The above is a picture of my windshield after a chance early morning encounter with an elk; I walked away while my car was basically totaled. Why is 2025 the year of the elk as elk should typically be the least of your worries? What does this mean for the upcoming year in real estate? Will a chance encounter radically alter 2025 predictions?

What happened in my accident

Living in the Colorado mountains, wildlife is very common. I was leaving around sunrise and was driving on a highway with a speed limit of 65, knowing there was a ton of wildlife, I had slowed down to around 50 to ensure I had time to react. Well, that morning things didn’t work out as planned, as I rounded a bend there was a group of willow bushes next to the road, before I could react, my Subaru was auto breaking and at that same moment an Elk jumped striking the passenger quarter panel and then rolled onto the hood. I put my hands up as I was immediately covered with glass and saw the rear view mirror fly off the windshield past my head and shortly after the elk came to a rest almost in my lap; it is unbelievable how windshields are created with a film in between two layers of glass, this basically kept me from being impaled.

I pushed the Elk off and looked around, the whole windshield was caved in and there was blood everywhere. Amazingly it was the elk’s blood, and the car was still running! I was around a blind corner so decided to make a quick U turn (with my head out of the window as the windshield was gone). Pretty crazy that I was able to drive the car home and walk away with only some minor scratches from where the elk went through the glass. I was extremely lucky as most are not so fortunate to walk away from an accident like this.

Why is the Elk is indicative the current economy?

You never think that an Elk is going to be the animal that ends your life one day, on a probability scale is much lower than many others like oncoming drivers, losing control on the road, etc… Yet still there is the probability as I can attest to. Currently our economy is like the Elk where more often than not you will never have an issue with an elk. If you look out to 2025, the similarities are striking, the probability of no issues in 2025 is considerably high, but there is the chance encounter that can change everything.

Furthermore, speed ultimately kills in car accidents, the faster you are going the higher the probability of a substantial wreck. The same can be said about the economy. Currently the economy is firing on all cylinders basically starting to go down a hill with only a slight tap of the brakes from the federal reserve.

Efficiency typically drives growth

Why is the economy running beyond all expectations and will it last? The current economy is radically different than other cycles. Typically, an economic cycle is driven by efficiency or breakthroughs that radically change how we do something. Think of what happened after the Internet really became mainstream. The efficiency was overwhelming, you had the ability to now have billions of pieces of data at your fingertips that was very difficult to access before. This was also the beginning of companies like Yahoo, Amazon, etc.. that radically changed how we shopped and digested information. These huge gains in efficiency powered the economy higher. Fast forward to 2025 and the current economy is dramatically different. On a side note, I’m not buying that AI is the same breakthrough just yet as we are 2-5 years away or longer from radical transformation from the technology.

Efficiency is not driving the current economy

The economy heading into 2025 is not powered by huge jumps in efficiency, ironically we are considerably less efficient than we were in 2019. Think of the work from home phenomenon. Initially there was a huge surge in efficiency, these gains quickly reversed as time went on and now the process according to most major studies is considerably less efficient than before. Here is an interesting study that shows the impacts:

“The study found that prior to lockdown, 99% of employees consistently had higher performance, with 71.4% ranking in the top 10. However, after lockdown, the percentage of employees with high performance decreased to 91.8%, with only 63.3% ranking in the top 10. These differences were statistically significant, indicating a decrease in work efficiency of 8.1%. Before lockdown, employees worked longer hours, including on off days, while after lockdown, a small proportion missed work due to various reasons”

In essence companies are paying more for workers and yet they are getting less in return. The reduction in efficiency is up for debate whether it is 10% 20% or 30%, but long and short it doesn’t really matter as companies have to absorb increased worker costs along with less efficiency considerably increasing the cost hits.

If efficiency is not driving this economy, then what is?

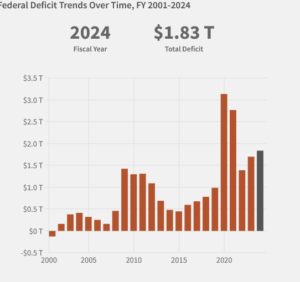

Government stimulus is the main driver of the current economy. Think of the trillions handed to people over the last 4 years from direct government payments, stopping payment on all student loans, rental assistance, lowering of mortgage rates into the 2%, and huge government spending on basically everything. All these items add up to the sugar high we are seeing in the current economy. The current economy is not like prior economies as this one is built on a house of cards that has led to huge increases in deficit spending leading to higher interest rates and stubbornly high inflation. Take a look at this chart to visually see the huge jumps in government spending.

Probability of a collision is elevated

With the economy basically running fast on gasoline from government spending, the probability of a collision increases. The biggest byproduct of the current government spending is interest rates. The continued deficit spending is driving up long term interest rates as the supply of bonds continues to increase leading to price declines and ultimately higher interest rates (remember bond prices and yields work in inverse so the lower price of bonds due to supply ultimately leads to higher interest rates like we are seeing today). In any economy, the higher rates stay for longer, the higher the probability of a collision down the road.

Note, even if the federal reserve cuts short term rates this does not mean that long term rates will react the same way. We saw this in September when the fed cut rates half a percentage and yet long term rates like 10 year treasuries and mortgage rates actually increased.

Elk signifies the chance encounters that can cause big problems

Although almost every economist is forecasting smooth sailing going into 2025, my collision with an elk should serve as a warning for 2025. Probabilities are pointing to a repeat of 2024, but with the economy running on gasoline from government spending as opposed to huge jumps in efficiency, the probability of a collision is likely more enhanced than the models are predicting.

The biggest byproduct of government spending is huge jumps in long-term interest rates. The economy over the last 20 years or so has been predicated on much lower rates which means that something will likely break as a result. The economy will have to adjust to the higher rates, especially in real estate and this adjustment will no doubt cause some heartburn (think of the office sector with values down 60% on some properties). Whether this collision happens in 2025 or beyond, eventually there will be a reckoning. Although we are unlikely to see an economic catastrophe in 2025, the odds of a collision have risen substantially due to deficit spending and higher rates and should not be easily dismissed. Heed my collision with the Elk as a warning as you’ll want to keep your eyes on the road in 2025 both literally and figuratively.

Additional Reading/Resources:

- https://bmcpublichealth.biomedcentral.com/articles/10.1186/s12889-023-15886-3

- https://www.fairviewlending.com/fed-cuts-rates-why-are-mortgage-rates-rising/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender