Wall Street investors believe inflation will remain a major roadblock for the markets in 2022 and stocks will only see muted returns, according to the new CNBC Delivering Alpha investor survey. What does this mean for interest rates and in turn real estate?

What was in the CNBC data regarding the biggest “worries” in 2022?

CNBC polled about 400 chief investment officers, equity strategists, portfolio managers and CNBC contributors who manage money about where they stood on the markets for the rest of 2021 and next year. The survey was conducted this week.

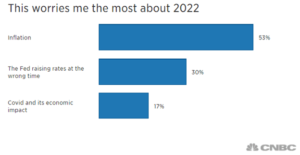

More than half of the respondents said inflation worries them the most about 2022. Thirty percent said the Federal Reserve raising rates at the wrong time is a top concern for them next year, while 17% said the pandemic and its economic impact is the biggest worry.

Why is this survey so important for 2022 predictions?

I was floored that 83% of respondents think the biggest issue in 2022 is going to be inflation and the effects of inflation. This lends a high degree of certainty that inflation will continue to be an issue going into 2022.

Market strategists are stating with their answers to the survey that there is an 83% probability that inflation will continue and in turn interest rates will need to increase. 30% think that that the federal reserve will respond by raising rates too quickly.

The Treasury market underpricing the risk in 2022

It is fascinating that key market participants/money managers are indicating that inflation is the biggest risk, and yet 10-year treasuries are barely budging which would indicate that inflation will not be an issue going forward.

The survey participants are not buying the trends in treasuries as 30% are stating that the federal reserve will respond by raising rates too quickly. This highlights that the treasury market, for whatever reason, is underpricing future increases.

Rates will increase; 30% think there will be a bad surprise

As the treasury market is underpricing future inflation this means that there is an 83% chance that rates will rise substantially. What does this mean? The federal reserve is likely to do 3 or 4 rate rises which would put mortgage rates around 4.25% to 4.5%. Furthermore 30% of respondents think that rates will rise even more sharply which would put the economy into a tailspin.

Increased rates will slow real estate

As rates rise, real estate payments become considerably more expensive. The rise in interest rates is far outpacing increases in wages. This will lead to reduced buying power. For example a borrower with a 3% rate could afford a 400k house, but as the rate rises to 4.5%, the same borrower can now only afford a house worth 325k. A large increase in rates as is predicted as the base scenario will drastically slow real estate purchases and essentially end any refinance activity.

Summary

83% of a select group of very wealthy and smart people that were polled by CNBC name inflation and the effects of inflation as the top concern for 2022. With such a high percentage worried about inflation, this will become a self fulfilling prophecy which we are already seeing in the economy. For example workers are feeling the impacts of inflation and therefore demanding higher wages in order to absorb the increased costs. The increased labor wages are then baked into costs and prices rise even further to compensate for the higher labor expenses. This is a very bad cycle that is emerging that the federal reserve will address through higher interest rates.

Higher interest rates will filter through the economy and ultimately cause a slow down in demand for items from cars to houses. The tricky part of the equation is if the federal reserve can balance the need to slow the economy without putting the brakes on too hard. Unfortunately 30% of respondents strongly agree that they will be unable to accomplish this with another 50% not fully convinced of the feds path as inflation continues.

Long and short, interest rates are going up which will slow real estate sales. If rates rise even higher than anticipated, real estate could essentially come to a screeching halt. The answer is in the hands of the federal reserve and the odds are stacked against them for a smooth transition to higher rates.

Additional reading/resources

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).