US labor productivity tumbled by 7.5% in the first quarter of 2023 – the largest decline in worker output per hour since 1947, according to Labor Department data released Thursday. What does declining productivity mean for interest rates, commercial and residential real estate prices, and ultimately the economy? Is this decline a blip or a longer-term trend?

What was in the data on Productivity?

The labor department report in May showed that unit labor costs, or how much workers are paid per unit of output, surged by 11.6% during the quarter. That reflects a 3.2% increase in hourly compensation and a 7.5% decrease in productivity.

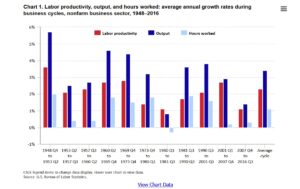

Quarterly productivity figures are volatile, but the weak second-quarter number follows a 7.4% pullback in the first quarter, the sharpest drop in 74 years. It appears that the decline in productivity is not a blip and is starting to solidify in the recent data.

Why focus on productivity

Rising productivity is the key to improving living standards; it allows companies to raise wages without raising prices and fueling inflation. Instead, businesses appear to be paying workers more to produce less. The higher unit labor costs suggest companies will either endure lower profits or pass on higher costs to consumers. In essence, declining productivity is contributing to the increase in inflation and in turn reduction in purchasing power.

No mystery why labor productivity has fallen substantially.

It is puzzling why the markets seem so surprised by declining productivity. The writing has been on the wall for a while. When the pandemic first hit, everyone touted the rising productivity of workers due to more “efficient” work. The productivity gains quickly changed to productivity losses.

I think of a business like a soccer team (or any sports team). During Covid everyone was training by themselves so on the surface each individual was making progress aka being more productive. Unfortunately this does not translate into the team being more successful. You could have the fastest runners on the field, but if they do not have the synergy to coordinate plays with each other it does not matter and the team will ultimately lose aka being less productive in scoring, defense, etc..

The above example is indicative of what is happening in the economy today. With most still working remotely, coordination amongst employees is lost. There is no synergy, and the company is not operating to their potential. This in turn is showing up in declining productivity rates along which in turn is being passed through the economy in terms of higher prices.

What does a decline in productivity mean for inflation and interest rates?

Declining productivity means that each hour of output is costing more. From a manufacturing perspective it could mean that the parts produced/hour are reduced. From an office worker, it could mean that it takes x hours longer to produce the same sales report as last year. However, it is measured in a particular business the outcome is the same. Lower productivity coupled with higher wages leads to higher prices on everything involving labor.

These higher prices are flowing through the economy in the form of higher airline tickets, elevated car prices, more expensive dinners out, etc… All these higher prices ultimately are adding to inflationary pressures.

As inflation continues to run hot, the federal reserve will be forced to continue raising interest rates to cool the economy. These higher interest rates will flow through to higher mortgage rates

How will a decline in productivity impact real estate?

Residential: So far, the higher interest rates have not led to a huge reduction in values. For now, the higher rates will continue to slow down volume as it is too expensive for people to give up their low interest rate for a much higher rate. I do not foresee a huge change in values until unemployment kicks up substantially forcing more inventory to come online.

Commercial: As rates continue to stay high and likely head higher, commercial property will continue to have substantial problems with value. As interest rates rise, cap rates will be forced to rise leading to substantially lower values. Commercial is much more rate sensitive as most loans reset in 3-5 years and will be coming up on a reset at substantially higher rates.

What does lower productivity mean for the overall economy?

Declining productivity is going to keep the labor market tight as more people are needed for the same economic output. This will keep up pressure on wages and severely complicate the federal reserve’s job of taming inflation.

Look for rates to stay high and likely continue to rise a bit more. The market has been pricing in federal reserve cuts for later this year which seems unlikely as the opposite will likely occur. As rates go higher, the probably of a hard landing will increase.

Higher rates will lead to considerable losses in commercial real estate while at the same time treasuries will decline in value. This will lead to more bank failures and ultimately more market distress.

Summary

Lower worker productivity should not be a surprise to anyone. As with any sport, business is not an individual event and higher individual productivity does not translate into a greater benefit for the organization as we are now seeing. It does not appear that productivity will improve anytime soon without a substantial reset in the labor market.

The lower productivity further complicates the job of the federal reserve and will ultimately lead to higher rates for considerably longer than the market is anticipating. Commercial real estate and ultimately mid size regional banks will feel the brunt of the losses. Fortunately, residential does not look like it is set for a huge reset until the labor market resets which will likely not occur until very late this year or early 2024.

Additional Reading/Resources

- https://www.cnn.com/2022/05/05/economy/us-productivity-first-quarter-2022/index.html

- https://www.wsj.com/articles/u-s-productivity-falls-for-second-straight-quarter-11660049393

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, wages