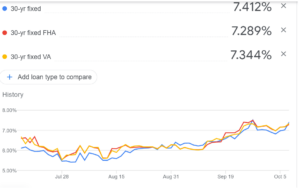

A few weeks ago, the big news was 6% rates and now everyone suddenly woke up with stocks crashing and yields soaring to new highs and rates jumping again. What does this mean in the short term for interest rates? Is focusing on the 30 year mortgage rate the correct metric? Where will interest rates head in 2023 and beyond? How will real estate prices react? What can you do now in light of the surge in interest rates?

7% tipping point, but short-term rates really changed the market:

It is interesting that myself, like basically everyone else in the market, is extremely focused on the 30-year fixed rate. Don’t get me wrong, a 7% rate is eye popping as I locked in at 2.75% less than a year ago but the real focus should also be on the short-term rates.

As mortgage rates started rising over the last several months, there was some relief for borrowers in the short-term market. For example, a borrower could take out a 5/1 or 7/1 (fixed for 5 and then floats after that) to take the sting out of higher rates. These short-term rates were in the 3-4% range and helped “buffer” the market from a huge slow down.

The tables have turned and now short-term rates like a 5/1 are above 6% as I am writing this post. This is a huge jump and basically has shut down the residential real estate market as there are no longer alternatives for lower upfront payments.

Where will interest rates head the rest of 2022?

They likely will head about a quarter point higher which would put the 30 year fixed around 7.25% and the 5/1 a little over 6% and 7/1 6.25%+

What happens in 2023?

Unfortunately based on the recent numbers, 23 gets worse than now. The personal consumption expenditures price index excluding food and energy rose 0.6% for the month after being flat in July. That was faster than the 0.5% Dow Jones estimate and another indication that inflation is broadening.

On a year-over-year basis, core PCE increased 4.9%, more than the 4.7% estimate and up from 4.7% the previous month. The Fed generally favors core PCE as the broadest indicator of where prices are heading as it adjusts for consumer behavior. In the case of either core or headline, the data Friday from the Commerce Department shows inflation running well above the central bank’s 2% long-run target. Outside the inflation data, the numbers showed that income and spending continues to grow.

What this means is that inflation is not getting under control quickly and the federal reserve will continue raising rates. Look for short and long term rates to rise further in 2023 and then maintain around their peak for the year. I see the 30 year fixed ending up around 7.5% to 7.75% and then hanging in the 7%+ range for the year. This will continue to slow the real estate market.

What should you do now if you are purchasing/financing?

I would be hesitant to lock into a 30 year mortgage, a better option might be a 3/1 or 5/1 where you lock in for a shorter period of time with the intention to refinance into a longer term rate down the road when interest rates begin to adjust down. Note, this is my personal opinion, and I am not providing you financial advice, you will need to make the best decision for you.

How will a 7% mortgage rate impact prices?

Say goodbye to the housing bull run. US home prices — for the first time in a decade — are falling.

A national measure of prices in 20 large cities fell 0.44% in July, the first drop since March 2012, the S&P CoreLogic Case-Shiller index showed Tuesday. The last real estate crash ended in 2012, ushering in 10 years of price gains, capped off by the two-year pandemic buying frenzy.

Unfortunately we are just in the first inning of this correction. Until the last 30 days, short term rates were still “reasonable” and allowed buyers to continue closing on properties even in a rising rate environment. As short term rates have also crossed the 6% threshold, the rug has been pulled out from under the real estate market.

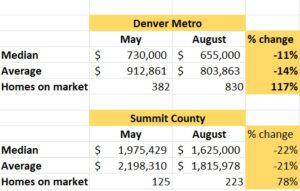

Here is an interesting chart I did looking at recent price changes in Denver and Summit County (home to 3 ski resorts: Breckenridge, Keystone, and Copper Mountain). On an annual basis, prices are still up, but from the peak in around May prices are definitely correcting.

Look for 10-20% declines in prices in most markets with substantially overvalued markets correcting in the 20-30% range. I do not see a recovery until late 24 or 25 time frame as the world adjusts to a much higher rate environment.

Summary:

There is a silver lining in all the turmoil in the mortgage markets. Many buyers locked in rates at extremely low levels which should help moderate the amount of inventory coming on the market in the short term. Unfortunately, life happens (marriage, divorce, kids, job changes, etc…) so this will be a short-term phenomenon. Eventually inventory will increase and as rates stay high through 2023, this is when we will see the reset in the market as life happens and people are forced to move for whatever reason.

This next real estate cycle will not be like 2008 where all the sudden the bottom fell out on prices, this cycle will take a little longer to work through due to the “golden” handcuffs of low rates the last several years. On a positive note, this cycle will not be as deep as 08 but depending on when you purchased, it will still be painful.

Additional Reading/Resources:

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender