The Federal Reserve just raised interest rates .5% as expected. The market originally rallied and then plummeted 5% the next day. The fed made a colossal error and the stock and bond markets are not buying their guidance. What did the fed say at the meeting that changed the inflation dynamics? What does this mean for interest rates and in turn real estate?

The Federal reserve is underestimating future inflation: Three reasons inflation will continue

The federal reserve is making the same mistakes as a year ago when they stated that inflation would be transitory and would come down on its own once supply chains were fixed. We all know how this story goes, inflation did just the opposite and has been steadily increasing over the last year.

In yesterdays federal reserve meeting, Powell implied that we are near a peak in inflation and that half a point rate increases would suffice for now. The stock market had been pricing in .75% increase in June and Powell threw cold water on that premise when he announced a “slow and steady” increase. Unfortunately like the transitory call, the federal reserve is once again substantially behind the curve. The market is not buying the federal reserve predictions as bond yields spiked and the stock market plummeted which implies that inflation will run considerably hotter than the fed acknowledges and for longer. Three reasons why inflation will continue upward for longer than anticipated:

- Labor prices: Labor prices have shot up along with inflation. Price alone is not the biggest issue, but when they are coupled with declining productivity the byproduct is more inflationary pressures.

- Nonfarm productivity, a measure of output against hours worked, declined 7.5% from January through March, the biggest fall since the third quarter of 1947. Hourly compensation rose 3.2% in the period, but with the drop in productivity, unit labor costs climbed at a 11.6% rate in the first quarter. While the quarterly gain in hourly compensation adjusted for productivity likely overstates the degree of wage pressures, the 7.2% annual gain in labor costs was the largest since 1982.

- Wages are factored into everything from services to goods as wages go up so do prices on basically everything.

- House prices: House prices appreciated nationwide over 20% last year. There is always a lag of between 12-18 months for prices to be factored into rent. For example let’s say someone bought a rental house for 500k (previously sold for 300k two years ago). The purchaser will have to increase rents to justify the increased housing price along with higher mortgage payments, taxes, maintenance, etc…

- Remember rent comprises 40% of the Consumer price index. With house prices increasing by double digits, rent will continue higher for the next year or two which will ensure inflation continues to run above the federal reserve target. For example Denver’s rents have increased 14%+ over the last year. How does anyone expect inflation to average 2% when rents that compose 40% of the index are rising 700% greater than the target.

- Supply issues: with China shutting down factories to ensure a zero covid policy, supply chains are once again undergoing substantial stress. With supply chains remaining snarled and demand continuing, even at lower levels for goods as consumers switch more spending to services, prices will remain high. This will continue to increase upward pressure on inflation.

Rates will have to rise considerably faster than is priced in today

Now that inflation has become entrenched in everything from supply chains to housing to labor costs achieving a 2% target inflation rate will be increasingly difficult as inflation is currently running 300% above this metric. The only way to get inflation under control will be to substantially slow cost increases in the labor market, reduce housing costs, and reduce demand for goods and services.

The only way to achieve these goals is for the Federal Reserve to raise rates high enough to slow down each of these items. The longer Powell waits to “shock” the market, the more inflation becomes entrenched, and the higher rates will have to rise.

Odds of a hard landing have increased

Every day that inflation continues, the odds for a soft landing become more elusive. It is almost certain now that the only way to slow inflation will be to push up unemployment rates to slow wage gains, while at the same time slowing demand for housing and goods/services. The federal reserve continues to be late to the party and out of touch with basic economics. This has led to the untenable no-win situation we are in where the only answer is a recession.

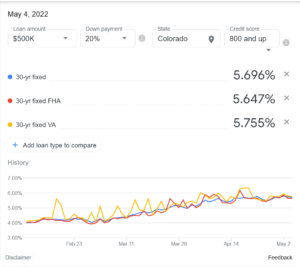

6% rates coming into view

When I was writing this, 30-year fixed rates were around 5.7%. As the federal reserve allows its purchases of mortgages to run off and continues to raise rates to battle inflation, 6% rates are in sight by the end of the year. A rate of 6% will more than double mortgage payments from the pandemic low. This is on top of prices that have appreciated throughout the country of 30%+ in almost every market since the pandemic.

Will there be a real estate bubble?

The Federal Reserve seems to think that a “bubble” could be brewing in the recent report from the Dallas Fed: Real-Time Market Monitoring Finds Signs of Brewing U.S. Housing Bubble

“Our evidence points to abnormal U.S. housing market behavior for the first time since the boom of the early 2000s. Reasons for concern are clear in certain economic indicators—the price-to-rent ratio, in particular, and the price-to-income ratio—which show signs that 2021 house prices appear increasingly out of step with fundamentals.”

The US real estate market is in dangerous territory as prices continue to rise even in the face of increasing interest rates and decreasing affordability. The longer the market defies “gravity” the harder the fall will be when there is a market correction.

Although I don’t think there is a substantial bubble in real estate now, the odds continue to increase the more prices rise above historical metrics.

Summary

The Federal Reserve made a colossal mistake last week by alluding to the fact that they can tame inflation by “slow and steady” rate increases. I didn’t buy this statement and neither did the stock or bond markets. The federal reserve needs to wake up and smell the coffee. As wages continue to increase, housing continues to appreciate which leads to rising rents in the future, and supply chain woes persist the federal reserve will have to be much more aggressive in future rate hikes. Even if you ignore wages and supply chain woes, with the housing equivalent comprising 40% of the consumer price index inflation is set to continue and possibly even accelerate.

With inflation rising much faster than the federal reserve expects, the only option left will be to raise interest rates high enough to slow down wage growth and demand. This will inevitably push the US into a recession. At this point, I hope it comes sooner rather than later as the longer we wait, the harder and more substantial the fall.

Additional Reading/Resources:

- https://www.cnbc.com/2022/05/05/labor-productivity-fell-7point5percent-in-the-first-quarter-the-fastest-rate-since-1947.html

- https://www.cnbc.com/2022/05/05/bank-of-england-hikes-interest-rates-in-bid-to-fight-soaring-inflation.html

- https://www.bloomberg.com/news/articles/2022-05-05/u-s-productivity-drops-on-weaker-output-while-labor-costs-jump?srnd=premium

- https://www.reuters.com/business/bank-england-hikes-rates-clamour-contain-spiralling-inflation-2022-02-03/

- https://www.bloomberg.com/news/articles/2022-05-05/falling-jobless-rate-is-set-to-complicate-fed-s-inflation-fight?srnd=premium

- https://www.dallasfed.org/research/economics/2022/0329

- https://www.globest.com/2021/09/10/rent-plays-a-key-role-in-cpi-inflation-measurement/?slreturn=20220405141720

- https://www.washingtonpost.com/business/2022/02/10/rent-rising-inflation-housing/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender