Consumer spending in the world’s largest economy has been so resilient in the face of stubbornly high inflation that economists and traders have had to repeatedly rip up their forecasts for slowing growth and interest-rate cuts. Is Phantom Debt driving consumer spending? What is Phantom Debt and what does this mean for real estate, the economy, and interest rates?

What is Buy now Pay Later?

Buy now Pay later is the leader in “Phantom debt”. Millions of shoppers now use a buy now, pay later, or BNPL, service to finance their purchases. BNPL plans, also known as point-of-sale loans, let shoppers pay for their items over a period of instalments.

The concept isn’t new. Installment plans have been around for years, known as “layaway” in the U.S. These agreements let people spread the cost of items over a certain amount of time. BNPL is similar in that consumers get the product upfront and pay for it in incremental amounts, often interest-free.

Buyers can opt to use a BNPL service when checking out online with just a few clicks. They typically pay the first instalment then and get invoiced the remaining sum during a period of three to four months.

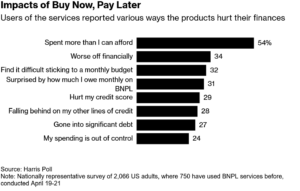

One of the main criticisms of BNPL is that it could encourage shoppers to spend more than they can afford. Pay-later plans are particularly popular with millennial and Gen Z shoppers. Which?, a consumer advocacy group in the U.K., says it conducted an investigation which found that almost a quarter of BNPL users spent more than they initially intended to because the service was available. Furthermore, we are seeing this in the data from the recent Harris Poll (above).

Why is Buy Now Pay Later not included on credit scores?

A few years ago supposedly BNPL loans were supposed to be reported to the credit bureaus but this has not happened, here is a brief synopsis: The credit bureaus argue that incorporating pay-later loans into the reporting system would benefit consumers, who could build credit by repaying the loans on time, and lenders, who would gain fuller insight into consumers’ borrowing.

The pay-later providers agree — in theory. But they worry that reporting the loans would end up hurting their customers. Existing scoring models penalize borrowers who take out many loans in a short period. That could be a problem for the pay-later industry because, unlike credit card purchases, each pay-later transaction is treated as a loan.

So long and short the BNPL industry has blocked their data from flowing to the credit bureaus and there is no law requiring them to share that is being enforced. This is intentional as they do not want to impact their clients credit scores and actually show the true financial distress of their borrowers.

Note, although BNPL loans are not included in credit scores per se, when a BNPL hits default and goes to collections that information is picked up by the credit bureaus and will ultimately have a huge impact on the credit score.

Buy Now Pay later hiding consumer distress

The Harris Poll survey (pic above), conducted last month, provides some crucial clues about how Americans use BNPL. For one, splitting payments into smaller chunks encourages more spending.

More than half of respondents who use BNPL said it allowed them to purchase more than they could afford, while nearly a quarter agreed with the statement that their BNPL spending was “out of control.” Harris also found that 23% of users said they couldn’t afford the majority of what they bought without splitting payments, while more than a third turned to the services after maxing out credit cards.

“BNPL essentially lets people dig a deeper and deeper hole of credit, which will be harder and harder to climb out of,” said Ed deHaan, a professor of accounting at Stanford Graduate School of Business, adding that it happens “more easily when there’s no transparency.”

How is this black hole of buy now pay later impacting real estate?

If you look at conventional lending, the basis of a conventional loan from a bank or other lender is credit score along with debt-to-income ratio. There is a huge blind spot of buy now pay later loans. These loans are payments that should impact a borrowers debt to income ratio, but they aren’t included and there is no way for lenders to even know about these loans under the current system.

The BNPL loans are inflating credit scores along with lowering debt to income ratios which means that lenders are making riskier loans that they do not even know about. Furthermore, this risk is migrating through the economy from auto loans to rental agreements, etc.. that rely on credit scores to gauge repayment ability.

Note, for my business, we are a hard money/private real estate lender and we focus on the value of the investment property so credit score is not the key determinant of our lending as opposed to loan to value.

How big of an issue are Buy Now Pay later loans?

Buy Now Pay Later lending is expected to reach almost $700 billion globally by 2028. The industry is masking a complete picture of the financial health of American households which is crucial to see where the economy is heading.

Phantom debt leads to a much more severe recession

Without insight into the black hole of phantom buy now pay later debt, we are skating on thin ice. Lenders are making decisions based on an assumption of consumer health that could be radically different than reality which means when there is economic distress the performance of the loan will be impacted. For example lenders price loans of borrowers with 600 credit scores lower than ones with 700 credit scores due to the higher likelihood of default. But what if the 700 score is really a 650, this means that the defaults will be much greater than the market is pricing in which will lead to much higher losses.

Summary

The huge jumps in buy now pay later are concerning for the economy as it is a black hole with limited insight. Lenders today are making assumptions about the health of the consumer that are likely considerably inflated. This will ultimately lead to bad outcomes as the number one determinant of what happens in a downturn is leverage. The higher the leverage the more opportunity for a contagion effect that will lead to a bigger downturn. The market is currently underpricing the risk of 700 billion dollars in unreported loans.

The crazy part is that the BNPL product was in its infancy in the last recession so the impacts could be much bigger than anticipated, but regardless I’m willing to bet 700 billion dollars that when the next cycle hits, we will have a much larger problem as a result of BNPL loans.

Additional Reading/Resources

- https://www.bloomberg.com/news/articles/2024-05-07/-buy-now-pay-later-has-americans-racking-up-phantom-debt?srnd=homepage-americas

- https://www.nytimes.com/2024/04/23/business/economy/buy-now-pay-later-credit.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender