by Glen | Dec 2, 2018 | Colorado Hard Money, Commercial Lending valuation, commercial private lending, Denver Hard Money, hard money, Hard Money Commercial Lending, Hard Money in the News, Housing Price Trends / Information

Contract signings to purchase previously-owned U.S. homes unexpectedly fell by the most since January, reaching the lowest level since mid-2014 amid mounting evidence that the housing market is struggling. New homes sales also tumbled 8.9% in October. On the...

by Glen | Nov 26, 2018 | Hard Money Lending, Real Estate Trends, Real estate Valuation, Residential hard money, Small Balance Commercial Lending, Underwriting/Valuation

Would you take the bet? I wouldn’t suggest it as we’ve seen this party before. As I’ve mentioned before the number one determinant of a default is leverage. This is obvious, yet our wonderful federal government doesn’t seem to grasp this concept. For a government...

by Glen | Nov 20, 2018 | Commercial Lending valuation, Private Lending, Property Valuation, Real estate Valuation, residential lending valuation, Small Balance Commercial Lending

I hope everyone had a great Thanksgiving. Unfortunately, the market plunge hasn’t helped get many folks into the Holiday Spirit! What is driving the recent market correction? Is this a bump or a real problem? Is this all driven by the fed? Is real estate the next...

by Glen | Nov 19, 2018 | Hard Money Commercial Lending, Hard Money in the News, Hard Money Lending, Housing Price Trends / Information

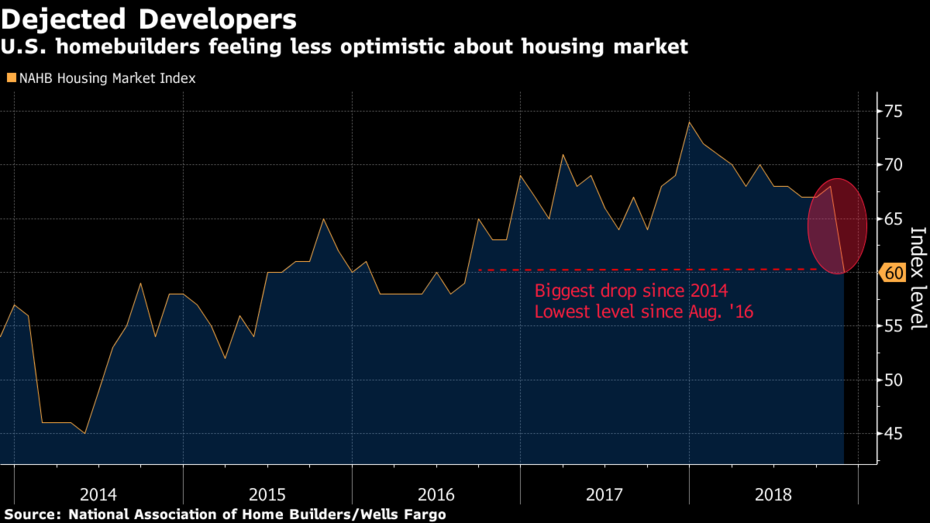

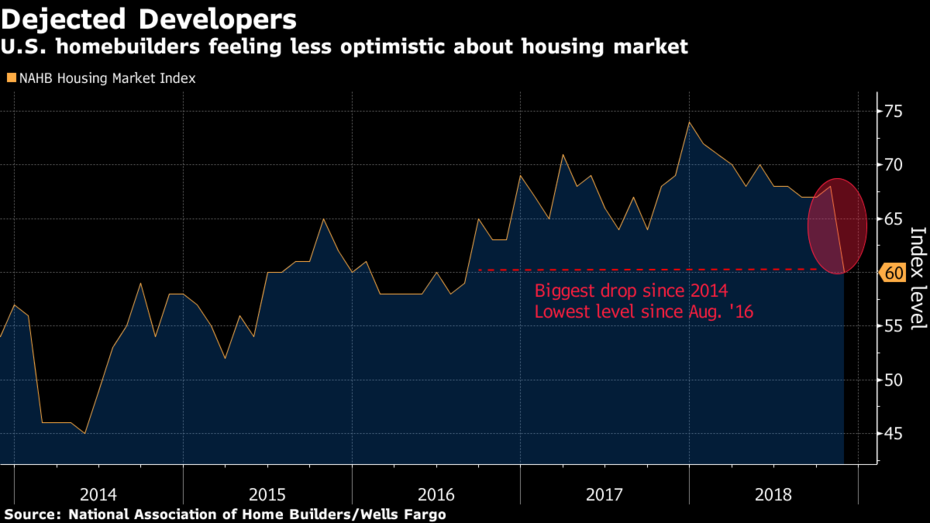

As Thanksgiving week begins, there was a surprising economic report just released. The National Association of Home Builders/Wells Fargo Housing Market Index dropped eight points in November to 60, according to a report Monday. That compared with the median estimate...

by Glen | Nov 10, 2018 | Private Lending, Real Estate Trends, Real estate Valuation

The Commerce Department reported GDP surged to 3.5%, well above most median economic estimates (full article). Is this the beginning of an era of increased economic prosperity? Will GDP continue to increase? Why is GDP increasing while housing stocks have tanked...