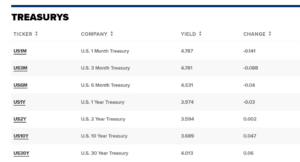

The market was anticipating a much smaller cut by the federal reserve as inflation is still high and employment and spending is holding up. The odds were about 75% for a smaller cut, but the federal reserve definitely surprised with a much larger cut of half a percentage point. As of this writing short-term rates fell while longer term rates like mortgages rose (check out the chart above). Is this big cut really good news? How can mortgage rates rise even though the fed just cut rates?

The federal reserve surprises with a huge cut

Like everyone else, I was floored by the huge cut. The market was anticipating a quarter point cut and yet the federal reserve surprised with a huge half a percentage point cut. The premise of the large cut is that there is a belief that inflation is coming down and employment is now the new priority. This new focus on employment is what led to the larger rate cut.

Mortgage rates rise even with a huge cut by Federal Reserve

Most believe that when the federal reserve cuts rates that all rates fall. This is completely wrong. Longer term rates are pegged to the 10 year treasury which the federal reserve can influence but not control. The 10year treasury yields are determined by market forces including supply, demand, anticipation of the economy in the future, etc… This means that rates like mortgages are not under the fed control, the market determines what these rates should be.

As soon as the news broke short term rates fell based on the new federal funds rate which is what I would expect. Longer term rates ironically rose which is not what I would have expected. I would have anticipated longer term rates falling or holding steady.

Why are longer term yields rising along with mortgage rates?

It is crazy, when the news was first announced at noon, long term rates initially fell and then they increased. The chart above is astounding as to how quickly rates reversed. This is not what I would anticipate. The stock market initially increased and then fell a little which shows uncertainty about the future. I would have anticipated 10 year treasury yields falling as opposed to rising which shows that the market is interpreting either a better economy or much higher longer term inflation.

What does this mean for mortgage rates and in turn real estate the remainder of the year?

Based on how the market is reacting now, I would expect mortgage rates to trade in a narrow band of about half a percentage from where they are now. I don’t expect a huge drop in mortgage rates the remainder of this year unless there is an economic shock which will keep housing expensive.

Based on the federal reserve’s interest in employment, I don’t anticipate a huge jump in unemployment just yet, which should lead house prices to be roughly 5% or so higher or lower than they are today.

Inflation is not dead

Based on the markets reaction with 10 year treasury yields, inflation is by no means dead. The market is showing that they fear that inflation will stay higher than the market is anticipating and/or government spending will continue to increase leading to higher rates for much longer periods.

Is the market correct in their interpretation of this rate cut?

Ironically the market initially rejoiced the larger cut, but I’m a bit more cautious. There are a couple scenarios as to why they cut more now.

- Larger cut now so not close to election: Part of the reasoning behind the cut is to ensure that the fed doesn’t get drawn into the election politics, so the theory is to go ahead and cut now to give them room, so they don’t have to make a larger cut in October or November

- Larger cut now as something else bad is lurking soon: The other theory is that the larger cut is because the fed is much more concerned on employment and wants to provide much great support to the economy.

Regardless of which theory you want to agree on or if you have your own, a large cut upfront is an indication that the federal reserve is much more concerned about employment and in turn a possible recession.

What is my data as a lender telling me?

As a private lender servicing loans and originating loans I have a unique perspective on the economy. I would agree with the half a percent cut. My take is that the economy is worse than what the headline numbers are telling us. In my recent call logs, I have seen a large jump in inquiries and considerably more underlying distress in the market. Furthermore, banks and other lenders have pulled back considerably more on their lending which in turn is leading to liquidity issues for many borrowers. Also, if you look at metrics like credit card delinquencies, they are surging to well above pre pandemic numbers showing further distress with the consumer.

Summary

By the federal reserve front loading a half a percentage point cut, it makes you wonder what is lurking. Fortunately with this cut, I think the federal reserve is going to kick the can down the road of a recession until 2025, but that is where the economy gets very interesting.

The federal government has pumped so much money into the economy over the last four years that eventually the music will stop. My baseline prediction is for a recession in 2025 as the economy runs out of steam and employment declines.

Even with large cuts the federal reserve will not be able to engineer a soft landing. As we can see in the 10-year treasury the federal reserve is no longer at the steering wheel. Even with a half a point drop in the federal funds rates, mortgage rates are increasing due to higher anticipated inflation and/or higher government spending. The 10-year treasury reaction is indicative of what the economy thinks and the federal reserve is no longer calling the shots. The market will make the fed’s job next to impossible to engineer a soft landing.

Additional Reading/Resources:

- https://www.wsj.com/economy/central-banking/fed-cuts-rates-by-half-percentage-point-03566d82

- https://www.cnbc.com/quotes/US10Y

- https://www.bloomberg.com/news/live-blog/2024-09-18/fomc-rate-decision-and-fed-chair-news-conference?srnd=homepage-americas

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender