by Glen | Oct 14, 2021 | interest rates, mortgage rates, Private Lending, Real Estate economic trends, real estate investing, Real estate Valuation

Happy Fall, it is hard to beat this time of year with snow up top and changing leaves in the valleys (do you know where I took this pic?) Yields for U.S. government debt posted the biggest weekly jump in months on Friday, as a selloff in bonds that commenced...

by Glen | Oct 7, 2021 | Colorado Hard Money, Georgia hard money, Hard Money Lending, Housing Price Trends / Information, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation

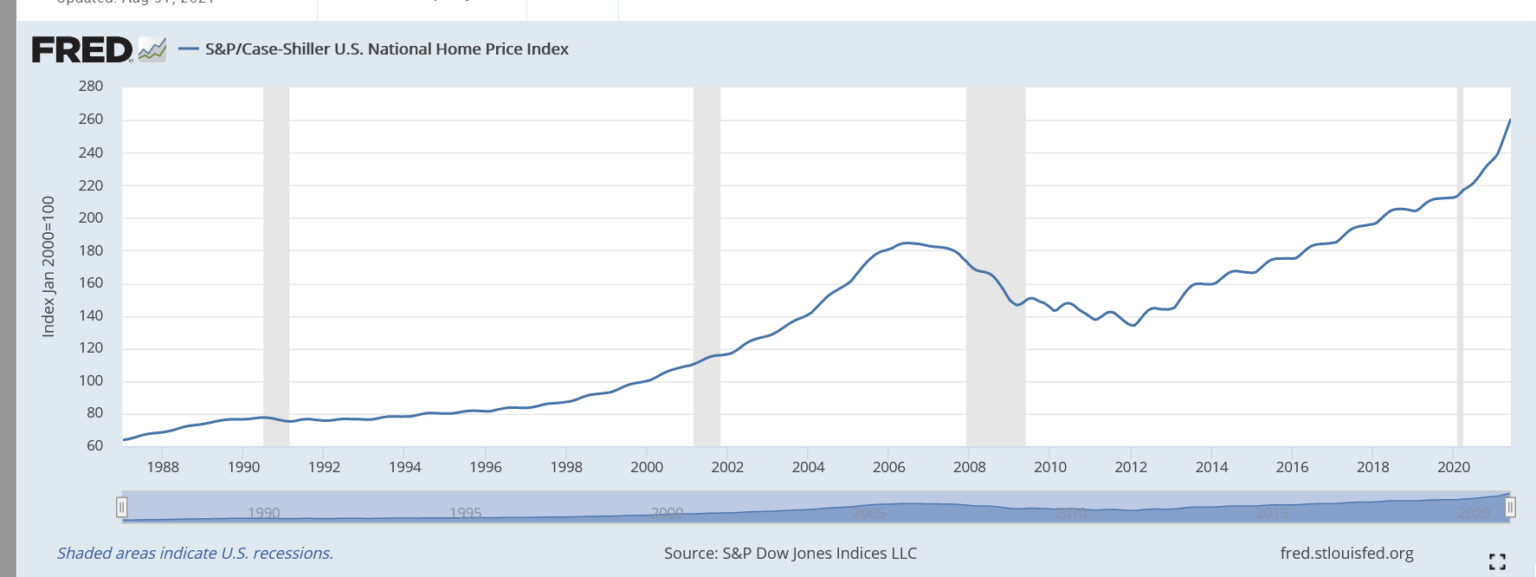

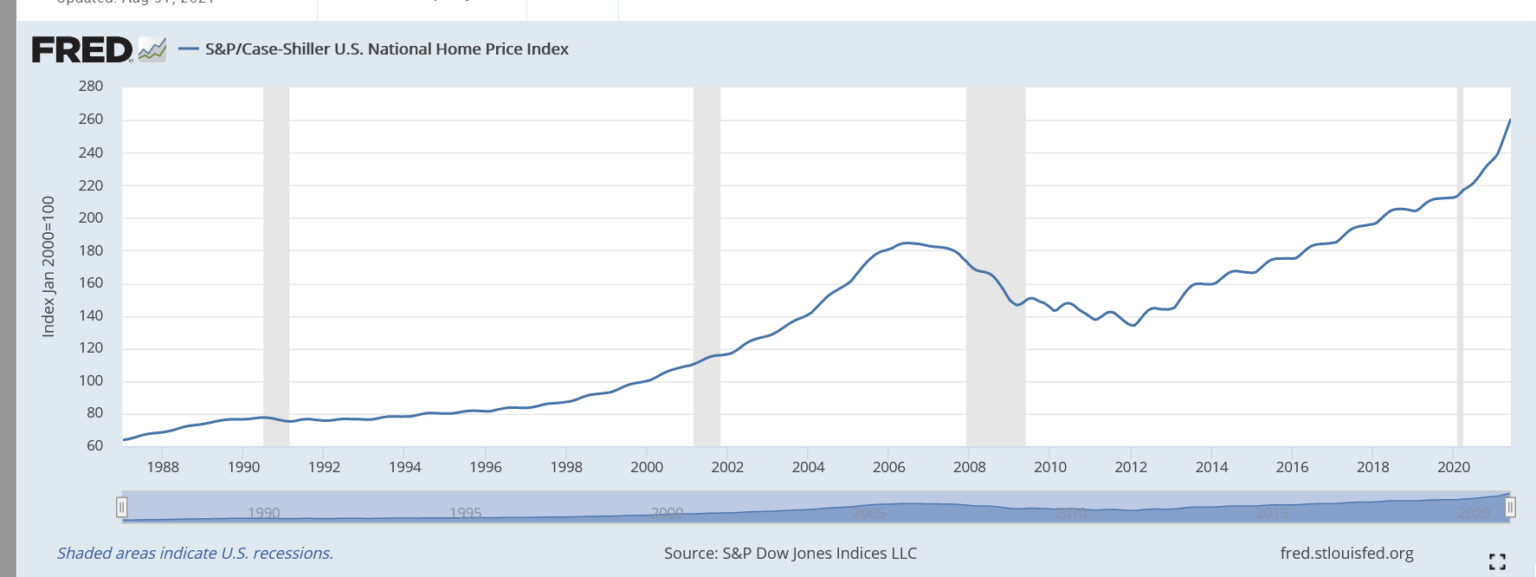

Would-be home buyers priced out of the sales market are finding little consolation when they turn instead to the single-family rental market. Prices are soaring there as well. What is causing the large surge in rents? How is this related to housing prices? Will the...

by Glen | Sep 29, 2021 | Colorado Hard Money, commercial private lending, commercial property trends, General real estate financing information, Georgia hard money, Housing Price Trends / Information, Property Valuation, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation

First I hope everyone is having a good fall. It is crazy how quickly the year has gone by. It has been quite the ride with last week no exception as the stock market plunged. The key culprit that started the stock market saga is the impending blow up of Evergrande,...

by Glen | Sep 21, 2021 | CO hard money, Colorado Hard Money, Colorado ski lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Residential hard money, residential lending valuation

Prices for an array of consumer goods rose less than expected in August in a sign that inflation may be starting to cool, the Labor Department reported Tuesday. The consumer price index increased 5.3% from a year earlier and 0.3% from July. Is inflation really...

by Glen | Sep 14, 2021 | Housing Price Trends / Information, interest rates, mortgage rates

Investor Peter Boockvar, the chief investment officer at Bleakley Advisory Group, is sounding the alarm on a housing price bubble brought on by the Federal Reserve’s Covid pandemic policies which have stimulated so much demand that the supply side can’t keep up. What...