The Urban Institute think tank says nearly two out of three loans made in 2019 would fail to meet at least one of the stricter standards lenders have imposed since March. Banks are tripping over themselves to be the first to hedge against future downside risks and the economic unknowns. How will this impact real estate?

The pandemic and cares act

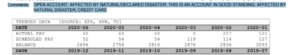

No impact on credit score, but can’t get credit

The Cares act prohibits lenders from reporting the payments as missed payments and therefore loans put into Forbearance do not affect your credit score. Unfortunately, what is happening in the marketplace is drastically different.

Banks have pulled back sharply on lending to U.S. consumers during the coronavirus crisis. One reason: They can’t tell who is creditworthy anymore. By early April, 33% of banks that responded to the Federal Reserve’s senior loan officer survey said they had increased their minimum credit-score requirements for credit cards over the previous three months, up from 14% in January. Bank respondents tightened lending standards for all consumer-loan categories tracked by the survey.

This is a wonderful theory that your score is not impacted. I was recently reviewing credit for a borrower and it was quite apparent that there was financial duress. A payment was missed, the account was flagged as deferred, and yet no late payments were utilized in determining the credit score. The borrower’s score should be considerably lower. Many banks will see the deferment and deny credit.

What banks are pulling back?

The list is long. For a time, the secondary markets seized up taking down many lenders. For example, the non-qualified mortgage is basically gone as there is no outlet in the secondary markets. Furthermore, many private lenders are out of business as their lines have been shut down (fortunately we fund in cash so we are still funding). Furthermore, many banks have stopped home equity lines of credit and underwriting has increased. In the past, someone could get a loan with a sub 700 credit, now many lenders have increased their minimum credit of 700 regardless of federal guidelines.

For example, JPMorgan Chase tightened its standards last month, requiring borrowers to have minimum credit scores of 700 and to make down payments of 20% of the home price on most mortgages, including refinances if the bank didn’t already manage the loan. Wells Fargo is no longer letting borrowers refinance their mortgages while cashing out home equity, and both Wells and JPMorgan have suspended new home-equity lines of credit. Truist Financial Corp. has suspended some cash-out refinances for jumbo loans with high balances because of economic conditions, a spokesman said.

The credit contraction has been most severe in markets without government backing, from jumbo mortgages to loans to buy investment properties. Credit availability fell sharply in April to its lowest since 2014, according to an index maintained by the Mortgage Bankers Association.

What does this mean for real estate and the economy?

The Urban Institute think tank says nearly two out of three loans made in 2019 would fail to meet at least one of the stricter standards certain lenders have imposed since March.

You are probably thinking I am crazy writing this article as the real estate market is the hottest it has been in decades. Unfortunately, the recent real estate run up is not indicative of where we are heading as many borrowers are being locked out of the credit markets.

With credit tightening, a handcuff is being placed on the economic recovery. Eventually with tightened credit, the number of purchases will decline, refinancing will decline, and consumers will have less available funds as the banks are focusing on the best borrowers leaving everyone else behind.

Furthermore, many sellers are forgoing the “trade up” move as they can’t get approved for the new loan. We are already seeing this with inventories at their lowest level in decades. The drastic reduction in available credit will no doubt create a drag on the economic recovery.

Additional Reading/Resources

- https://www.wsj.com/articles/mortgage-credit-tightens-creating-drag-on-any-economic-recovery-11590431459?mod=mhp

- https://www.americanbanker.com/articles/mortgage-lenders-tighten-screws-on-credit-in-echo-of-2008

We are still Lending as we fund in Cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).