There is a new mantra being used in small/regional banks that is “survive until 2025”. In essence the theory is that rates will drop precipitously and basically “bail out” many banks’ portfolios. This includes treasury holdings that are underwater, commercial real estate, etc… How accurate is this mantra, will a great event happen in 2025 to solve the banking crisis? Should we all be banking on survive until 25?

What is happening now that is making bank survival difficult?

There are two primary drivers that are making it hard for many small/regional banks to survive

- Interest rates making treasury portfolio worth less: Remember as interest rates rise, mortgage bonds fall. As rates have risen and stayed higher for longer, banks holdings of government bonds/treasuries has declined. This is not an immediate issue until they need liquidity and have to sell. Unfortunately, as rates stay higher for longer this exponentially increases the probability that banks will have to sell their bonds at a loss.

- Commercial properties declining in value due to rates/occupancy: Small community banks and regional banks are the largest lenders on commercial properties. As rates have risen the value of commercial properties has declined. This is occurring as a result of capitalization rates increasing which in turn leads to lower prices. Higher interest rates are not the only issue for commercial real estate as there is substantial vacancies now in office, retail, and even light industrial properties. All these factors are leading to huge decline sin commercial property values and ultimately losses to the lenders on these same properties.

Why did bankers pick 2025 as the recovery year?

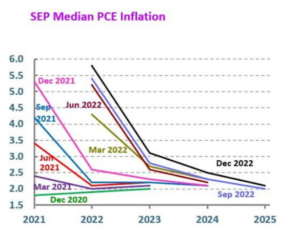

Last year, most economists were predicting a continued decline in interest rates and in turn an easing of interest rates by the federal reserve. This would ultimately lead to a recovery in the value of bonds as rates declined. Furthermore, commercial real estate would rebound due to the lower rates. The theory is that banks and others could just wait out this downturn as there will be a swift recovery in 2025.

How accurate are these predictions of a swift recovery in 2025?

Unfortunately, the wait until 25 mantra is not going exactly as planned. We are seeing inflation continue to stay well above the federal reserve targe of 2% which in turn is leaving long term rates considerably higher than predicted. Furthermore, the pace and quantity of interest rate deductions has radically changed with many predicting that interest rates are ultimately going to settle considerably higher than anticipated. Furthermore, as we can see so far this year, inflation is proving substantially stickier than originally anticipated and 10 year treasuries continue to fall while interest rates are rising or staying near their highs.

What happens to banks and other lenders when these predictions falter?

As interest rates settle at much higher rates than anticipated we will see banks start to falter. The longer interest rates stay high, the higher the probability of catastrophe in the banking sector and in turn commercial real estate. The mantra of waiting longer for the market to improve likely will backfire if commercial prices stumble further.

Will banks Stay alive until 25

Although it is a catchy mantra, in practice it is likely delaying the inevitable for many small and regional lenders. The market has continuously underestimated the stickiness of inflation and in turn overestimated how much interest rates will actually fall. We are in a new paradigm with higher rates for longer regardless of the market optimism. This will ultimately lead to more bank failures and/or shotgun weddings with other banks. Alive until 25 is merely delaying the inevitable consolidation in the banking industry as rates remain much higher than anticipated.

Additional reading/resources:

https://www.fairviewlending.com/why-are-home-prices-still-rising/

https://www.fairviewlending.com/what-does-higher-for-longer-mean-for-real-estate/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender