The chief economist of the National Association of Realtors, Lawrence Yun, has released his 2025 and 2026 predictions for residential real estate and they were a huge surprise. What is Yun predicting for real estate prices, interest rates, and appreciation? How accurate are these predictions?

First take all these predictions with a grain of salt

Before getting into the NAR’s predictions, it is important to take their predictions with a huge grain of salt. Last year’s predictions for 2024 were for a swift recovery and yet the opposite occurred. 2024 has been one of the toughest years in real estate history with volumes dropping to 2025 levels.

What is the NAR forecast for sales volumes and prices?

The worst of the housing inventory shortage is coming to an end, mortgage rates are stabilizing and job additions are continuing, according to NAR Chief Economist Lawrence Yun. “Maybe the worst is coming to an end,” added Yun.

“Directionally, I think there’s going to be roughly a 10% boost of existing-home sales in 2025 and 2026.” Yun projects new home sales to be 11% higher in 2025 and 8% higher in 2026. Yun forecasts the median home price to be 2% higher in both 2025 and 2026.

What is the NAR predicting for mortgage rates?

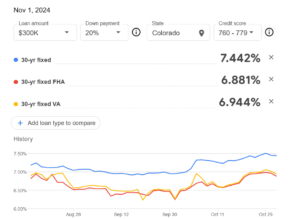

Yun addressed mortgage rates during a second Donald Trump presidency, saying, “Mortgage rates in his first term (at 4%) were the good old days. Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%. That will be the new normal, bouncing around 5.5%-6.5%.”

How accurate are the NAR forecasts for mortgage rates?

I think his rate forecast is a little optimistic, I think rates will be closer to 6.5-7.5% over the next several years. As of this writing rates were north of 7% for a conventional 30year fixed rate.

Most believe that when the federal reserve cuts rates that all rates fall. This is completely wrong. Longer term rates are pegged to the 10 year treasury which the federal reserve can influence but not control. The 10year treasury yields are determined by market forces including supply, demand, anticipation of the economy in the future, etc… This means that rates like mortgages are not under the fed control, the market determines what these rates should be.

Based on the markets reaction with 10 year treasury yields when Trump was elected it shows that inflation is by no means dead and neither are deficits. The market is showing that they fear that inflation will stay higher than the market is anticipating and government spending will continue to increase leading to higher rates for much longer periods.

Long and short, the chart above on 10year treasury yields is telling and I’m not buying the predictions of interest rates dropping into the 5% range next year based on the current market reactions and the trend of the chart above.

Will housing prices decline as opposed to the predicted NAR increases?

I’ve read hundreds of articles all professing that this cycle is different and that prices will continue rising as there is still a shortage of housing. Regardless of all the theories, eventually gravity and basic economics prevail. As supply increases and demand stays flat/declines, the only outcome is declining prices.

We are seeing this scenario play out today. Even with interest rates dropping and supply increasing, the number of closed sales is also decreasing which means eventually prices will come down. If we look at the Colorado data, we can already see how this transitions through the market, huge jumps in the supply of condos have led to a drop of 13% in the median sale price.

What happens to sales volumes in 25 and 26?

Sales volumes is where I strongly disagree with the NAR predictions. With rates remaining high and costs of home ownership like property insurance, property taxes, etc… soaring I’m not buying that sales volumes will accelerate in 2025. Based on what is currently happening in the real estate market, the market is basically stuck until either rates drop substantially due to a recession or other event or unemployment picks up substantially to force movement in the market.

Summary

The recent predictions out of the National Association of Realtors was more marketing and hype than anything else. The predictions show the huge optimism they are trying to convey to the market.

Unfortunately, the market is not buying the NAR predictions as interest rates remain high due to inflation and government deficit expectations which will greatly temper sales volumes next year. Furthermore we are seeing in many hot markets that inventory is starting to increase which will ultimately lead to price declines as we are already seeing on condos in places like Denver, CO and various Florida markets.

Furthermore, 2025 looks to be very similar to 2024 with very low sales volumes due to high interest rates and the lock in effect of lower interest rates.

Additional Reading/Resources:

- https://www.nar.realtor/newsroom/nar-chief-economist-lawrence-yun-forecasts-9-percent-increase-in-home-sales-for-2025-and-13-percent-for-2026

- https://www.fairviewlending.com/does-the-trump-election-matter-for-real-estate-homes-sales-lowest-since-95/

- https://www.fairviewlending.com/huge-increases-in-inventory-what-does-this-mean-for-prices/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender