. If you want to learn more about Colorado real estate, please send an email to me and I’ll get you signed up.

Additional Reading/Resources:

https://coloradohardmoney.com/2025-best-colorado-ski-real-estate/ Why is Vail resorts stock declining?

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country. My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it. Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games). Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications. Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender