There is pretty much a universal theme that there will be a recession in the future. It is like saying that it might rain sometime in the next month. It doesn’t help you much without knowing approximately when it will rain and if it will be a light sprinkle or turn into a snow squall. To be actionable, we need to know at least a smaller window of when there will be a recession and how bad it will be. Fortunately, I have some answers and historical context that will guide our views on the impact to real estate prices.

Will there be a recession?

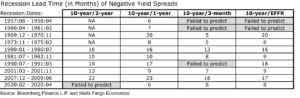

It is important to address the number one question. Yes, there will be a recession. Since 1955 every single time the yield curve inverted (yields on shorter dated bonds are higher than longer dated bonds) there has been a recession. When the recession hits could range from 6 month to 24 months so a recession is not imminent. Bloomberg just released a new model showing a 100% probably of recession in the next year.

Has the yield curve inverted in this cycle & why is this important

Yes, the 1st yield curve inversion of 2 year/10 year treasury was March of 2022. Well’s Fargo did an interesting analysis where they showed the lead time of the first yield curve inversion for each of the inversions to when a recession hit. Based on this information we can work backwards.

When will this recession occur?

As of this writing, we were at approximately 9 months since the first yield curve inversion. Furthermore, consumer spending continues to run strong along with the labor market and wage gains. Even with the substantial federal reserve tightening the economy seems to be holding up strong.

Based on the recent data, I think it is highly unlikely we will see a recession in the first quarter of next year which would put us out a min of around 14 months since the first yield curve inversion earlier this year. Also note that the Federal reserve tightening is not immediate, it typically lags 3-6 months. I think the likely scenario is around the beginning of Q3 around the July time frame. Which would mean we are around 16-17 months since the first inversion. Which gives us two options for recession depth.

How deep will this recession be?

Based on this information we have the most likely two scenarios are a 1980 recession or a 1990 recession. Each recession was radically different:

- 1980 recession: This was a very deep recession with unemployment hitting 11%. It was a Federal Reserve caused inflation. The Federal reserve was forced to continue raising rats due to the runaway inflation of the 70s. The 10 year treasury increased to about 15%, currently it is about 4% today.

- 1990 recession: This was a relatively mild recession. It was caused by an oil shock which hurt consumer and business confidence. Even though it was mild it ended in a jobless rate of almost 8%. Currently we are sitting around 3% so this would be a significant jump from where we were today.

I don’t see some of the warning signs we saw in the 1980 recession as the economy and consumers are in much better shape. A 1990 style recession seems allot more probable based on the most recent data. I’d put the odds at around 60% mild recession and 40% an 80s style recession.

What does a 90’s style recession mean for real estate?

Unemployment will likely almost triple from where it is today which will lead to a slowdown of the economy. This is the federal reserve’s intent to slow wage growth and inflation. Even though it will be mild compared to the 08 recession it will still be painful for many.

If the current recession is similar to the 90’s recession, then real estate should fall around 15%. Based on the information we have today this seems like a realistic/probable outcome. As the fed raises rates the affordability of houses will continue to decline which will ultimately lead to drops. We are already seeing this in expensive markets like Denver where prices have already dropped off their highs.

Summary

Mid-year of 2023 looks to be the most probable time for a recession which would indicate a 90’s style recession with unemployment increasing substantially and real estate correcting around 15%. It is ironic that good news is bad news. Although nobody wants a recession, the longer we go without one, the higher the probability of a much harder landing. Although I don’t foresee a 2008 style recession, the 80 recession is still a probability that we need to be aware of if the federal reserve is unable to quickly contain inflation.

Additional Reading/Resources

- https://www.frbsf.org/economic-research/publications/economic-letter/2018/march/economic-forecasts-with-yield-curve/

- https://files.stlouisfed.org/files/htdocs/publications/review/03/09/Kliesen.pdf

- https://www.bloomberg.com/news/articles/2022-10-14/fed-s-george-warns-of-risks-of-moving-too-fast-on-rate-hikes?srnd=premium

- https://www.federalreservehistory.org/essays/recession-of-1981-82

- https://www.forbes.com/sites/simonmoore/2022/08/15/yield-curve-inversion-deepens-and-lengthens-upping-recession-chances/?sh=1b814a277afd

- https://www.bloomberg.com/news/articles/2022-10-17/forecast-for-us-recession-within-year-hits-100-in-blow-to-biden?srnd=premium

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender