It was already difficult for businesses and households to borrow money earlier this year — but after the collapse of three US regional banks and a cascade of rate hikes by the Federal Reserve, getting money has become considerably harder. What does the decline in credit access mean for real estate? Why are lenders pulling back while the stock market continues heading higher? How does the increase in credit rejection rates ultimately flow through to the general economy?

What was in the federal reserve data on credit access?

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released results from its latest Survey of Consumer Expectations (SCE) Credit Access Survey , which provides information on consumers’ experiences with, and expectations about, credit demand and credit access. The survey is conducted every four months.

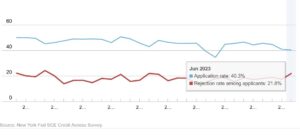

- The application rate for any kind of credit over the past twelve months declined to 40.3 percent from 40.9 percent in February, its lowest reading since October 2020. Application rates declined to 11.9 percent for auto loans and 12.5 percent for credit card limit requests, but increased to 24.8 percent for credit cards, 6.5 percent for mortgages, and 5.3 percent for mortgage refinances.

- The overall rejection rate for credit applicants increased to 21.8 percent, the highest level since June 2018. The increase was broad-based across age groups and highest among those with credit scores below 680.

- The rejection rate for auto loans increased to 14.2 percent from 9.1 percent in February, a new series high. It increased for credit cards, credit card limit increase requests, mortgages, and mortgage refinance applications to 21.5 percent, 30.7 percent, 13.2 percent, and 20.8 percent, respectively.

- The average reported probability that a loan application will be rejected increased sharply for all loan types. It rose to 30.7 percent for auto loans, 32.8 percent for credit cards, 42.4 percent for credit limit increase requests, 1 percent for mortgages, and 29.6 percent for mortgage refinance applications. The readings for auto loans, mortgages, and credit card limit increase requests are all new series highs.

Why have banks sharply decreased their lending?

Small/Mid-size banks are the largest commercial real estate lenders. The bank model is to take in deposits and pay low rates and then lend the money back out via commercial real estate loans. With the recent bank collapses, the amount of deposits at small and midsize banks has decreased as people moved their money to larger institutions. Furthermore, for the money that has remained, higher deposits are required to keep that money further impacting a banks margins and in turn profitability.

Not only have deposits declined, but banks have gotten nervous about having enough liquidity to ensure they do not have a bank run like what occurred to Silicon Valley Bank. With less funds available it is no surprise that lending has declined dramatically.

Regardless of the headlines, lenders are getting concerned about the state of the economy and future defaults. With rising interest rates, student loan payments restarting, and inflation still running higher than desired lenders are being more cautious. The pullback in lending is just beginning and will accelerate later this year/early next year as defaults increase further.

What is the impact of decreased credit availability on real estate volume and in turn prices?

Initially commercial property will feel the pain the most as the overwhelming majority of residential loans are government backed so the banks can easily pass them through to Fannie/Freddie. Commercial loans on the other hand are typically held by the banks (some larger ones are securitized or sold to life insurance companies) which ties up substantial capital.

With capital at small and midsize banks constrained there has been a sharp pullback in commercial real estate lending. This will first lead to much lower commercial real estate volumes due to lack of financing.

Ultimately there will be a major reset in commercial real estate prices as financing is more expensive and harder to obtain, many deals will no longer cash flow or make sense at their current pricing. We are already seeing this in the office sector, but multifamily is up next as the extremely low rates of the past three years reset to almost double their prior levels.

Residential lending should not initially be impacted too much by the reduction in credit as most loans are sold directly to Fannie/Freddie and not kept on the books of banks. Jumbo loans and other loans held on banks books will be much more challenging. As commercial lending takes a hit, banks overall will continue to get more nervous about all real estate lending.

What does the pullback in lending mean for the general economy?

Fallout from the U.S. banking crisis is likely to tilt the economy into recession early next year. As credit tightens ultimately consumers and businesses slow down spending. As spending slows down, hiring will slow down and unemployment will increase leading to a general decline in the economy. This has occurred in every single cycle and will happen again this cycle.

Regardless of the media hype around a soft landing, it is very unlikely that credit tightens, and rejection rates increase without causing some economic harm including higher unemployment and reduced consumer spending.

How accurate is the new federal reserve prediction of a “soft landing”?

I take everything with a grain of salt now. The federal reserve for years has said that inflation was transitory, then they said the inflation would recede quickly. Neither of these items occurred as they had predicted which leads me to question their recent predictions of a soft landing.

There will be a recession and I think the recession starts early 2024 and could end up deeper than the market anticipates as inflation remains far stickier and they are unable to quickly drop rates. Furthermore, we are likely going to see a commercial real estate market blow up to the tune of 20-50% declines on many office properties and a reset in apartments as rents stagnate and cap rates rise due to inflation. This will eventually flow into residential real estate as well as unemployment ticking up which will lead to defaults/distress situations.

Summary

We are just at the beginning of the reset in the market. A decline in credit availability/ bank lending coupled with huge jumps in rejection rates for credit is just the tip of the iceberg. With the recent blow up in small banks, look for credit availability to continue to decline and rejection rates to stay high as lenders get nervous about liquidity and future defaults.

In the short term, real estate closing volumes will decline, but the real pain will be in the long term with a substantial reset in prices especially on the commercial side as credit continues to dry up which will ultimately lead to a cooling economy.

Recall, the federal reserve has severely missed in predicting the stickiness of inflation and they are unlikely to get the “soft landing” correct. The slowing of the economy will not happen as the federal reserve predicts.

When credit availability quickly declines and rejection rates spike, like we are seeing now, there is a 100% probability of a recession. Remember every single recession always happens radically different than is predicted and this cycle does not look like it will buck the historical trend.

Additional Resources/Reading

- https://www.cnn.com/2023/05/08/economy/fed-senior-loan-officer-opinion-survey-q1/index.html

- https://www.newyorkfed.org/microeconomics/sce/credit-access#/experiences-credit-applications1

- https://www.newyorkfed.org/microeconomics

- https://www.aba.com/about-us/press-room/press-releases/q2-2023-credit-conditions-index

- https://www.bloomberg.com/news/articles/2023-04-07/us-bank-lending-declines-sharply-for-a-second-straight-week?srnd=premium

- https://www.cnbc.com/2023/04/12/fed-expects-banking-crisis-to-cause-a-recession-this-year-minutes-show.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, lending, loans