When high end markets fall, what does it mean for you?

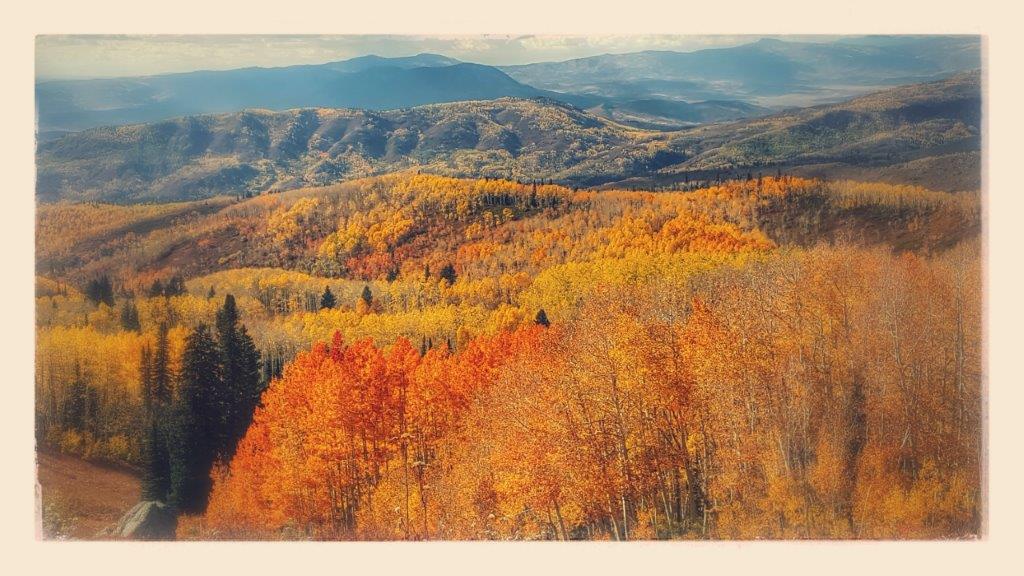

I think most real estate pros would agree that the recent run up in prices in many areas throughout the country is concerning. Are there leading indicators of what could be to come? Aspen is down 42 percent from last year! This isn’t just affecting Aspen, but also ultra-high end markets. The Hamptons are down 48% and Telluride is down 33%. Is the sky falling or just a few leaves? What does this mean? Are we in for another wild real estate cycle? Can this indicate pain to come for the rest of the economy?

As seen in the Colorado Biz Magazine

If we look at the last cycle, we saw that in more expensive markets the real estate pullback started well before the rest of the country. Aspen is the epitome of the ultra-luxury market with an average home price of 7m which is why it is important to take note of the market trends occurring here. The latest market data show Aspen down 42% from last year (see Denver post article). Is this unique to just Aspen?

After seeing the news in Aspen, I looked at other ultra-high end markets such as Telluride and the Hamptons. I found Telluride is down (see article from telluride real estate) the Hamptons are also down considerably (see article) along with Vail and other high end markets throughout the country. When I see this many ultra-high end markets struggling this is likely not just coincidence but an indicator of things to come.

If we study the last cycle, the ultra-wealthy saw the writing on the wall of the imminent downturn before general America and began taking steps to protect themselves months before the rest of general America. With the wealthy pulling back, is this a precursor of the next cycle? Most economists believe there will be some sort of a pullback in 2017 or 18 (see cnn article) regardless of who wins the presidency.

What is causing Aspen, Telluride, the Hamptons and others to decline. Unfortunately, nobody knows the true reason since the purchases in the high end markets are purely discretionary (sorry to say nobody really “needs” a 7 million dollar house with leather on the walls). So in any cycle discretionary purchases are cut first.

Here are 4 factors I see influencing the sharp drop off in sales in these markets:

- Global uncertainty. The list is very long from China to Brexit to possible trade wars and everything in between

- Turbulence in financial markets: exchange rates, etc.. scaring off foreign buyers/investors

- Oil: Substantial wealth in the US was wiped out from the oil collapse that may never come back

- Election: The US election is the most contentious in recent memory regardless of which part of the aisle you sit on the policies of the next president could be a game changer for taxes, trade deals, immigration, etc…

What does this mean for other markets?

Depending on the economic theory you buy into (trickle down or trickle up economics) will influence what the impact to other markets will be. Personally I think that as the ultra-wealthy pull back their spending (or lack thereof) it will ultimately trickle down through the rest of the economy. For example, if buyers are pulling back from the Aspen market, are they also delaying other discretionary purchases (cars, boats, etc…)? The nosedive in Aspen and other high end markets is invariably a precursor of things to come for the general economy. The only question is when this will this “trickle” through the rest of the economy and how badly will it end.

References:

- Telluride is down 33%: Telluride Real estate Corp

- Aspen Real Estate in a first ever nosedive: Denver Post

- Is Aspens six-year surge over? Aspen Times

- The Hamptons are down: Zero Hedge

- Aspen home values decline: Zillow

- Will there be a recession if Hillary or Donald wins?: CNN

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).