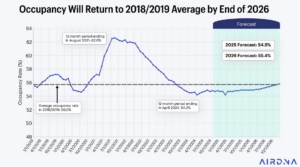

After peaking around 215 dollars, Airbnb stock has taken a tumble of almost 40%. At the same time occupancy of nightly rentals has plummeted from its peak while available listings continue to grow. What does this mean for real estate prices? The two charts below should scare you! Will there be a market correction from the nightly rental hangover?

Airbnb growth slows, what does this mean for real estate prices?

10 years ago, nightly rentals were a novel concept, fast forward to the predictions for 2026 and the number of nightly rentals has doubled. What does this huge increase in nightly rentals mean for real estate values? Has the real estate market gotten ahead of its skis? Airbnb stock price is a warning for the short-term rental sector

Supply vs demand of nightly rentals

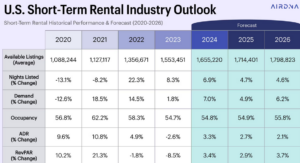

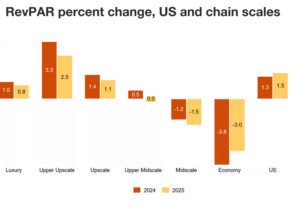

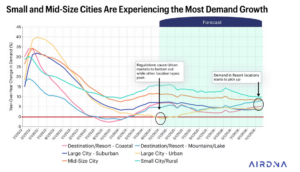

Looking at the two charts below, supply throughout the country has basically doubled over a 6 year period. At the same time occupancy rates are expected to fall back to 2019 levels. This is leading to a decline in revenue per room (RevPar which is the third chart below). Long and short this means that nightly rentals are substantially less profitable than they were a few years ago which is leading to trouble in many markets where owners can barely cover the cost of the property (mortgage, taxes, insurance, maintenance). Although the problems are not widespread, the numbers below point to a bumpy road ahead for nightly rental owners.

Breckenridge/Summit County a cautionary tale

Breckenridge (owned by Vail resorts) Colorado is the heart of Summit County with three major resorts including Keystone and Copper Mountain. I did a quick analysis on Summit County and it shows a huge increase in nightly rentals, up 24% according to recent data. Demand cannot come even close to keeping up with the increase in supply. This is resulting in lower utilization rates that will not be able to offset by increases in nightly rates. Ultimately nightly rentals in Summit County will become increasingly less profitable as nights rented plummets due to increased supply while nightly rental rates in a best-case scenario stay about where they are.

“In the last couple of years, you have seen an over saturation in some markets and one needs to do more research because there is so much variance in the market,” said Paul Kromidas, founder and CEO of Summer, a short-term rental operator based in New York. “People want to commodify these assets; they want to try to fit it into a box. There are opportunities in this market, but it now needs to more thought and you cannot wake up and decide to do it.”

Most short term rentals bought with leverage.

Here is an interesting statistic by Homeaway: “ Fifty-nine percent of subscribers get at least 75 percent of their mortgage covered by the rental stream.” For almost 60% of people that utilize short term rentals 75% of their mortgage is paid for by the rental income. What happens when the party stops? The last recession can give us some clues.

Not only are people renting condos, but primary residences.

The Wall Street Journal wrote an article about how people can buy more house as a result of the additional income from renting rooms in their property. For example, someone might have bought a 250k house, but instead paid 50k more so that they could rent out the additional space for a profit. This seems like a logical assessment from a homebuyer, why wouldn’t a homeowner do this? It is human nature to focus on the positives, as opposed to the negatives. What happens as the market changes and that room is no longer rented out?

Do you really think that property owners saved their earnings!

This is highly unlikely. Look at the graph below from the federal reserve. The average American saves less than 2.5% of their income annually; this includes income from short term rentals. How will the mortgage get paid?

Why this crisis will be worse.

With 60% of owners on HomeAway saying that around 75% of their mortgage is covered by short term rentals, what happens when the short-term rentals slow? Where are the additional funds coming from? With most short-term rentals bought with leverage, the mortgage, taxes, maintenance, HOA fees, etc… continue whether you are renting the unit or not.

Two items could derail the short-term rental market.

First, a pullback in consumer spending coupled with increased supply is the obvious risk. As disposable income decreases and debt service remains high, they will spend less on vacations including lodging. At the same time the supply of nightly rentals continues to increase further amplifying the supply/demand mismatch.

The second risk is regulation. Many cities are banning nightly rentals, substantially restricting them, and/or increasing the taxes. For example, the state of Colorado has proposed taxing nightly rentals throughout the state as commercial properties. This increases the taxes by around 400% and changes the economics of renting. The two risks above could be catastrophic for many short-term rental owners.

The extent of the impending problem is deeper than we think. The explosive growth in nightly rentals has led to an exposure to millions of property owners from a possible recession.

- Best case on Foreclosures: let’s assume 10% are foreclosed on similar to the hospitality industry. There are approximately 2.6 million nightly rentals in the US this would lead to 260k foreclosures, although this is not a big number it could be concentrated in various markets

- Worst case: With a 23% drop in income the impact could be substantially worse. As mentioned above 60% of nightly rental owners get 75% of their mortgage from rentals, if this number drops precipitously the defaults could be drastically worse to the tune of 500k, note that on 2022 foreclosures were averaging about 30k a month so this would be a substantial increase

Ski towns will fare much better than other markets

I’ve said this in the past, the closer in to the core resort the better off you are in the long run. As the nightly rental markets continues to flat line, a property in downtown Breckenridge will do better than one in Silverthorne as there is more demand to be able to ski in/out or walk downtown, etc…

Also note, almost every ski town has implemented supply controls on nightly rentals from prohibiting new licenses, allowing nightly rentals in certain areas, etc.. This will substantially limit further supply growth in certain areas.

Furthermore, ski real estate is essentially built out in every Colorado ski town so at the end of the day inventory is limited as opposed to a city like Atlanta where there is still considerable room for growth. This will limit the downside risks to ski towns as opposed to other markets.

Summary

We are in a new paradigm. Nightly rentals were just coming onto the scene after the last crisis. Now almost 3 million nightly rentals have propagated throughout the country. We know what happened to the hospitality sector after the last recession with 10% going out of business and substantially more restructuring. Furthermore, there was a 23% drop in revenue during the last recession.

Regardless of whether there is a recession or not, we are no doubt on the cusp of a huge change in the economy. Consumers have exhausted their pandemic savings while continuing their spending habits with debt. 2025 will be a reckoning for consumer spending and in turn nightly rentals even in the mountain towns.

Additional Reading/Resources

- https://finance.yahoo.com/news/3-predictions-airbnb-hosts-2025-174106037.html

- https://www.airdna.co/outlook-report

- https://www.pwc.com/us/en/industries/consumer-markets/hospitality-leisure/us-hospitality-directions.html#:~:text=Demand%20growth%20in%202025%20is%20expected%20to,expected%20to%20continue%20to%20impact%20leisure%20travel

- https://coloradohardmoney.com/did-breckenridge-implement-rent-control-did-summit-county-take-property-rights/

- https://coloradohardmoney.com/category/nightly-rental-real-estate/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender