In almost every real estate advertisement I receive, there is a common theme that prospective buyers should not focus on the rate as they will be able to refinance relatively soon at a much lower rate. How true is this theory? (hint anyone who bought into this idea is in line for a shotgun wedding) Are rates going to drop quickly like in past cycles? Why are rates primed to stay higher for longer and what does this mean for residential and commercial real estate.

30 year bond predicts long term inflation

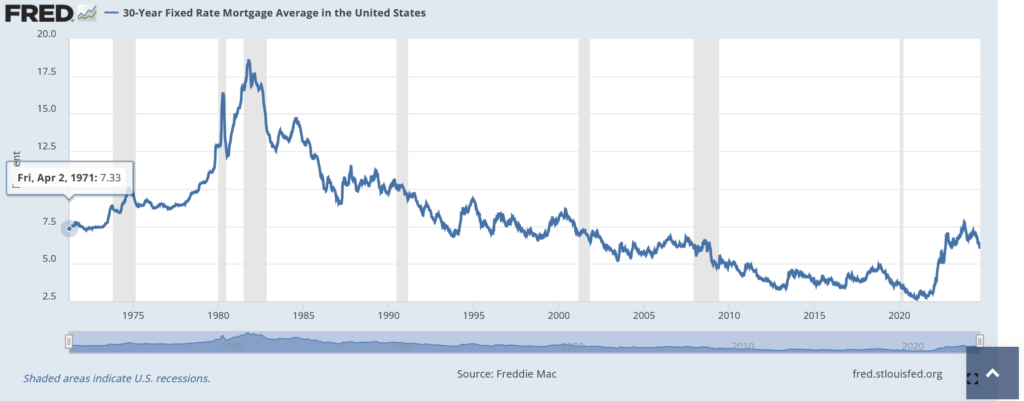

Although the 30 year bond is not the 10 year treasury that is basically the “peg” for mortgage rates, it does show the long term market expectations for treasuries and in turn mortgage rates. If we look at the chart above the latest predictions from Wells Fargo show that 30 year rates will remain about where they are today give or take ½%.

I would agree with Well’s predictions as government spending is off the charts both in the US and throughout the world which will ultimately lead to substantially more treasuries for sale and ultimately higher rates (remember treasury prices and rates work in inverse).

Mortgage rate predictions are wrong, they will be much higher for longer

If you look at any mainstream real estate publication, interest rates are predicted to fall well below where they are today. Unfortunately, I think these predictions are dead wrong. To determine where mortgage rates will be in 2026 if I lined up the 30 year historical chart above along with the historical mortgage chart below, it implies that rates will be very similar to where they were in 2008 which would put mortgage rates through 2026 in the 6.5 to 7.5% range which is about where they are now.

Even looking beyond 2026 rate likely will stay well above the ultra low rates from 2009 to 2019 as government spending ramps up which will keep rates considerably higher than the last 10 years.

What do 6.5% and above rates mean for residential and commercial real estate?

With rates staying higher for longer there will be huge impacts on real estate prices:

Residential: Higher rates eventually will lead to declining prices especially in higher priced markets as less people can afford to purchase expensive houses. Assuming a 500k mortgage at a 4% rate precovid the payments would be 2,387/month, now fast forward and that same mortgage would be 3160/month. This is an extra 9300/year in mortgage payments. This huge jump in payments does not work for most prospective buyers which will ultimately lead to prices falling in order to increase affordability. The million dollar question is how much? I think most markets will reset to the tune of 10-15% with some even higher.

Commercial: We have not even come close to seeing the bottom in the commercial market. As rates remain higher cap rates will also need to rise which will ultimately lead to a much deeper reset in commercial property values. Billions in mortgages are going to reset over the next few years and for now lenders have kicked the can down the road but as rates remain higher for longer eventually the market will have to face the music of much lower property values. For example, I’ve seen office buildings trading at 20-30% off their values from just a few years ago. You will also see a further reset in multifamily and retail as cap rates are way too low with treasuries staying higher for longer.

Marry the house/ date the rate

The assumption in this analysis to Marry the house and date the rate meaning that the house is a long term commitment, but you will be able to quickly refinance into a much lower rate is not holding true.

Based on fundamental changes in productivity, compensation, etc… rates are likely to stay considerably higher than anticipated and likely will never return to the 2.5-4% range for 5-10 years. Furthermore, government spending is still off the charts which will put further pressure on bond prices and in turn increase yields. As a result, we will see interest rates in the 6-8% range in the next 7-10 years or so. I know this is a huge range, but the trend is what is important in that rates will be substantially higher than if they were pre-pandemic.

Shotgun wedding ahead for people dating the rate

Unfortunately, the marketing mantra to marry the house and date the rate is proving to be false. Essentially anyone banking on a quick drop in rates is mistaken and just got married to the house and rate via a shotgun wedding. As a result of much higher labor compensation by Airlines, UPS, and countless others along with crazy government spending inflation will remain stubbornly above the federal reserve’s 2% target.

With inflation continuing to be stickier than the market anticipates treasuries and in turn mortgage rates will remain considerably higher for longer. I anticipate mortgage rates to stay north of 6.5% for the next five years (or possibly forever as this is about the long term mortgage rate average) which will give borrowers limited ability to refinance to save substantial money.

Furthermore I don’t foresee rates dropping to pandemic lows for quite a while if ever as this was a once in a lifetime event that caused the federal reserve to buy mortgages at the same time they pushed down long term rates.

As a result of high rates, look for real estate volumes to stay low for some time as there is little incentive for people to move that have a low rate. The real question is buyers that end up with a shotgun marriage to a much higher interest rate for much longer than they expected.

Mortgage rates stay higher for longer

The market is dead wrong on the assumption that interest rates will rapidly fall anytime soon. We are already seeing this play out today with the fed’s ½% cut mortgage rates ultimately increased almost ½% as opposed to decreasing. Unfortunately, larger government spending and the push for a soft landing will keep long term rates like mortgages much higher for much longer than is being priced in.

Since the market hasn’t come to terms with higher for longer, the market is grossly underestimating the impacts to residential and commercial real estate. With mortgage rates above 6% through 2026, both residential and commercial real estate is primed for a substantial correction as the current prices are not sustainable in a higher rate environment. For example, why would someone buy a commercial property on a 4-5% cap when they can buy a government bond with the same return with zero risk. Unfortunately, they would not, which means prices must adjust downward.

Unfortunately predicting when the reset will occur is challenging as macro factors like a war, surge in oil prices, tariffs, stock market meltdown, etc… can happen rapidly and drastically alter any predictions. With that said, my best guess is the second half of 2025 is when we start seeing reality set in as the market comes to grips that low long term rates are not going to bail out the real estate market as rates stay higher for longer.

Additional Reading/Resources

- https://fred.stlouisfed.org/series/MORTGAGE30US

- https://econforecasting.com/forecast/t30y

- https://www.fairviewlending.com/fed-cuts-rates-why-are-mortgage-rates-rising/

- https://www.fairviewlending.com/commercial-real-estate-what-is-causing-the-decline/

- https://transportgeography.org/contents/chapter5/air-transport/airline-operating-costs/

- https://apnews.com/article/united-airlines-pilots-pay-raise-d1cf2dcd38d0d267bf8cfd8c652c6750

- https://www.ustravel.org/research/monthly-travel-data-report

- https://www.wsj.com/articles/ups-teamsters-reach-agreement-on-new-contract-a134c910?mod=article_inline

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender