In a WSJ survey, economists lower recession probability below 50% and say Fed is finished raising interest rates

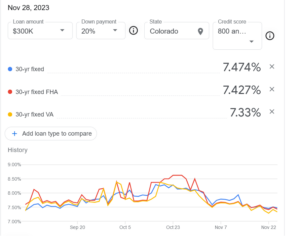

It has been quite a ride for mortgage rates over the last two years. As of this writing mortgage rates were around 7.5% (with no points) which is quite the move from the 2.5% lows not long ago. At the same time recession odds have plummeted. Where will mortgage rates be the remainder of 2023 and into 2024? With the federal reserve essentially done raising rates, how will this impact mortgage rates?

Before getting into my interest rate predictions it is important to refresh how mortgage rates are “set”.

Federal Reserve does not “control” 10 year treasuries (longer term rates)

First, it is important to note that the federal reserve does not directly control longer term rates and in turn mortgage rates. The fed controls the “federal funds rate”. The federal funds rate is the rate at which banks and credit unions lend reserve balances to other banks and credit unions overnight (very short term rates). In a nutshell this is the rate banks get on the money they are holding in cash/reserves. Here is a more detailed explanation from Wikipedia .

So how are mortgage rates set? Unfortunately, mortgage rates are not “set”. There is no government or private party that can set rates per se. Mortgage rates are typically based on the 10-year treasury yield. So how does this work?

Before discussing rates, it is important to understand how bond yields work. The most important piece of this equation is the relationship between a bond price and its return. For treasuries, it is critical to note that a bond price and its yield move in inverse. What this means is that a higher bond price results in a lower yield and vice versa where a higher yield results in a lower bond price. For simplification purposes, I will not get into the full details of why bonds function the way that they do. Rest assured that it works this way and will always work this way.

With this key piece of information, we can now understand why mortgages do not move in direct correlation with the federal funds rate and they are “pegged” off the 10 year treasury.

Will 10 year treasuries stay high?

To accurately predict where mortgage rates are heading it is important to look at the 10year treasury. There are two primary items currently driving interest rates higher:

- Future inflation expectations: It doesn’t look like inflation is going to fall easily. The labor market remains robust and consumer spending is off the charts which means even if the federal reserve is done raising rates, treasuries will have to stay higher for longer than the market anticipates.

- Supply of treasuries due to huge deficit spending: This one is a bit surprising. Typically during periods of growth the deficit is reduced as the government does not need to provide stimulus via spending. Unfortunately, the opposite is happening with the deficit now basically double what it was just a few years ago. The federal government will have to continuing financing these huge deficits by issuing bonds. As more bonds are issued (increased supply of bonds) prices will fall and rates will increase.

- General economic conditions: The Federal reserve will not feel a huge impetus to lower rates until they see a big slowdown in the economy. The last GDP report at the end of November once again defied expectations: “Gross domestic product, a measure of all goods and services produced during the three-month period, accelerated at a 5.2% annualized pace, the department’s second estimate showed. The acceleration topped the initial 4.9% reading and was better than the 5% forecast from economists polled by Dow Jones.”

The three items above look to keep mortgage rates high.

Where will interest rates be in 2023 and 2024?

Currently 10year treasuries are around 4.5%, and mortgage rates are around 3% higher than the 10 year treasury. In a WSJ poll “Economists also expect yields will ease in the coming months. On average, they expect the 10-year Treasury yield to close at 4.47% at the end of this year, and fall to 4.16% by June 30 of next year.” These predictions would put mortgage rates around 7.5-8% for the remainder of this year and falling to 6.5 to 7% late next year. Although these are big drops, the rates are still double what they were a few years ago.

Note, the downside of a “soft landing” is that the Federal reserve will not have a need to adjust rates down quickly like in past cycles.

What about rates beyond 2024?

I don’t think we will see a return to the 3 or 4% rates we saw during Covid. With increased government deficit spending, long term rates will likely settle in the 6.5 to 7.5% range. Unfortunately I do not see any changes coming down the pipe other than continued deficit spending which could make rates go even higher than my predictions. Also note their could be a wildcard as rates remain higher for longer, something is more than likely to “break” in the economy and lead to a radical change in the predictions of a hard landing. With 2024 being an election season, look for the federal reserve to do everything it can to try not to make economic waves.

Rates will ultimately drive real estate prices lower prices.

Eventually life happens and layoffs occur, divorces, deaths, etc.. which will lead to an increase in supply. As the supply increases there is only one way for home prices to go, down. As interest rates remain high it is not possible for buyers to pay the current prices which will ultimately lead to a large reset in prices. We are already seeing this on the commercial side and eventually residential real estate will feel the pain.

Summary

Although our politicians wants to convince us that money grows on trees, unfortunately it doesn’t. All the deficit spending will require the sale of tons of new bonds. This will ultimately lead to lower bond prices due to the supply and in turn higher rates on treasuries and ultimately mortgage rates. This is unfortunately a long-term trend that will have profound implications on residential and commercial real estate. Look for rates to trade around where they are for the rest of the year and then fall a little next year to about 6.5 to 7%.

We are entering a new paradigm with rates remaining double what they were just a few years ago. This will ultimately lead to much lower prices as life happens with downsizing, upsizing, layoffs, etc… We will start to see the effects of higher inventory and lower prices next year and we could be in for an extended real estate slowdown if deficit spending is not reined in quickly.

Additional reading/resources

- https://www.wsj.com/economy/a-recession-is-no-longer-the-consensus-3ad0c3a3

- https://www.cnbc.com/2023/11/29/us-gdp-grew-at-a-5point2percent-rate-in-the-third-quarter-even-stronger-than-first-indicated.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender