The stock market has been pricing in a fast and rapid V-shaped recovery, yet 106 million people and various businesses like United Airlines are painting a radically different picture. As Alan Greenspan, the former fed chief, famously said: markets can exhibit “irrational exuberance”. Unfortunately, this is what is happening today. What does this mean for real estate?

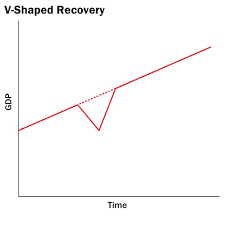

What is a V- shaped recovery?

A V-shaped recovery is just like it sounds where there is a rapid decrease in the economy which we saw from the pandemic shutdowns followed by a swift increase back up. When the virus first hit, many economists thought this could occur, but as lockdowns dragged on, businesses shuttered, and consumer behavior changed the V shaped recovery has become highly unlikely.

What is in the recent data?

A few weeks ago, we got a huge upside surprise regarding the unemployment numbers as they rebounded much quicker than anyone anticipated. Unfortunately the euphoria is short lived as US initial jobless claims are considerably worse than predicted at 1.51 million. Applications for unemployment benefits in the U.S. fell less than forecast last week, showing only gradual improvement from the worst of the pandemic-related layoffs even as states re-open more of their economies.

Initial jobless claims for regular state programs totaled 1.51 million in the week ended June 13, down slightly from an upwardly revised 1.57 million in the prior week, Labor Department figures showed Thursday. The 58,000 weekly drop was the smallest since claims began to retreat in early April. The median estimate in a Bloomberg survey of economists called for 1.29 million initial claims in the latest week.

What are consumers doing?

According to Transunion, one of the big three credit reporting agencies, the number of loans in some sort of forbearance rose to 106 million at the end of May, triple the number at the end of April. The largest increase came in student loans rising from 18 million to 79 million. At the same time, auto loan and personal loan deferments doubled to 7.3m and 1.3m respectively.

The deferments are predicated on a quick rebound in the second half of the year that will enable borrowers time to get back on their feet and get caught up. What happens if this doesn’t occur?

Consumer and business behavior changed quickly

The pandemic caused one of the largest and quickest changes in consumer and business behavior in recent times. Many of these changes will be permanent. For example, think of the office environment. The model was to build large campuses with cubicles, meeting spaces, cafeterias, etc.. to great group synergy. This model many never return in its current form even once the pandemic clears office users will want the flexibility to work from home and more space at the office as opposed to just a cubicle. This will have long lasting impacts on the economy. If people aren’t going into the office, they are likely buying less clothes to wear to the office, they aren’t eating out as much, they aren’t taking uber or other transit as frequently. With less people in the office, businesses will take less space which will lead to higher vacancies, lower rents, and lower returns to whomever owns the real estate.

Another example is business travel. Many companies have realized that they can drastically reduce their travel budgets which will have far reaching impacts on convention centers, hotels, rental cars, etc… As you can see the impacts from this one change in consumer behavior will be profound. United Airlines is already anticipating a seismic shift in demand and predicts they will shrink by around 60% of their current workforce. They are so certain in their need to resize that they are begging employees and paying nice severance packages for them to quit. Take a pilot that gets laid off that was making 100k. What does that pilot now do to make a similar income? How about the flight attendant?

These same changes in behavior are flowing through the entire economy including how we buy items as simple as dog food, or larger items like houses and cars. Each change in behavior is coupled with major disruption in employment. Take the car for example; I bought a new Subaru 100% without stepping into a dealer, I called a dealer 200 miles away, we did the trade over the phone and they delivered the car and drove away with the trade. Under the new model, the salesman can handle hundreds of online customers versus a traditional showroom where they might be able to handle 10 a day if that. The process for car buying has increased efficiency exponentially, but as a result, not as many salespeople are needed and the dealers can work with a smaller footprint as less people are physically coming into the dealers. Each small change in behavior is having seismic ripples throughout the economy.

Lots of pain around the end of the year

Consumer and business behavior has changed rapidly and the economy can’t turn on a dime. It will take years to digest the seismic changes and transition the workforce to the new paradigm. Unfortunately, these changes will not happen quick enough leading to millions of workers who are now unemployed or underemployed.

The forbearances on over 100 million loans is predicated on a swift recovery and a quick increase in employment; this is highly unlikely to materialize to the extent the market is pricing in. Irrational exuberance has taken hold and year end looks to be the reckoning as many of these forbearance agreements run out and the piper has to be paid.

Additional reading/resources:

- https://www.bloomberg.com/news/articles/2020-06-18/u-s-jobless-claims-declined-less-than-forecast-in-latest-week?srnd=premium

- https://www.reuters.com/article/us-health-coronavirus-united-arlns/united-airlines-sweetens-exit-deal-for-flight-attendants-others-idUSKBN23O0IX

We are still Lending as we fund in Cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).